Table of Contents

- What is a pumps?

- List of BEST Pump and Dump Telegram groups/channels

- The Basics Of Pump And Dump

- How Does Pump And Dump Work?

- Using Social Media To Identify Pump And Dump

- Profiting From Pump And Dump On Major Exchanges

- How to participate in the pump?

- If you don’t have BNB Smartchain in a Trust Wallet or if you’ve never used PancakeSwap here is an explanatory video that explains the whole process.

- Make Money Using Cryptocurrency

- Short-selling Cryptocurrency

- Avoid Getting Scammed

- FAQ

What is a pumps?

Pump is a deliberate and drastic increase in the value of a coin with the help of a massive purchase by entire team/group of people.

In short, telegram channel communities earn on PUMPs, manipulating small coins in the exchanges.

For example: the XXX coin costs 0.32 $, we agreed at 20:00 with the whole team to buy the XXX coin, it grows rapidly in price, other traders, whales, bots see growth and start buying after us. The price rises to 1-2 $ ?,

After, Telegram channel give the signal – we fast sell the XXX coin, and fix the difference. Bought at $ 0.32 – sold at $ 1-2. Feeling profitable? ?Sometimes you can earn up to x10-x20

List of BEST Pump and Dump Telegram groups/channels

-

Pump&Dump

Share Стабильность, как фундамент успешной торговли на рынке криптовалют. Инстаграм: fedor_krylov_fp Наш Youtube – PumpDump0 На связи 24/7, мой контакт @Krylov_Fedor Приветствую всех ещё раз! ? готовы к штурму рынка? Увидел потенциальные 4-6% по сделке ? Отличная возможность увеличить баланс, брать кредитное плечо буду по ситуации, может даже и без него. Рисковать лишний раз нет смысла. Максимальное плечо х10,…

-

NFT Forex Binance Pump Scalping Signal Робот Индикатор UZB N1

Share ???? I B CAPITAL INVESTMENT ?Помогаем с обучением ❗Разбираем торговлю без рекламы и скама ❗Торгуем на #NFT #Binance #Forex ?Контакт ?Asoschi: @I_B_CAPITAL_INVESTMENT_BOT Share

Visit ALL List of TOP Pump and Dump Telegram Groups – https://win-win-trade.com/best-crypto-tools/categories/pump-and-dump-telegram-groups/

The Basics Of Pump And Dump

Let’s look at the basics of pump and dump, as described by Investopedia: “In finance, pump and dump (short for pump and then dump) is a stock marketing technique used to make quick money by pushing up the price of a stock and then quickly dumping all the bought shares, usually when the price becomes too high.”

This practice is generally used to manipulate investors’ perceptions of a stock’s value so that they think it’s underpriced and then, once they’ve bought it at the inflated price, the share price quickly drops, causing them to lose their investment. It’s quite a risky practice, as you’ll often find out when an exchange or digital wallet goes down because of high profile incidents like the Coincheck 2018 hack, for example.

How Does Pump And Dump Work?

In order to understand how pump and dump works, you have to know something about how cryptocurrency and stock prices generally work. Basically, the price of an asset might rise or fall based on a number of factors, including supply and demand, rumors about that particular asset, and so on. In some cases, the price of an asset might never actually reach a level that’s accurate relative to what the asset is actually worth.

With that in mind, let’s take a look at how pump and dump works in the context of cryptocurrency and similar types of assets. When you make a purchase using a cryptocurrency such as Bitcoin, for example, there’s a good chance the price will go up, often quickly, in the days or hours after you make the purchase. In most cases, this price increase is a result of the so-called “pump,” where investors and speculators are buying the cryptocurrency or similar asset simply because it’s “hot” or “in demand” at the time. Once the desired price is reached, however, the “dump” will usually follow, where investors and speculators will quickly sell the asset at a significant loss, often after taking a short-term profit, if any. In many cases, there will be people who take the opposite approach and “dump” a cryptocurrency or similar asset priced higher than they feel it should be, attempting to cause a fall in the price.

Let’s say you purchase 1 BTC for $10,000. You might see that price increase to $11,000 or even $12,000 in the next few days or hours, depending on how Bitcoin is currently valued. Once that price is reached, however, you’ll start to see large numbers of people (“dump merchants”) enter the market and start to sell off their BTC, often at a significant loss. In some cases, the price might even fall back below the original purchase price, causing you to lose a good chunk of change.

This price movement can be very similar when it comes to certain types of stocks and is often used as a short-term strategy for profit, much like high-risk investments used to make money on Wall Street. Remember, though, that in most cases, the pump will soon follow the dump and the original price might not be reached, meaning you’ll have dropped your investment significantly, if not completely, in many cases.

With that being said, it’s quite easy to identify when pump and dump is taking place. You’ll often see people doing this on social media, where they’ll use the hashtag #pump #dumpsymbol or similar hashtags to let their followers know about their short-term investing strategy. If you want to get in on the action, simply buy the underlying asset (in this case, Bitcoin) when it’s cheap (under $10,000) and then, when the price goes up, quickly sell it off for a profit, avoiding the risk of significant loss. Of course, this is all theoretical and, in most cases, it’s quite difficult to actually make money using this strategy.

LIST of TOP Pump and Dump Telegram Groups – https://www.win-win-trade.com/crypto-directory/categories/pump-and-dump-telegram-groups/

Using Social Media To Identify Pump And Dump

With that in mind, let’s take a look at how you can make money using social media to identify when and where pump and dump is taking place. Most exchanges and other platforms that deal in cryptocurrencies and similar assets will have a Twitter account where they post news about the industry and relevant price movements. If you want to get in on the action, simply look for relevant hashtags (#pump #dumpsymbol) and scan through the tweets, paying close attention to any news about the industry and price movements.

In some cases, you might want to consider using tools like the Meta-Investor App, which can easily be accessed through a smartphone browser. The app will scan hashtags and offer you relevant tweets, allowing you to get an idea of what’s happening and when. By scanning through these tweets on a regular basis, you can learn a lot about the state of the industry, watching for any major news items and reacting quickly when important information is revealed.

Profiting From Pump And Dump On Major Exchanges

One of the most popular ways of making money using pump and dump is on major exchanges, where you can buy and sell cryptocurrency and similar assets, avoiding the risk of purchasing them directly from an individual. In most cases, you’ll make a purchase using a fiat currency (like the U.S. Dollar) and then quickly resell it for a profit. In some cases, however, you might have to wait a short while before reaping the benefits of the scheme, depending on the specific exchange and situation surrounding the market at that particular time.

Let’s say you’re using the Meta-Investor App to scan for pump and dump activity on a BTC/USD pair (Bitcoin to U.S. Dollar), as shown in the above snapshot. You see a tweet that mentions the #pump hashtag and then a few minutes later, the price of BTC/USD goes up significantly, based on the news that Twitter user @CryptoLolz just bought a bag of Bitcoin, causing the price to rise. Since you’ve already made a purchase using fiat currency, you can simply enter the other end of the trade, selling your Bitcoin for a profit. In most cases, you’ll make money using bitcoin’s price rise, but you might also make money from short-term stock price movements, as well. It all depends on the situation and which exchanges you want to focus on, using the Meta-Investor App.

Pump and dump is one of the oldest (and certainly one of the most popular) short-term investing techniques used on Wall Street. In many cases, it’s quite easy to make money using this strategy on social media, especially on exchanges that have large followings on Twitter. As long as you’re able to identify the pump and the dump, it’s quite easy for someone to make money from this strategy when applied to cryptocurrency and similar assets, using social media to their advantage.

How to participate in the pump?

Time needed: 20 minutes

How to participate in the pump?

- Step One

Download apps TrustWallet and Binance in Apple Store or Play Market

- Step Two

Create an account in Trust wallet and save a 12-word recovery code

Create an account in Binance and pass verifocation - Step Three

In order to take part in the pump, you need to upload a BNB coin to the trust wallet, for this we need to purchase it on the binance exchange.

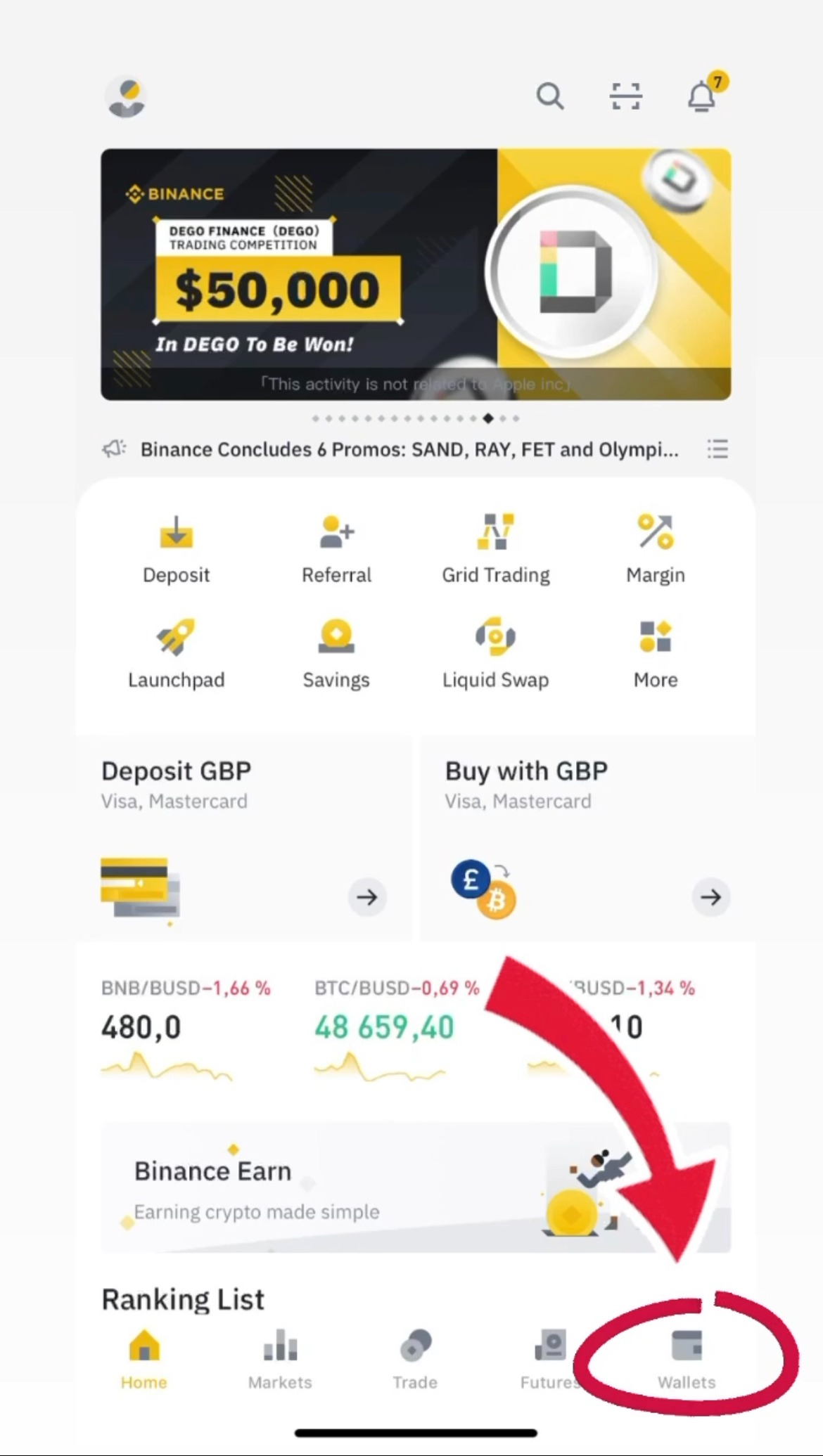

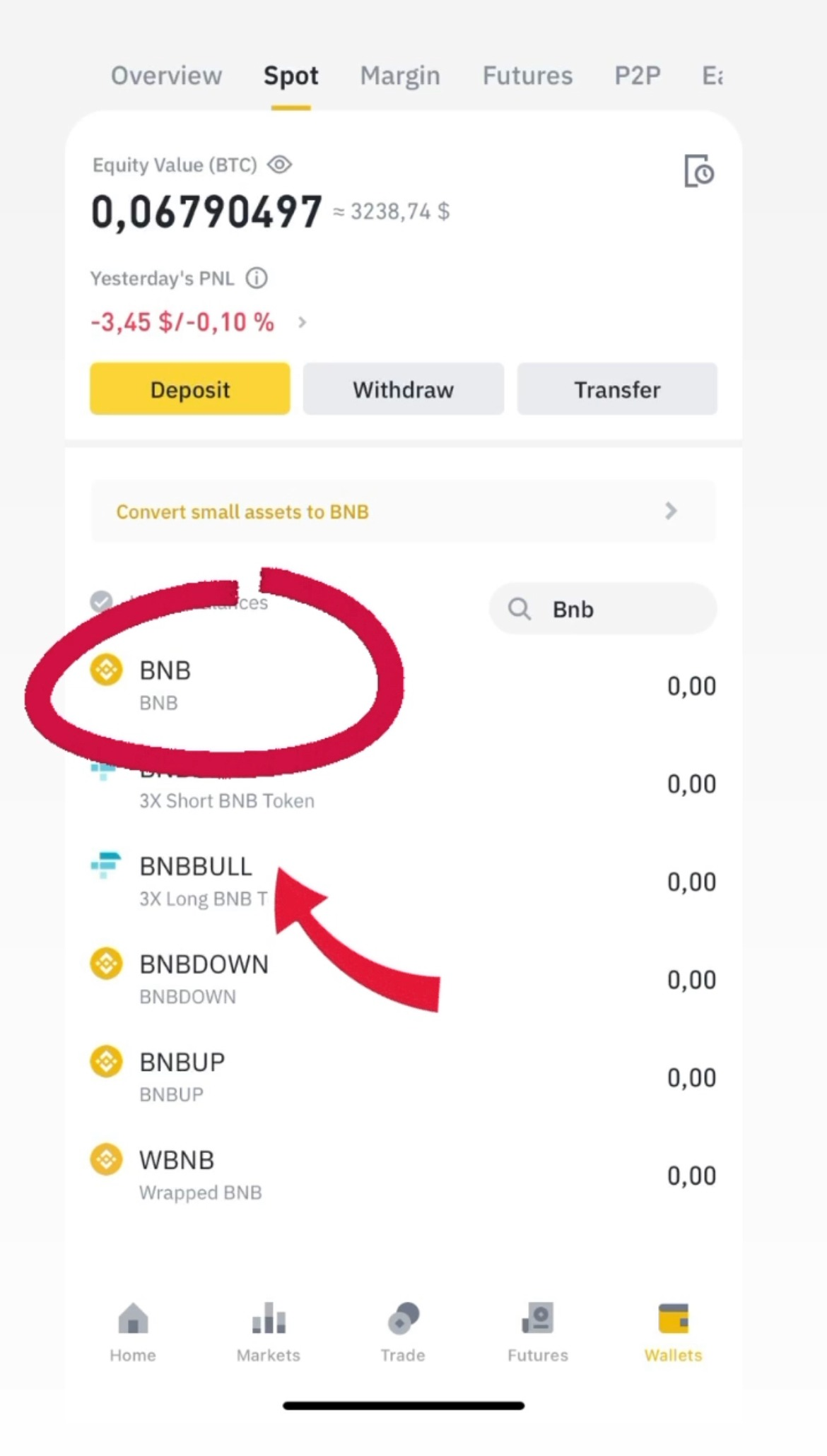

To do this, go to the main binance page and click “Wallet”

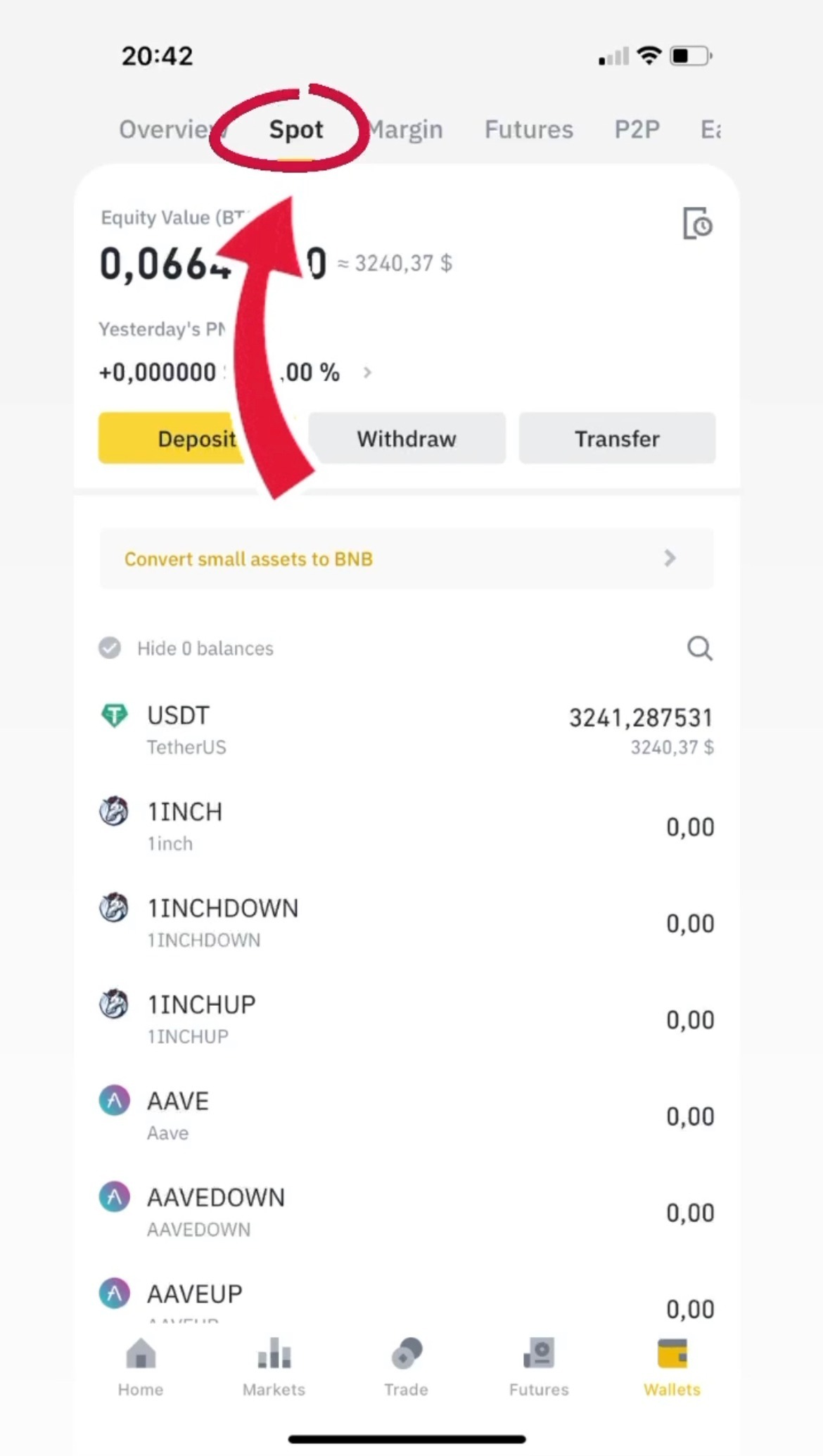

- When you are on the ‘Wallet’ page in the ‘Overview’ section you need to go to the ‘Spot’ section at the top of your screen

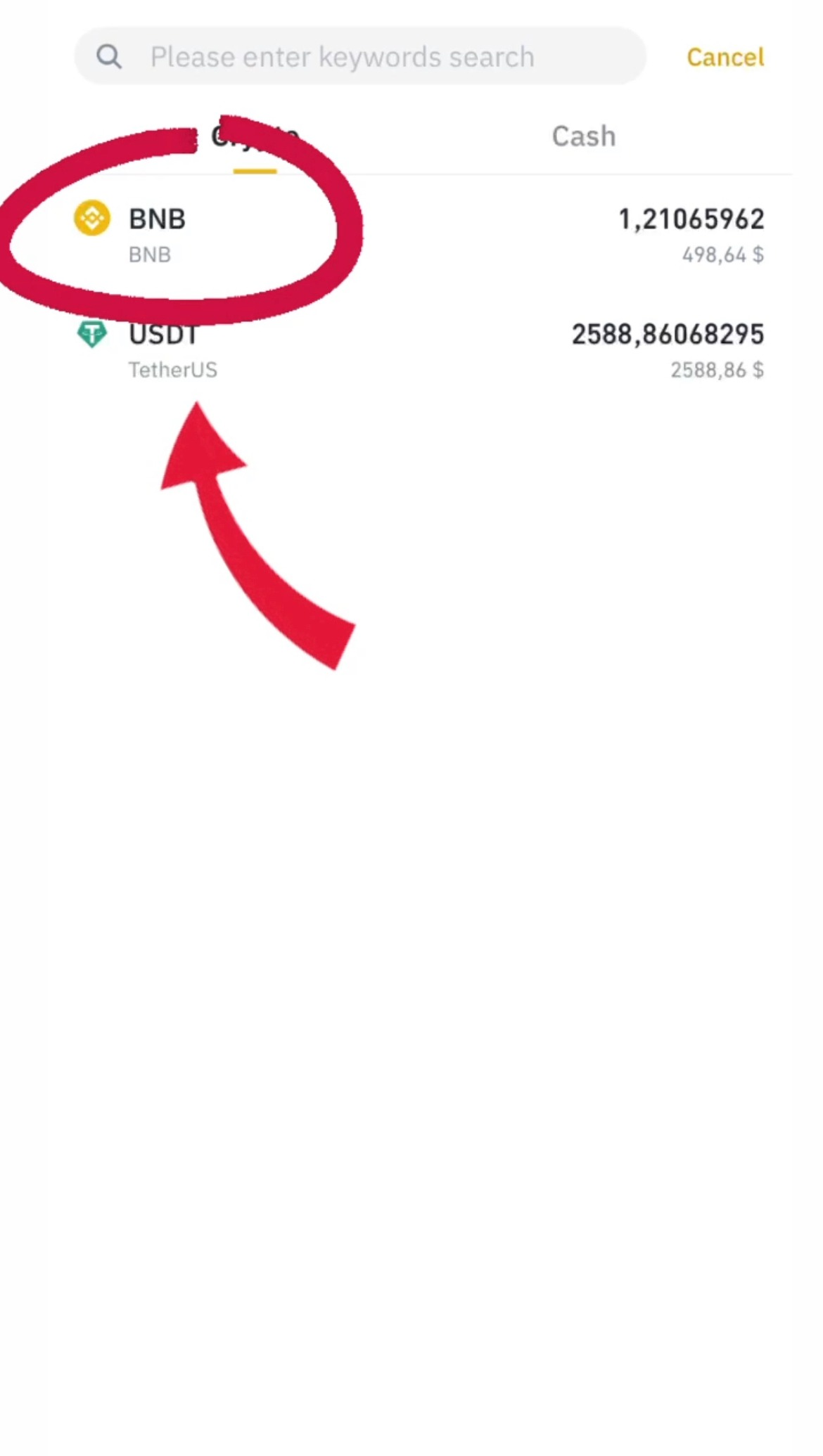

- At the ‘Spot’ press the magnifying glass to find the coin you need, exactly BNB and than press it.

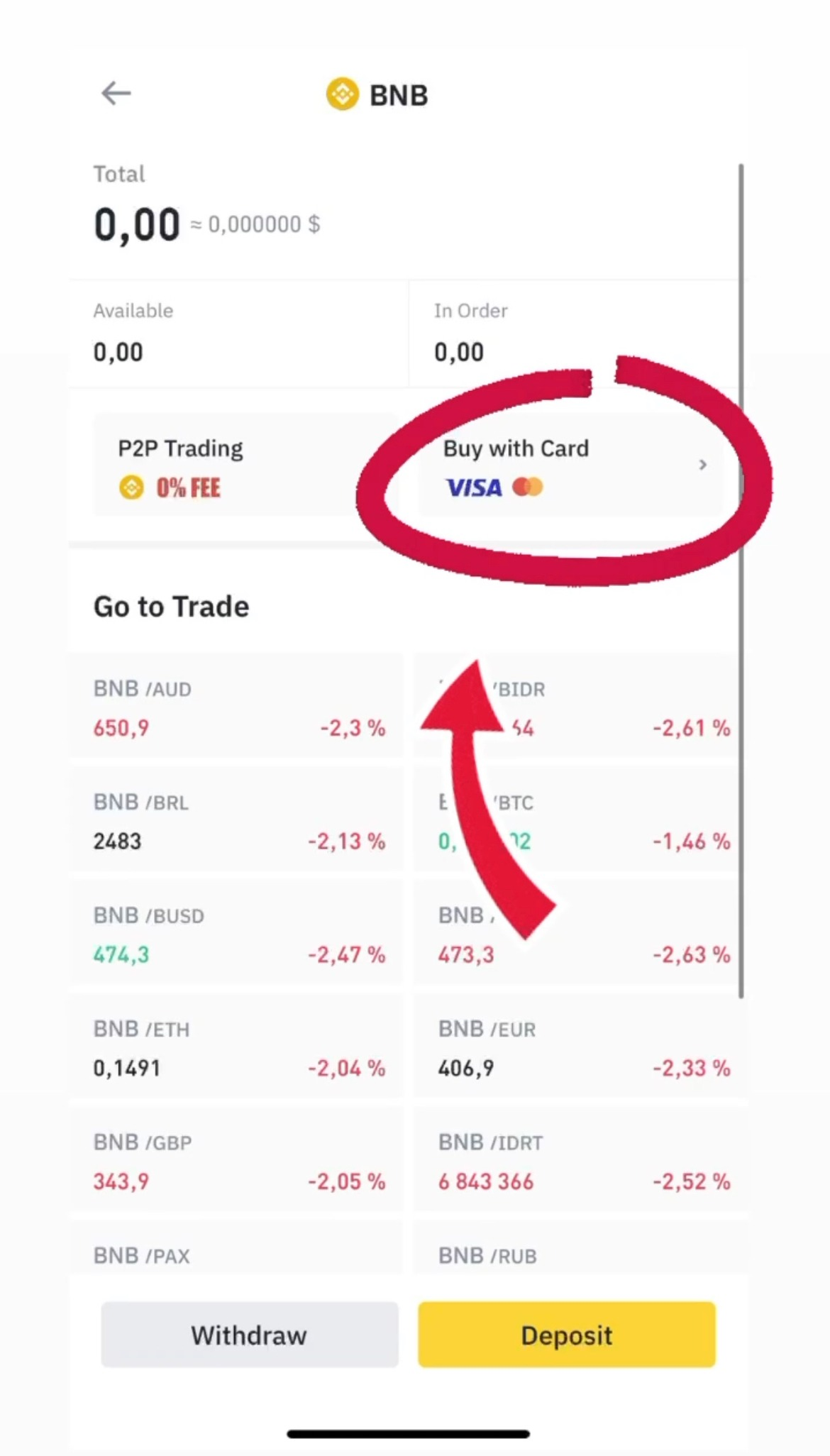

- After switching to BNB, select ‘Buy with card’

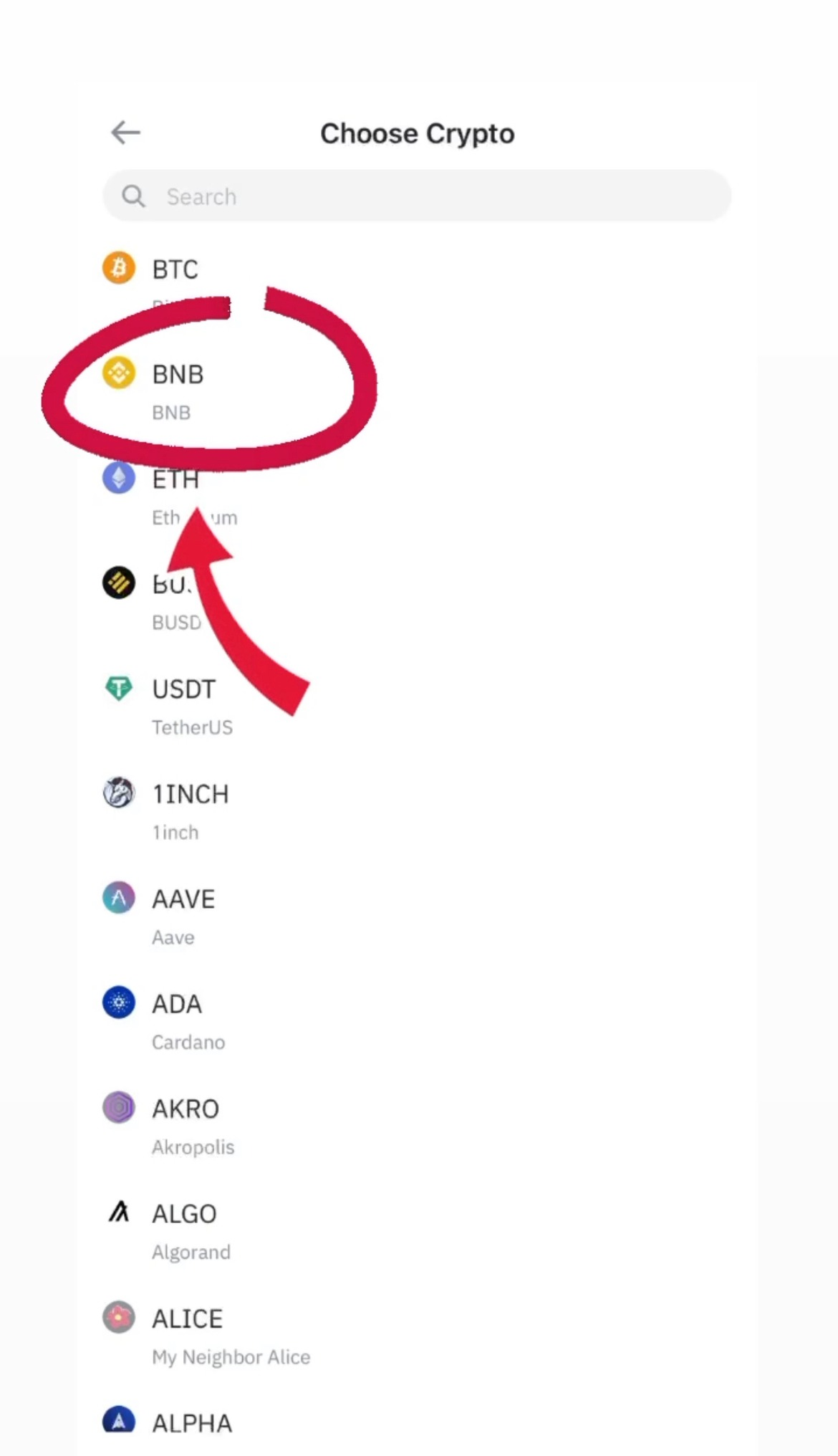

- Re-select BNB which will automatically be at the top of the list.

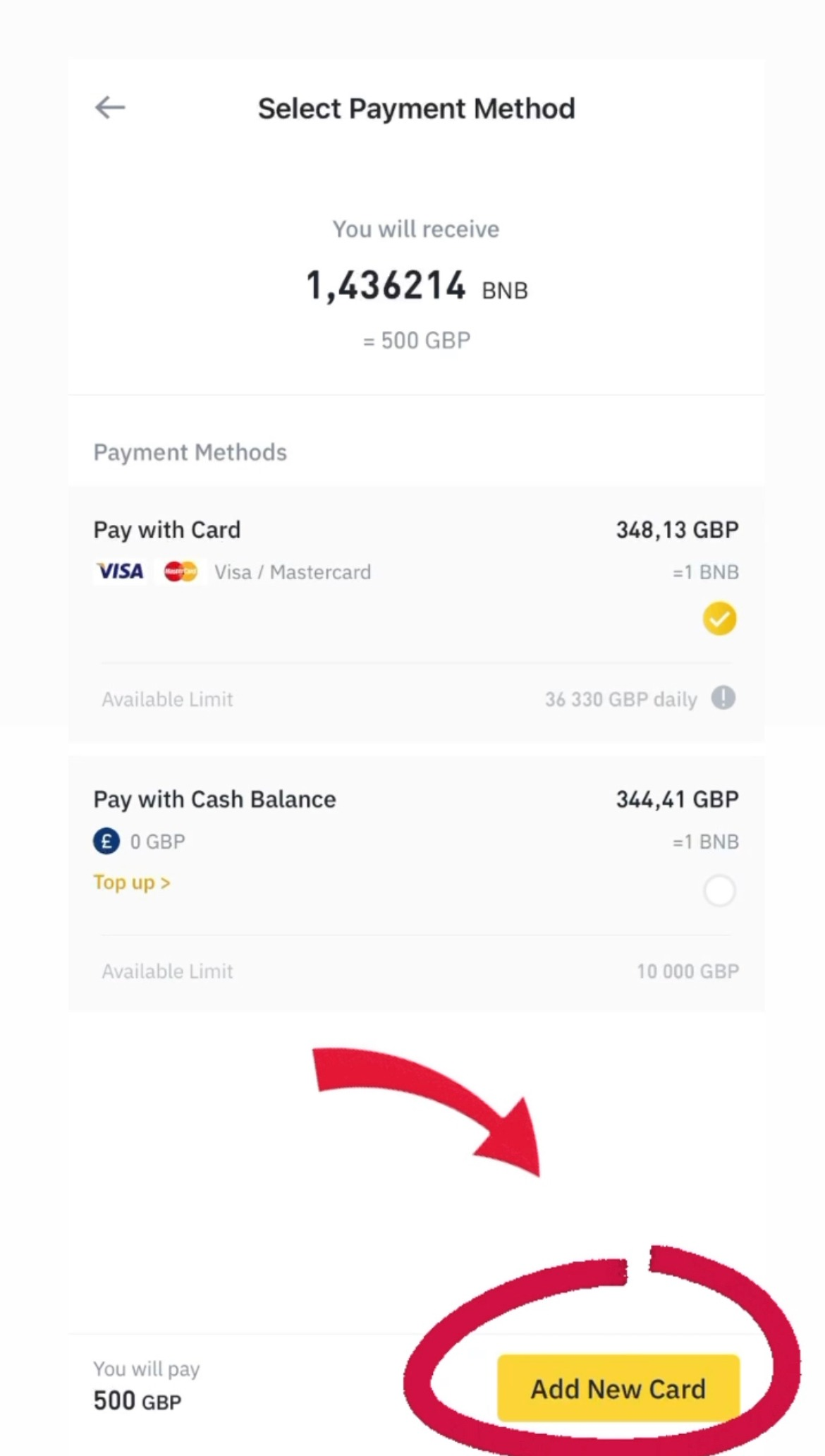

- Add new card

- Enter the amount you need and click Continue. Then add your card details and complete your BNB purchase

- Step four

After buying BNB you need to sent this currency to another wallet, exactly Trust wallet

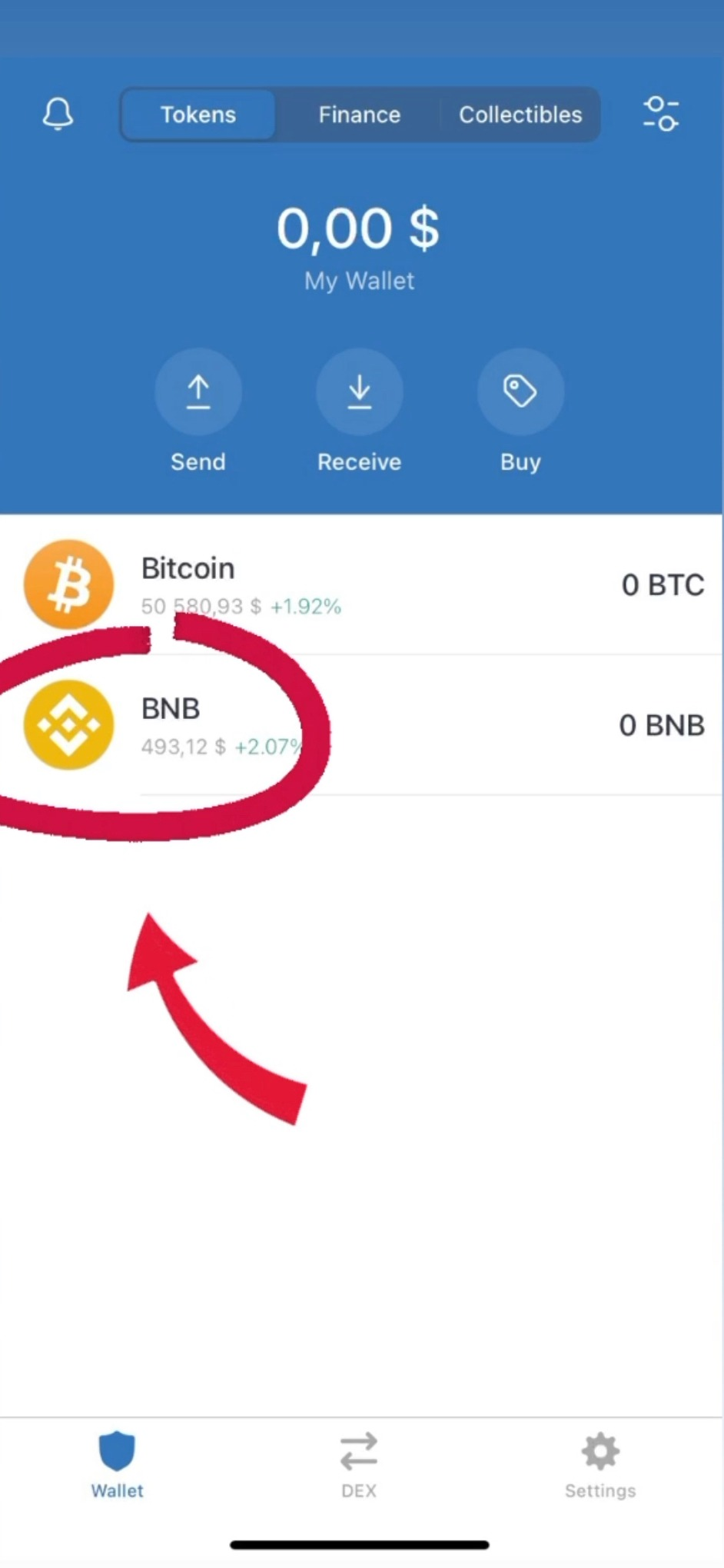

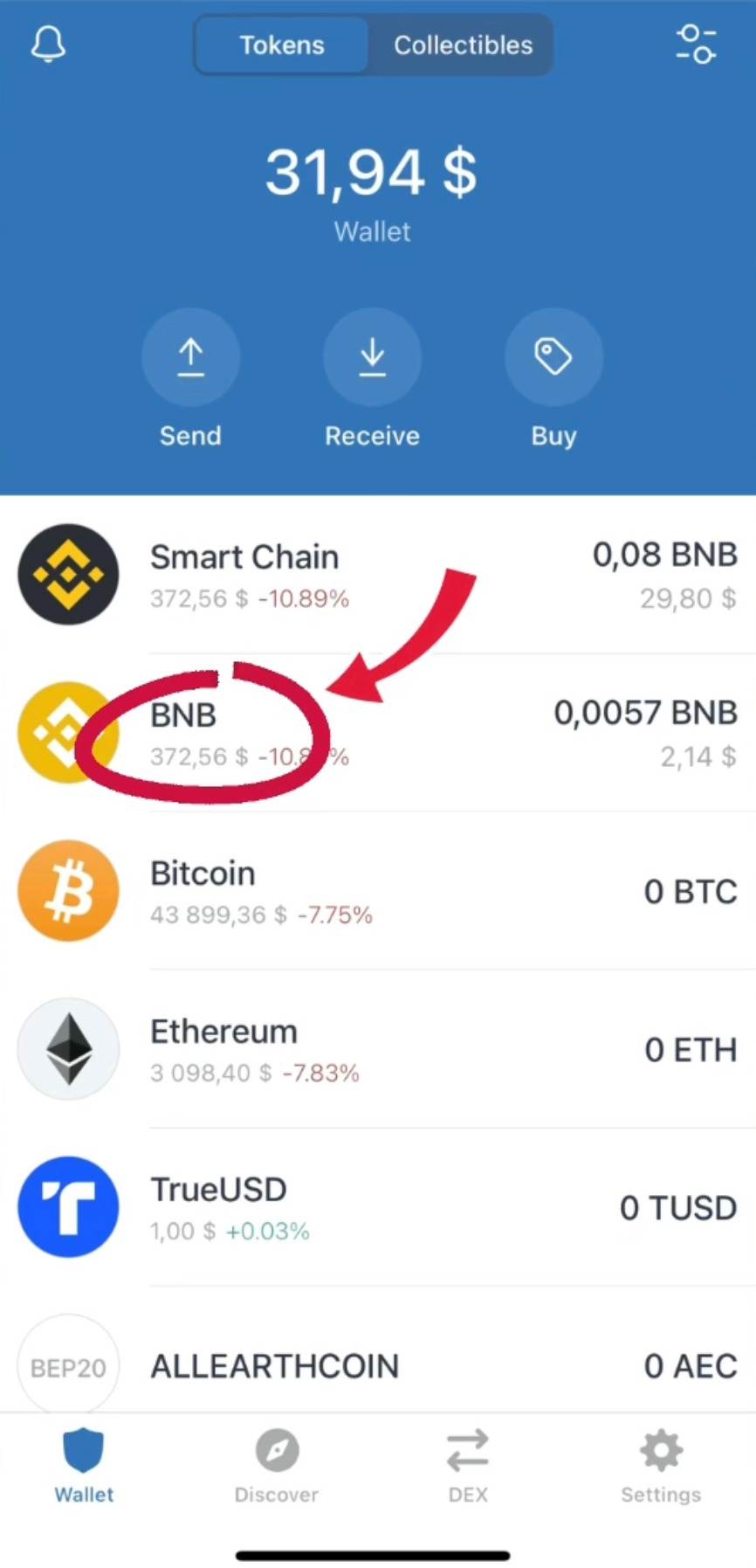

When you get to the start page of your ‘Trust’ wallet, press to go to the “BNB” coin

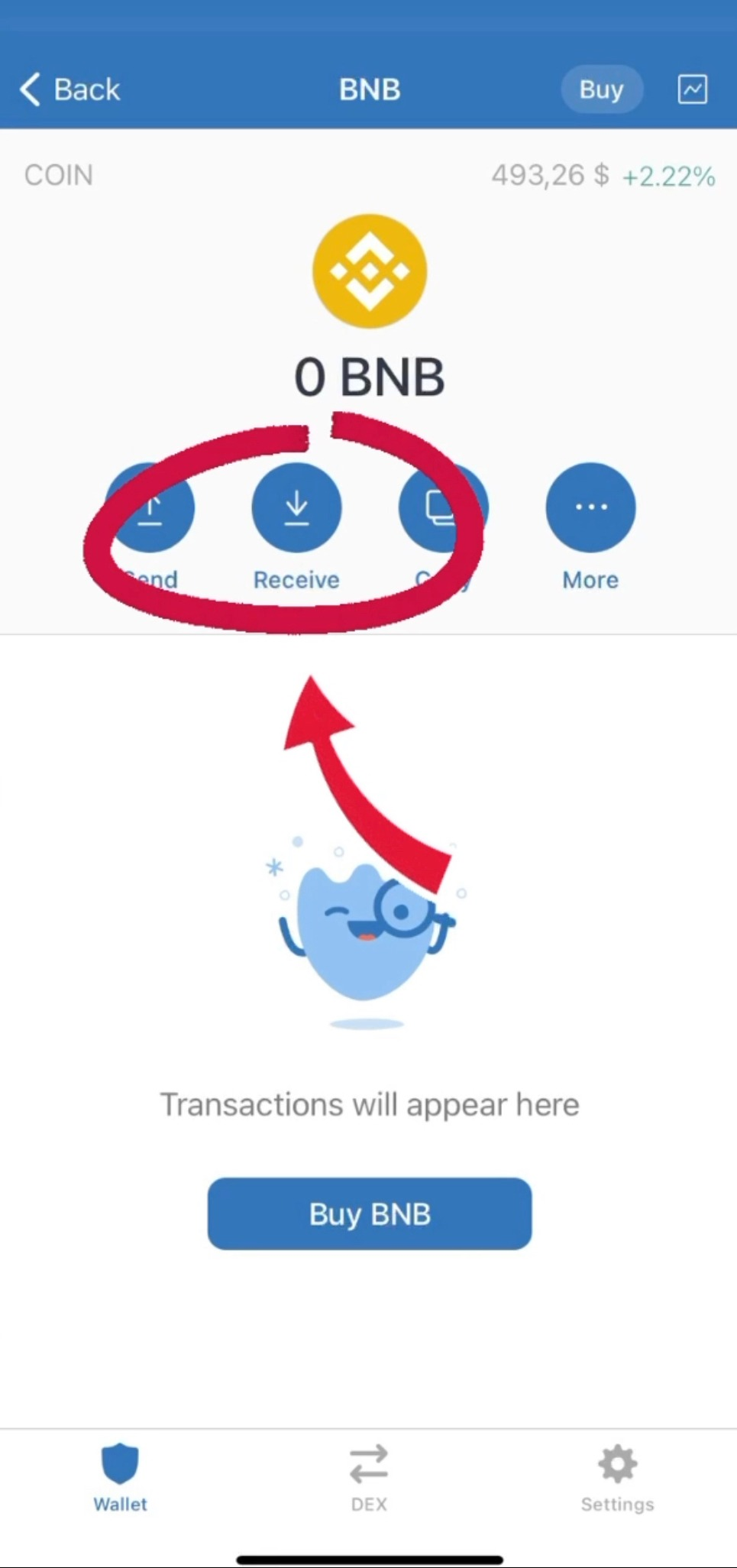

- Than click on ‘Receive’ where the address of your wallet will be displayed to which we will send ‘BNB’ from the Binance that was replenished earlier.

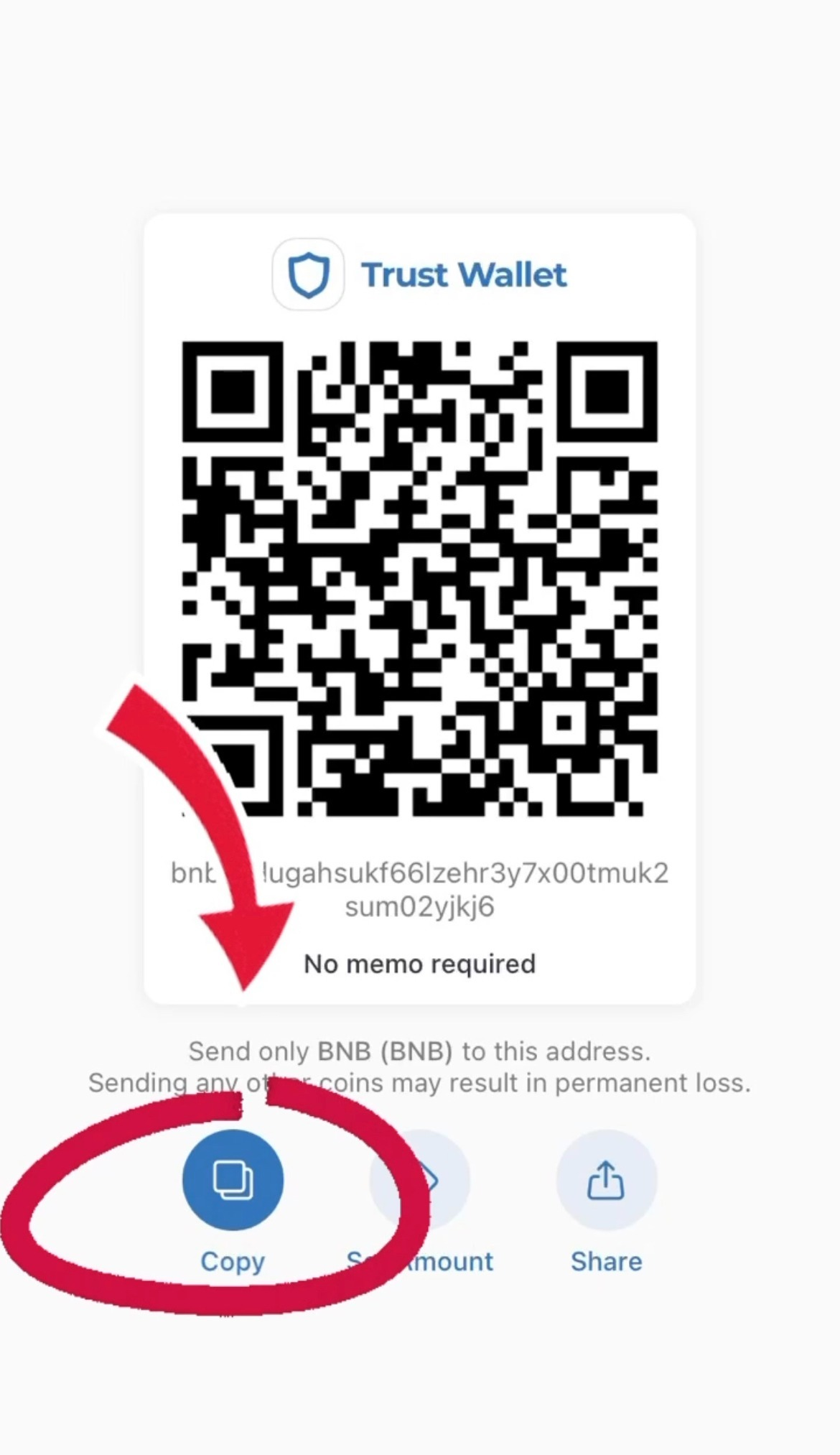

- Click “copy” to copy our wallet number to Trust Wallet

- Returning to the Binance app. Now we need to send our “BNB” which we bought earlier from our Binance wallet to our Trust wallet.

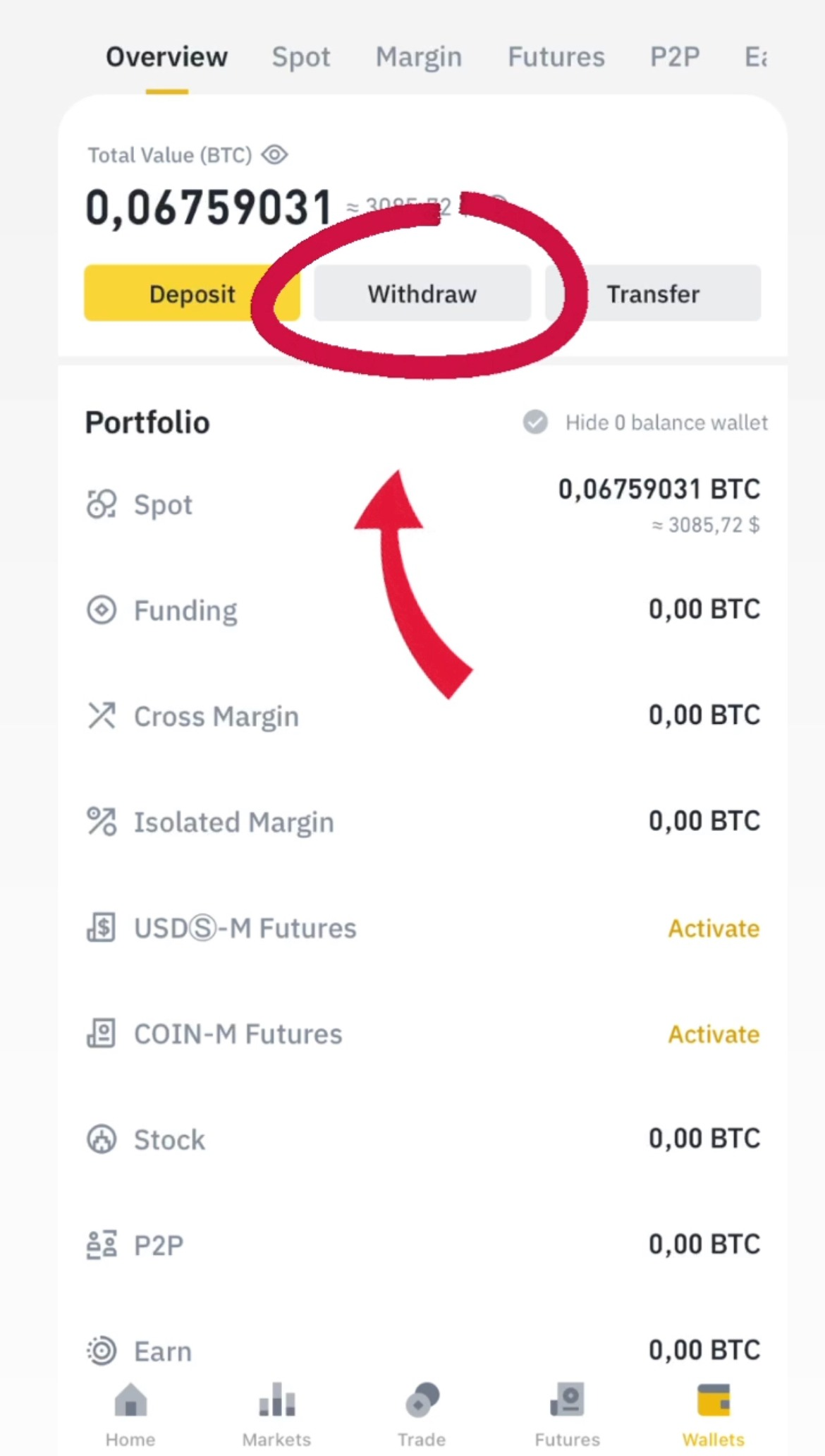

Go into the wallet, click ‘Overview’ and than ‘Withdraw’

- Click ‘BNB’

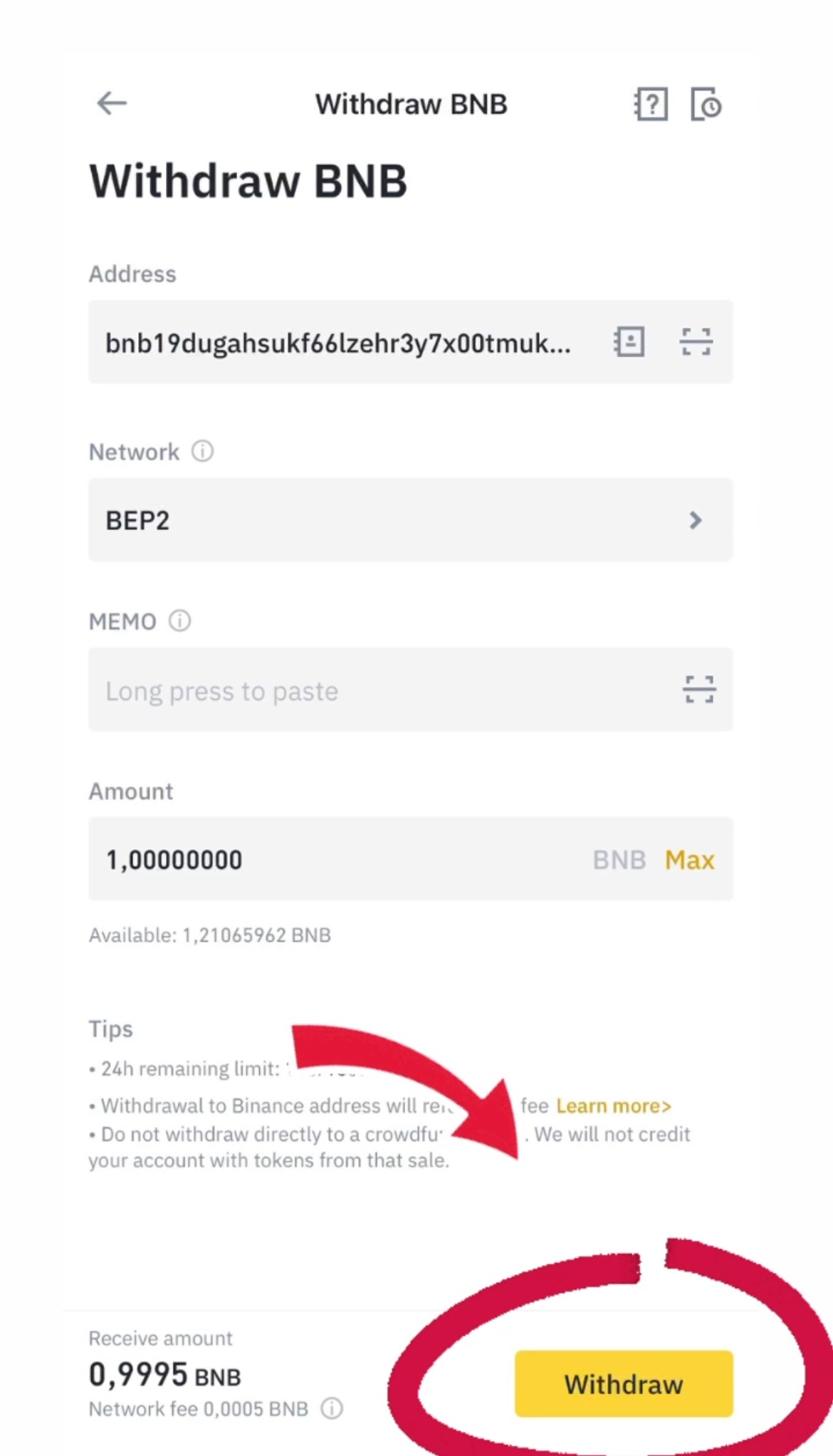

- Insert the address which we copied in the Trust Wallet, select Network “BEP2”, specify the sum and click “Withdraw”

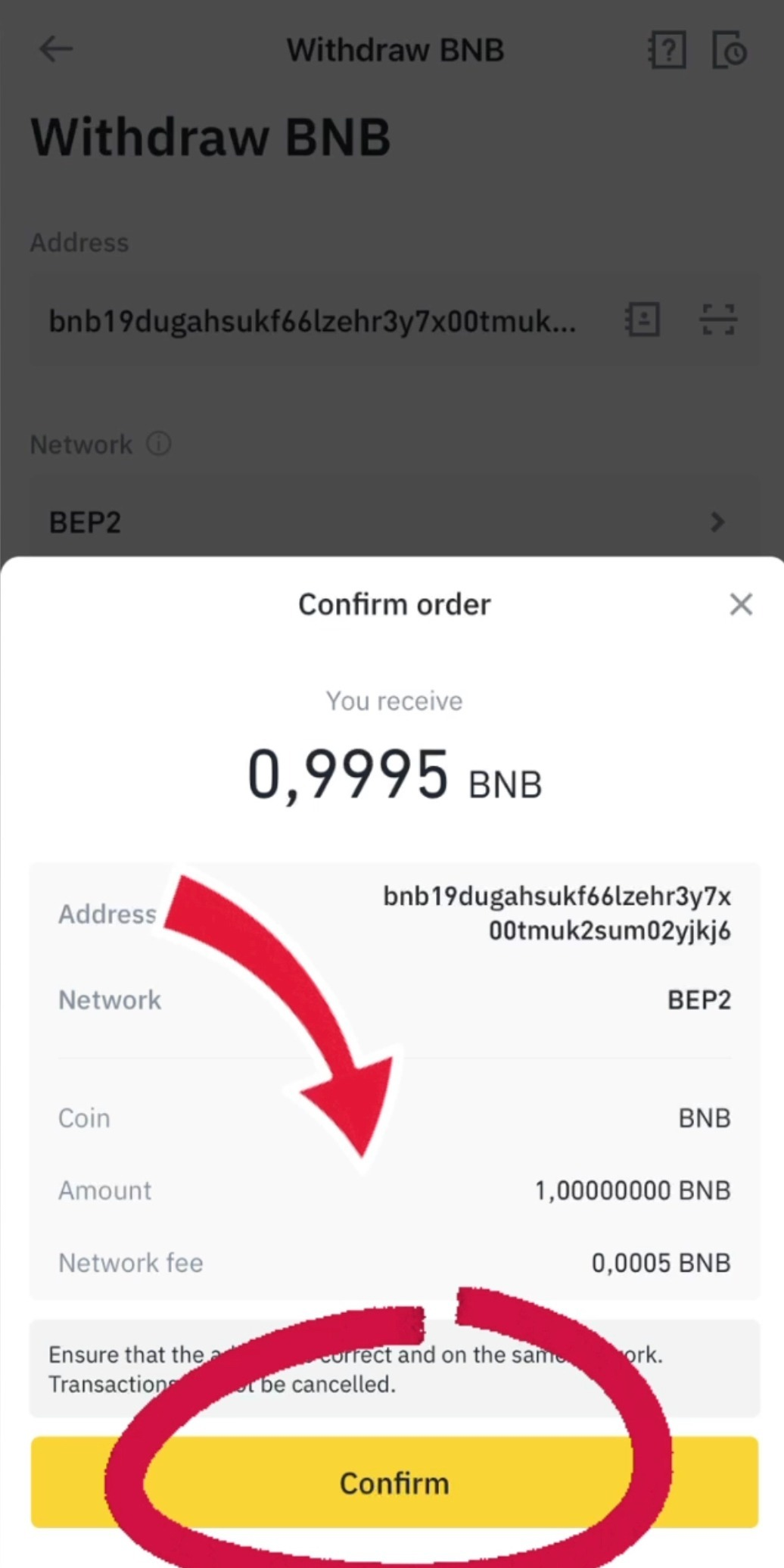

- Confirm the transfer

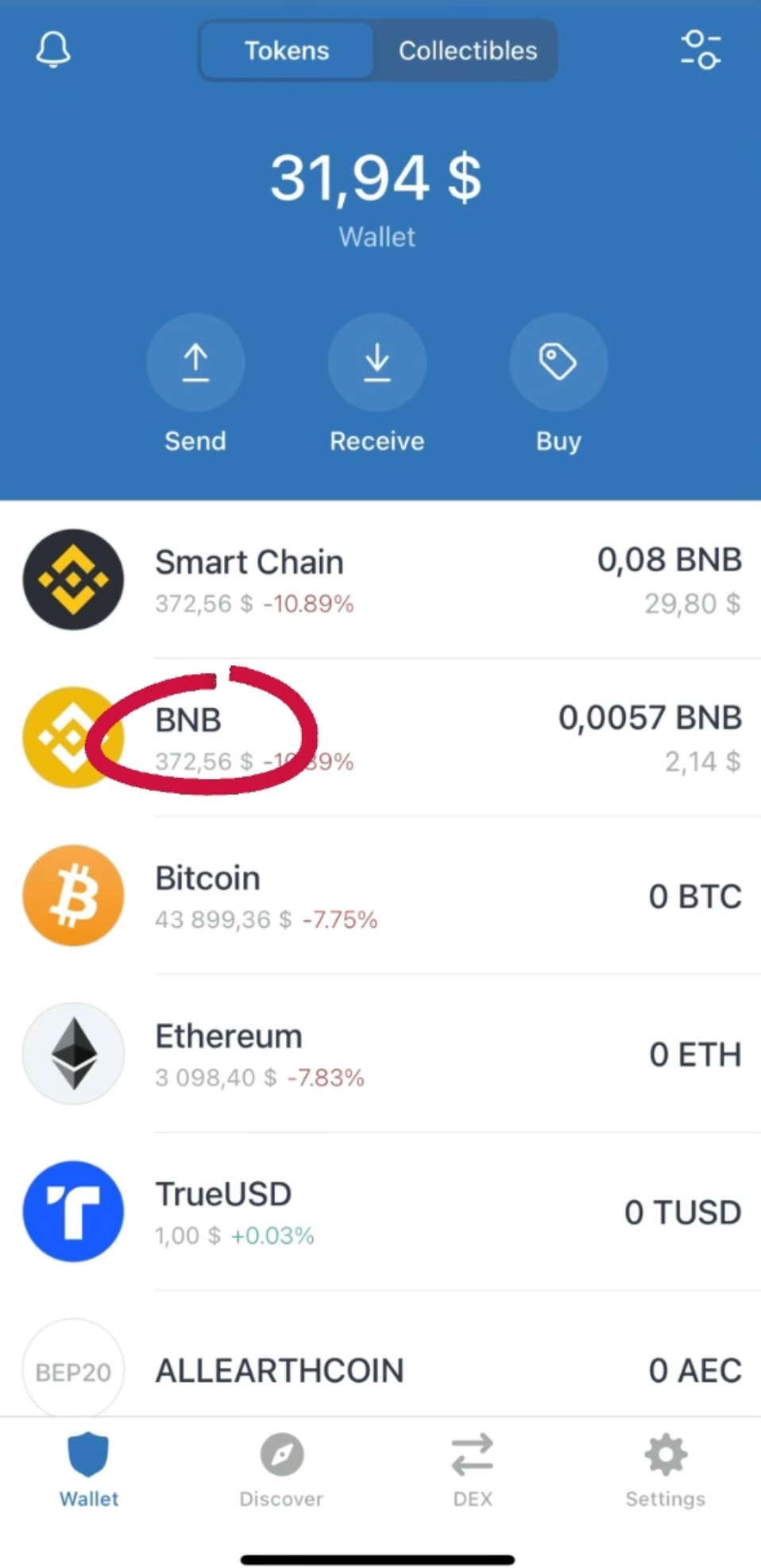

- You have BNB on your balance!

- Step five

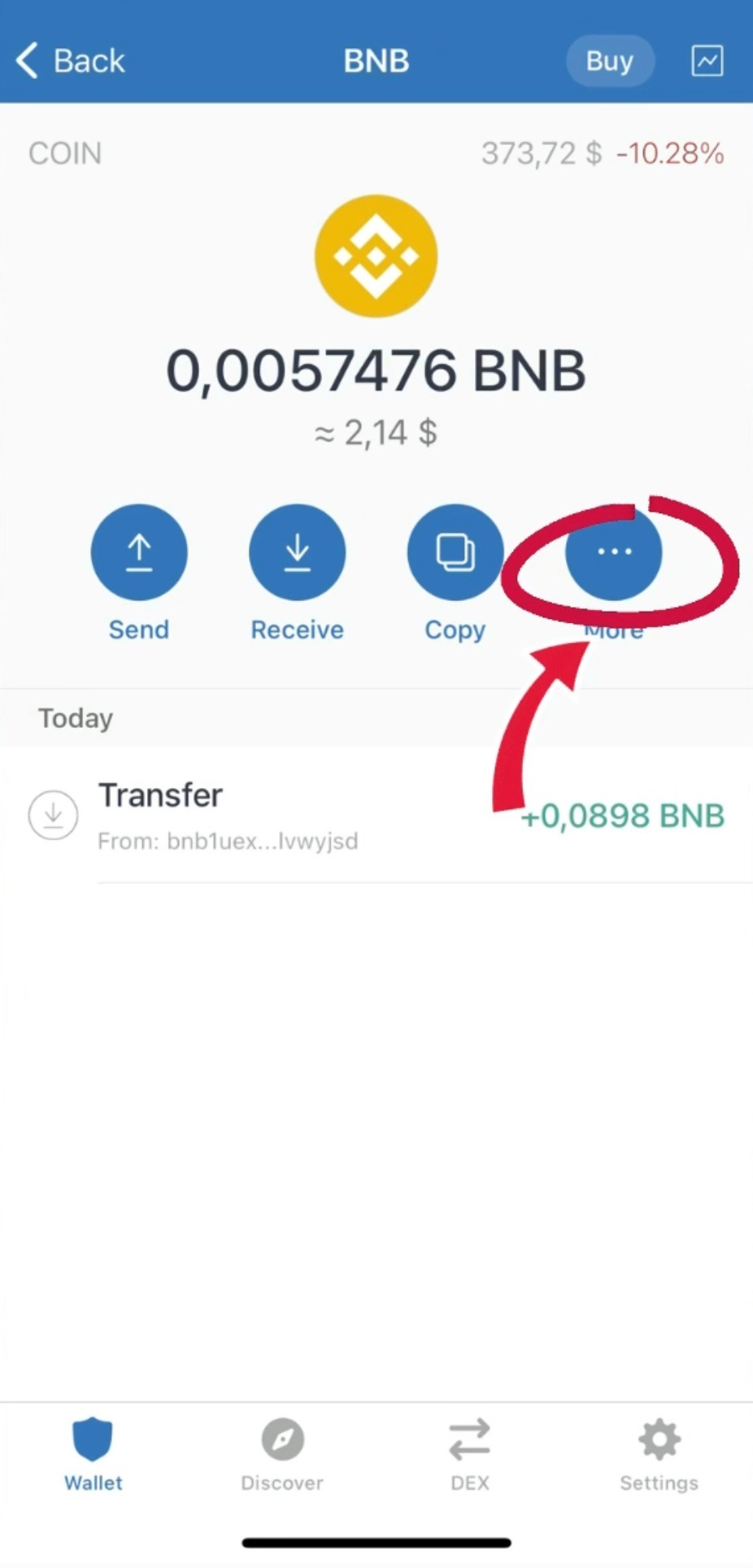

Select and click ‘BNB’ coin

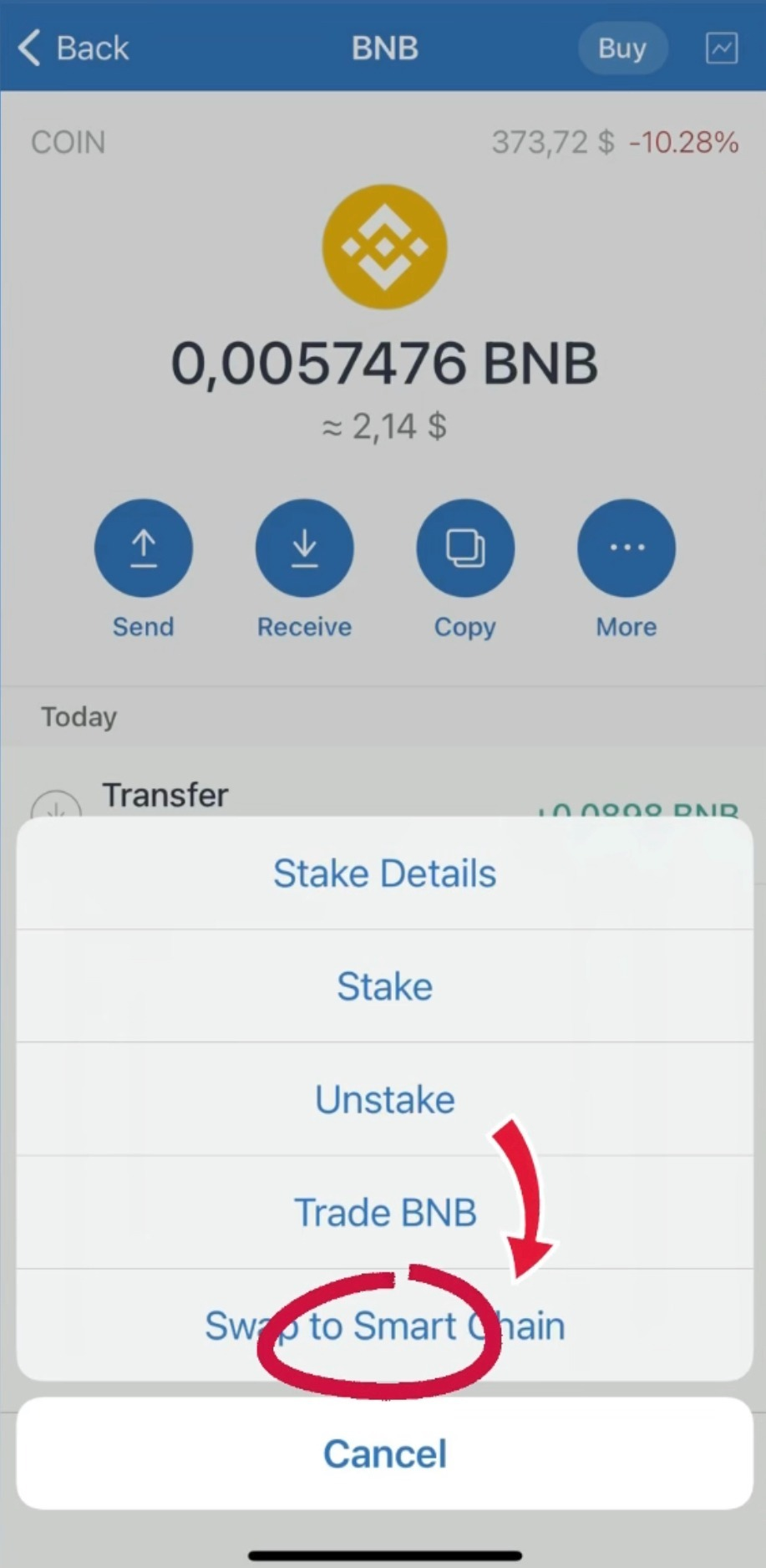

- Change the network BNB to Smart Chain, click ‘More’

- Click ‘Swap to Smart Chain’

Done, we created and transferred BNB to the Trust Wallet, congratulations.

Done, we created and transferred BNB to the Trust Wallet, congratulations. - Step six

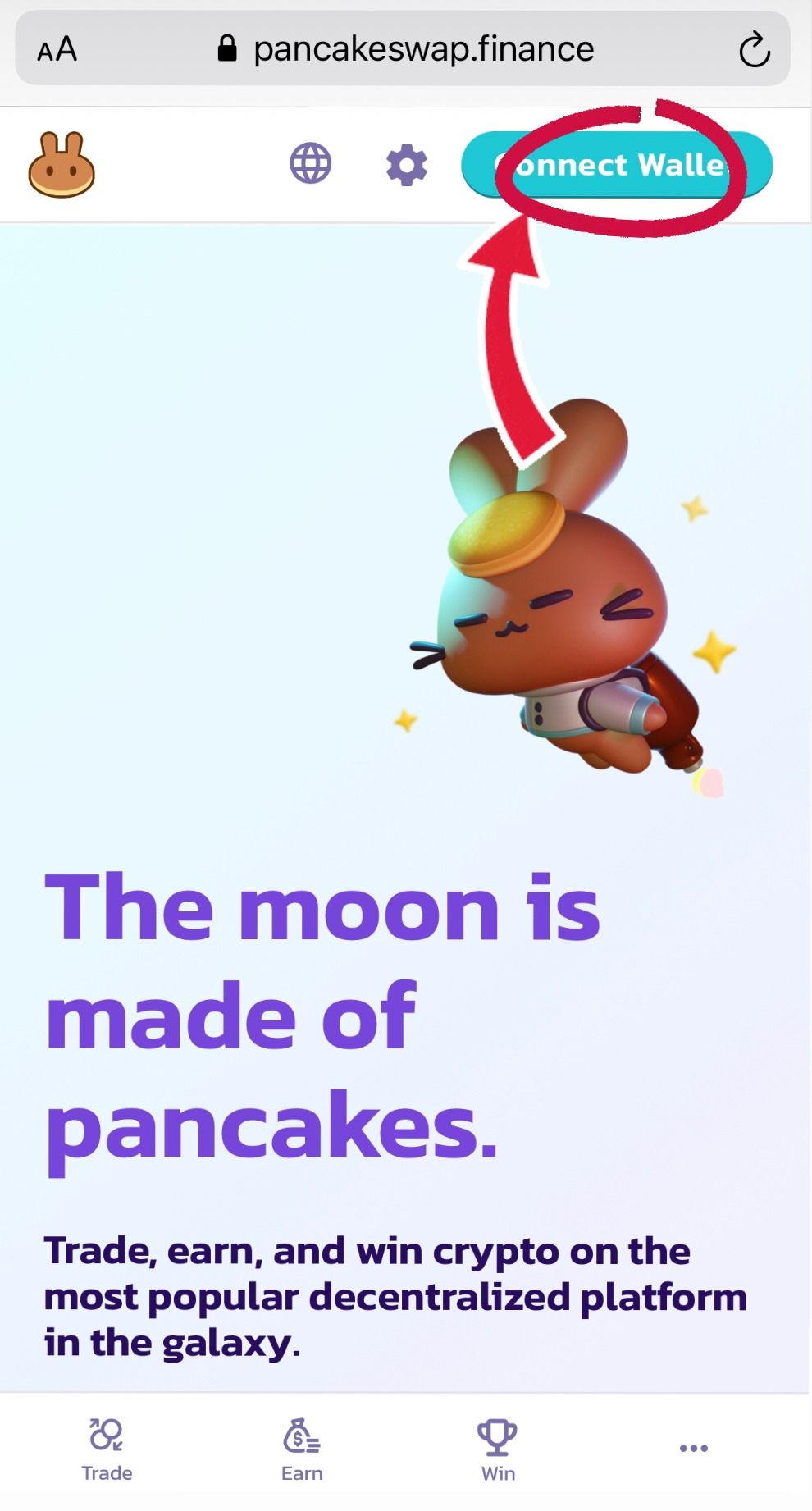

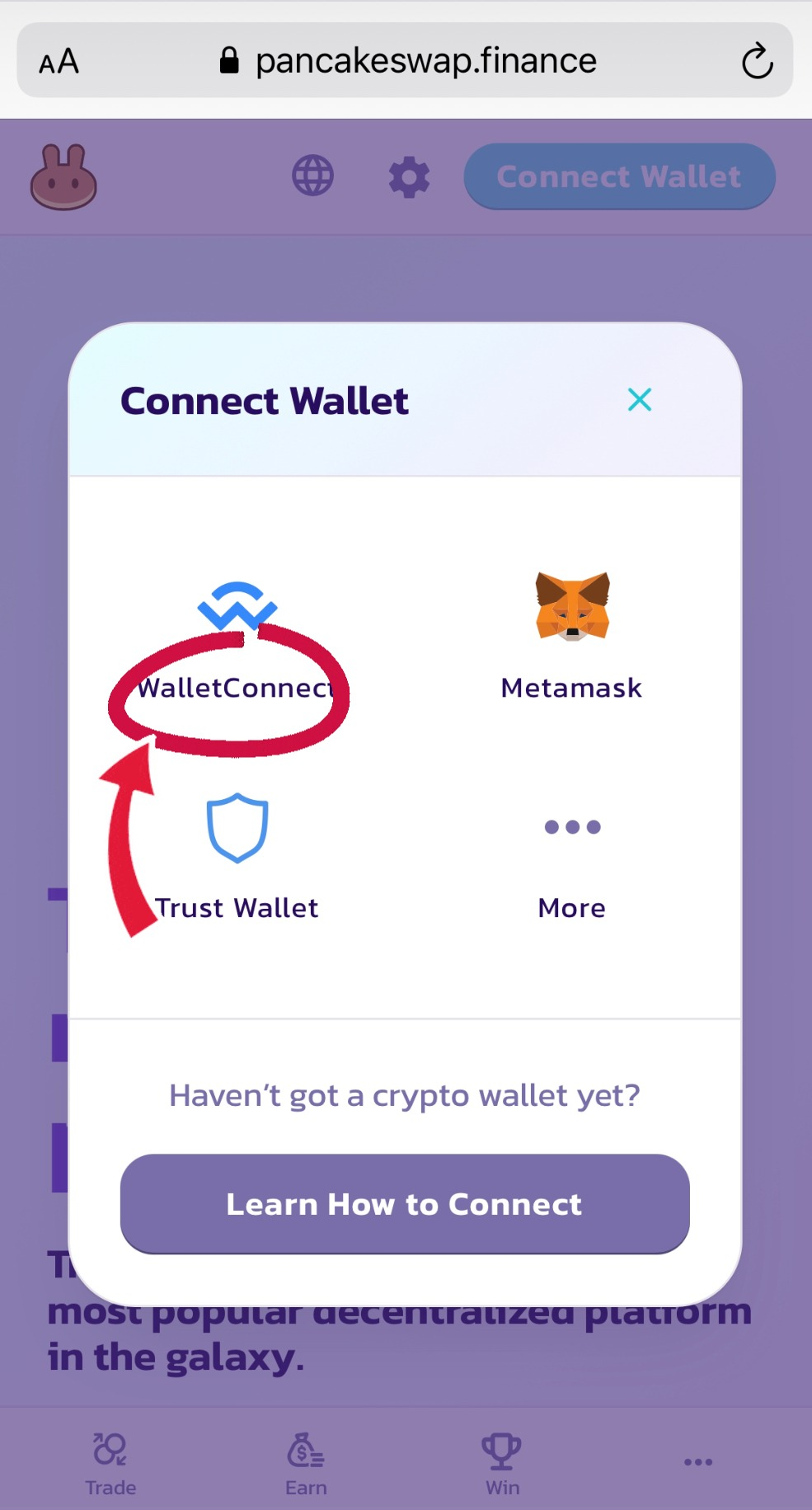

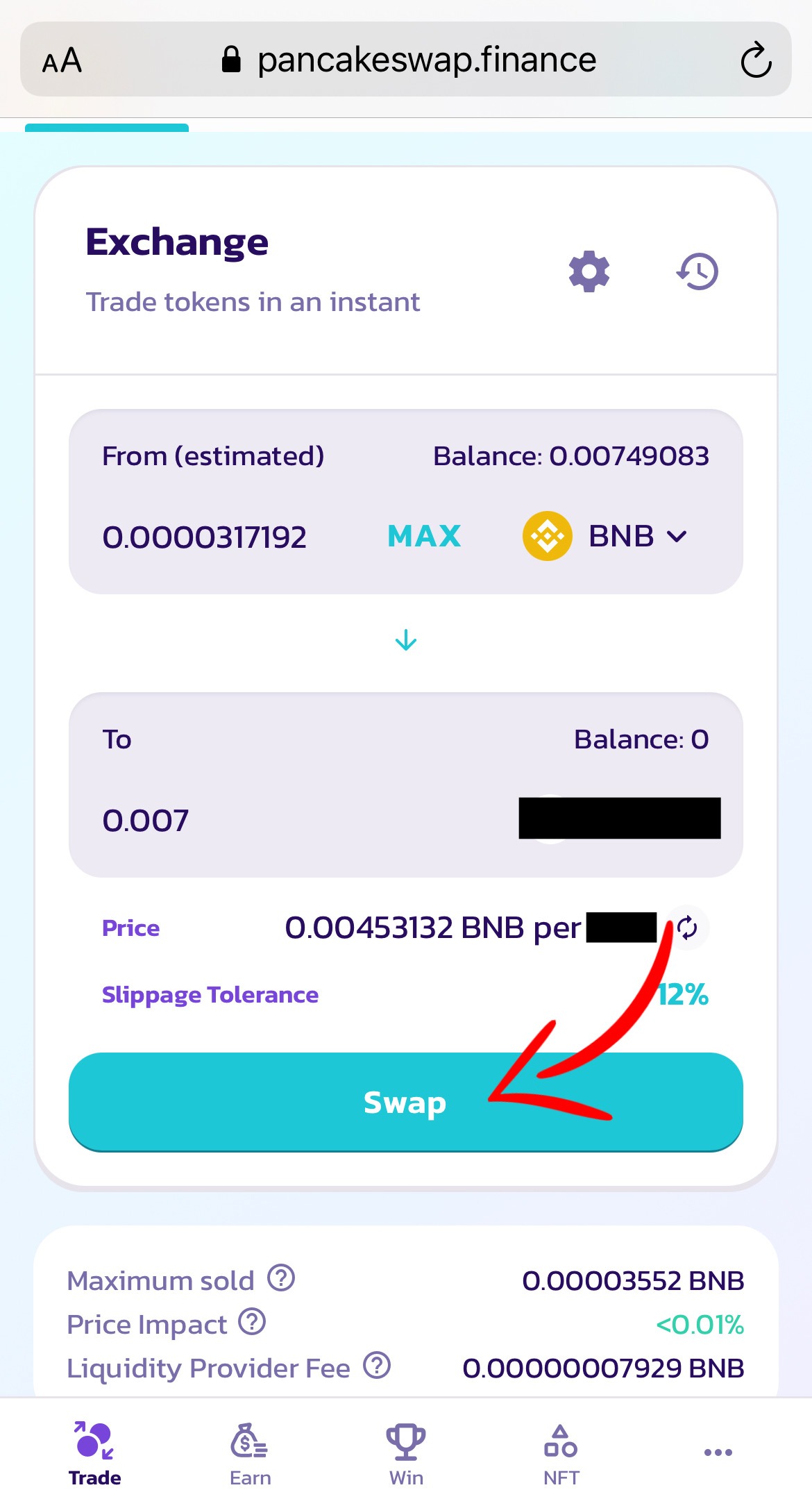

The next step is to connect our wallet to the pancake swap, click “Connect wallet”

- Click “Wallet connect”

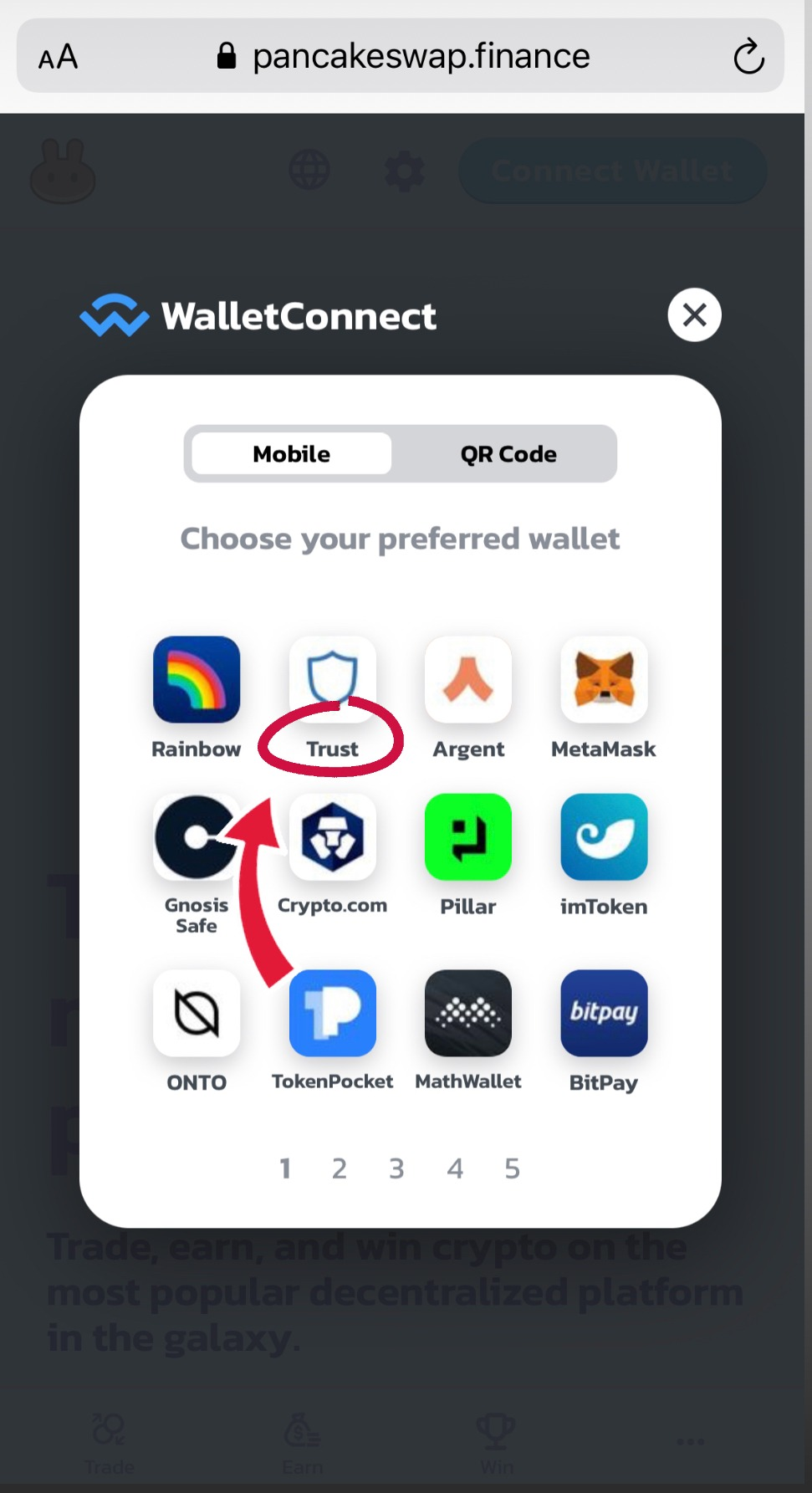

- Click ” Trust wallet”

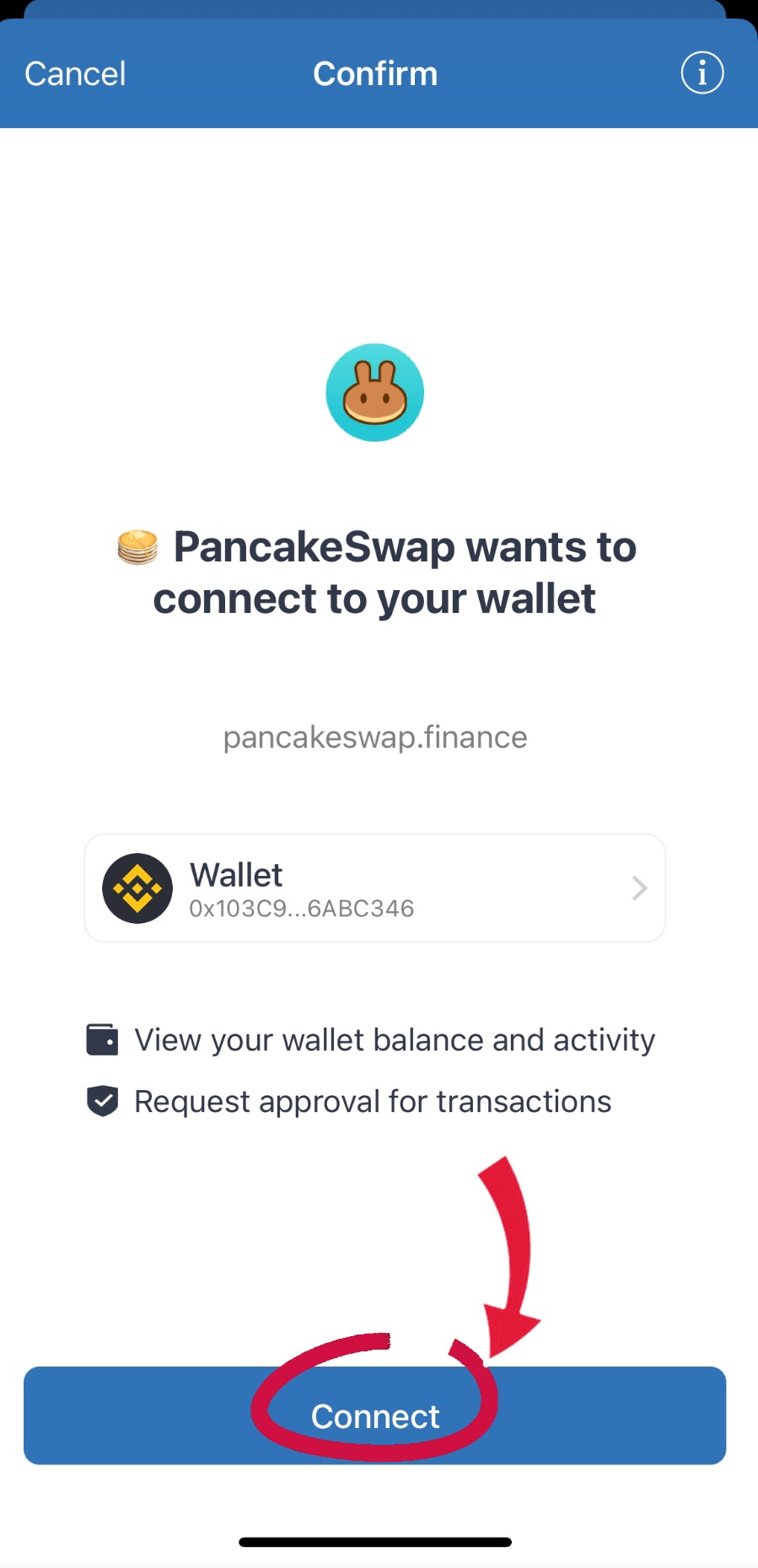

- Click “Connect”

- Back to the browser, wallet is connected !

- Step seven

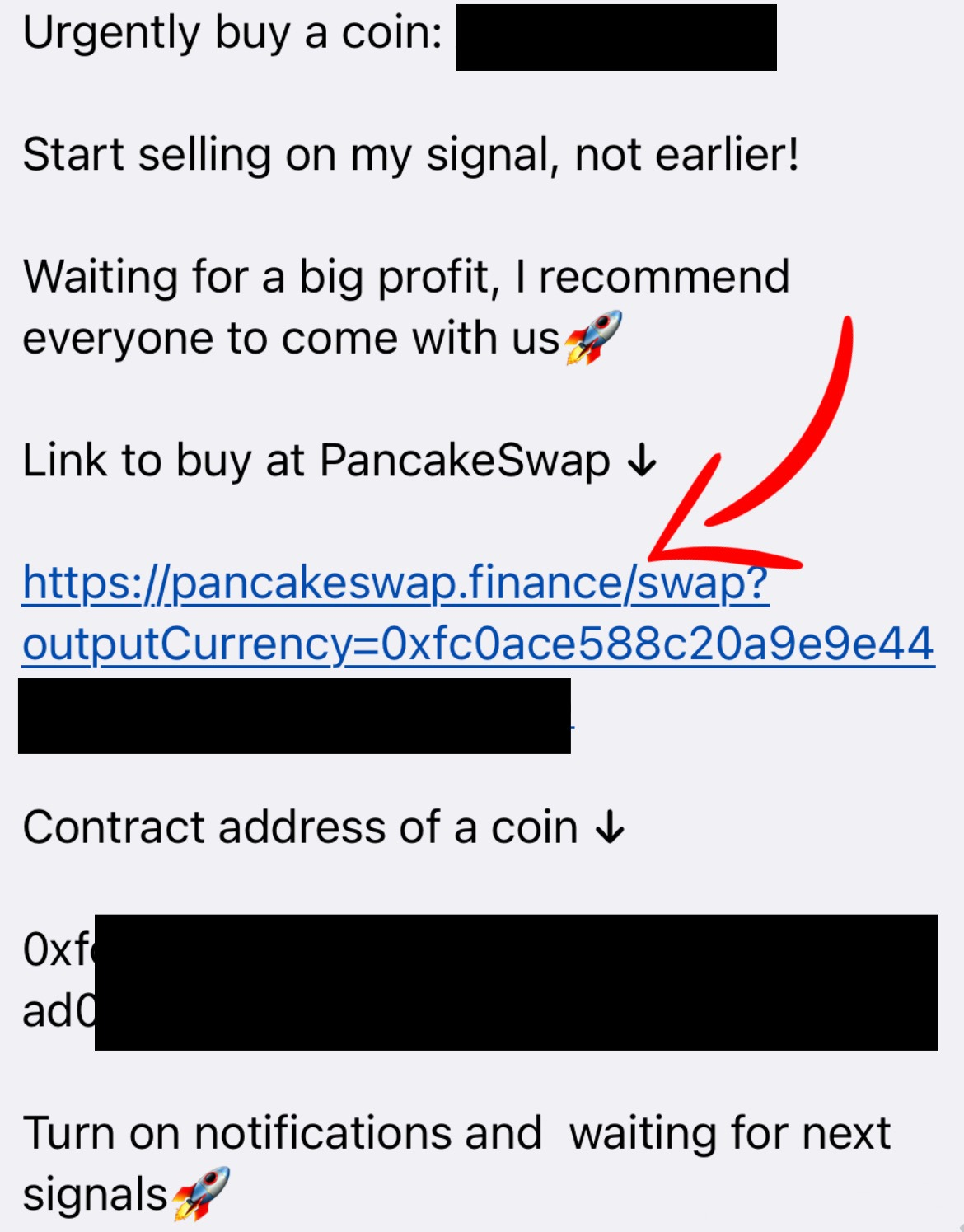

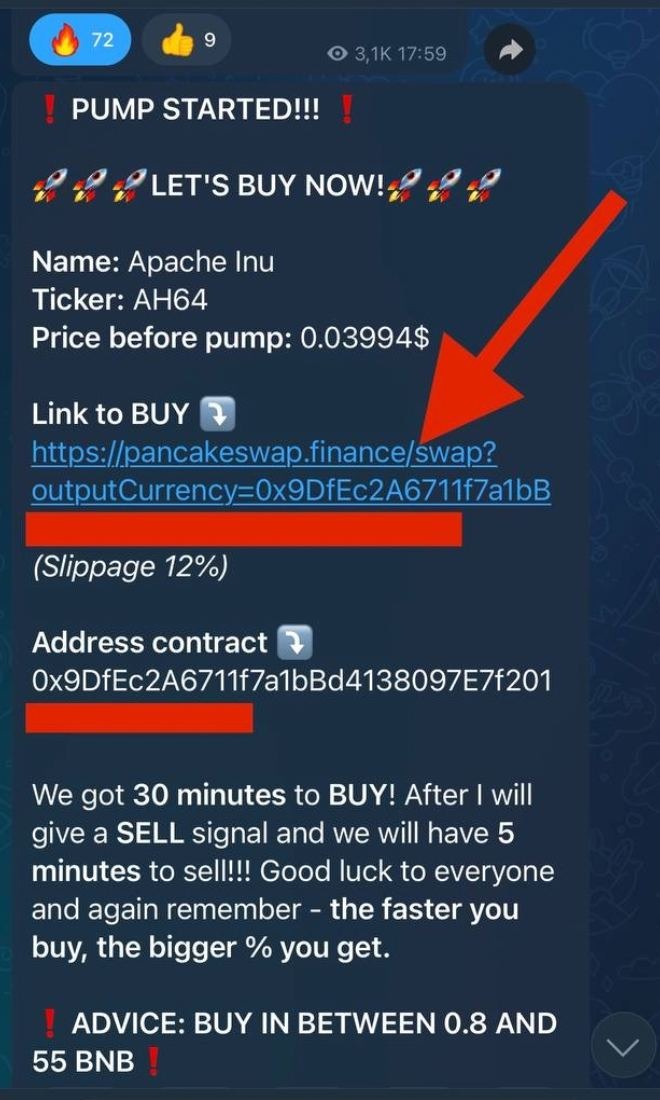

Now it remains to purchase a coin at our signal, all signals about pumps are posted in our telegram channel, in this format ?

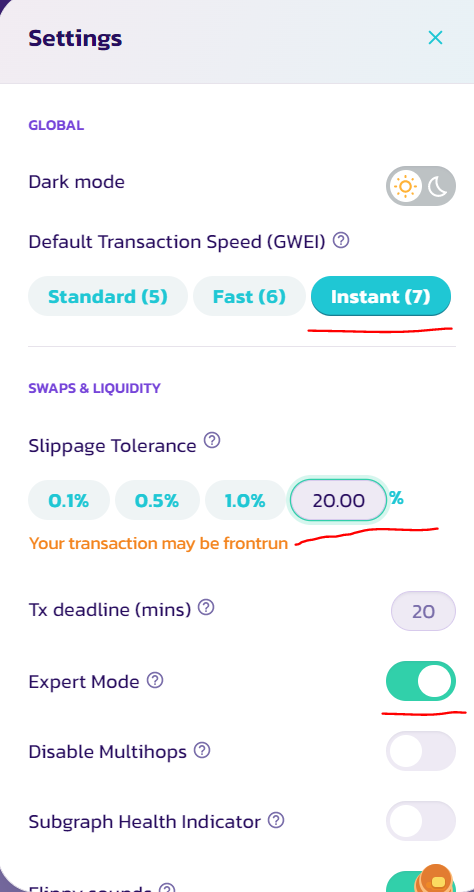

Click on the pancake swap site link, after clicking on the link, we expect 5 – 10 seconds after which we will see a window where we must click the “I understand” checkbox

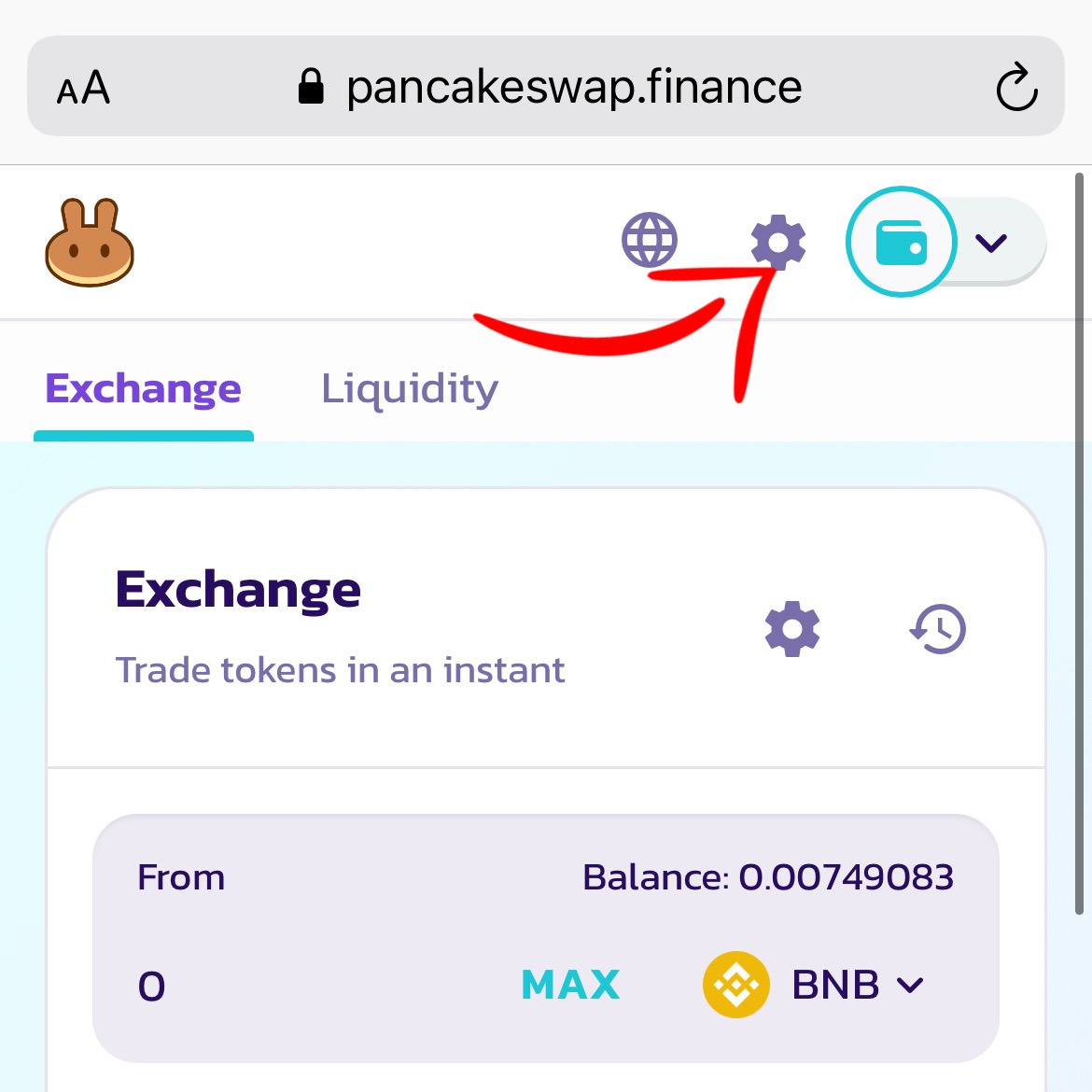

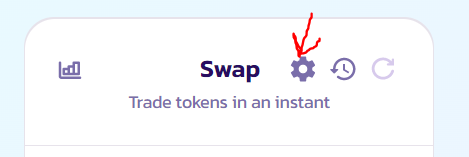

- Press “Settings”

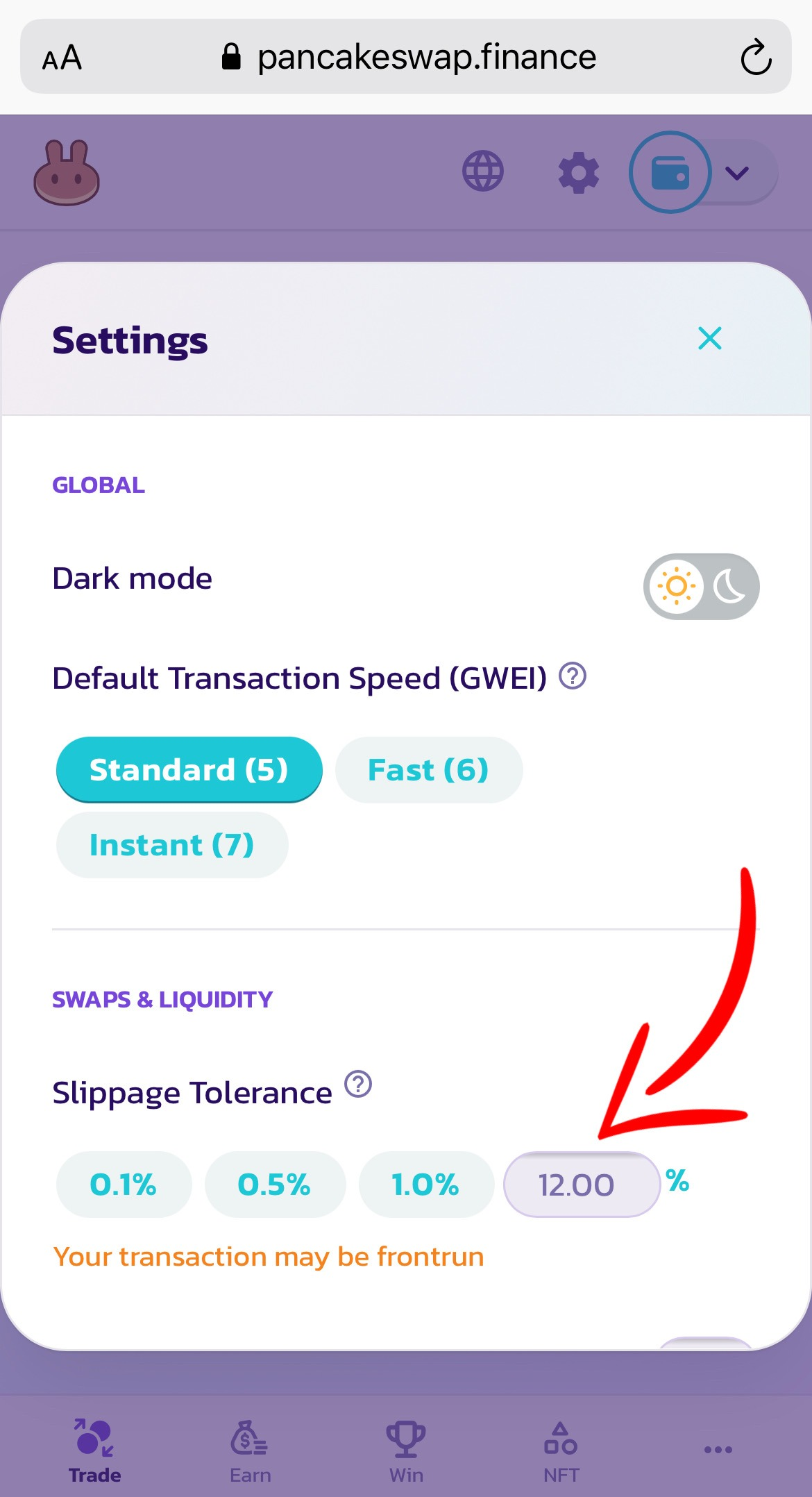

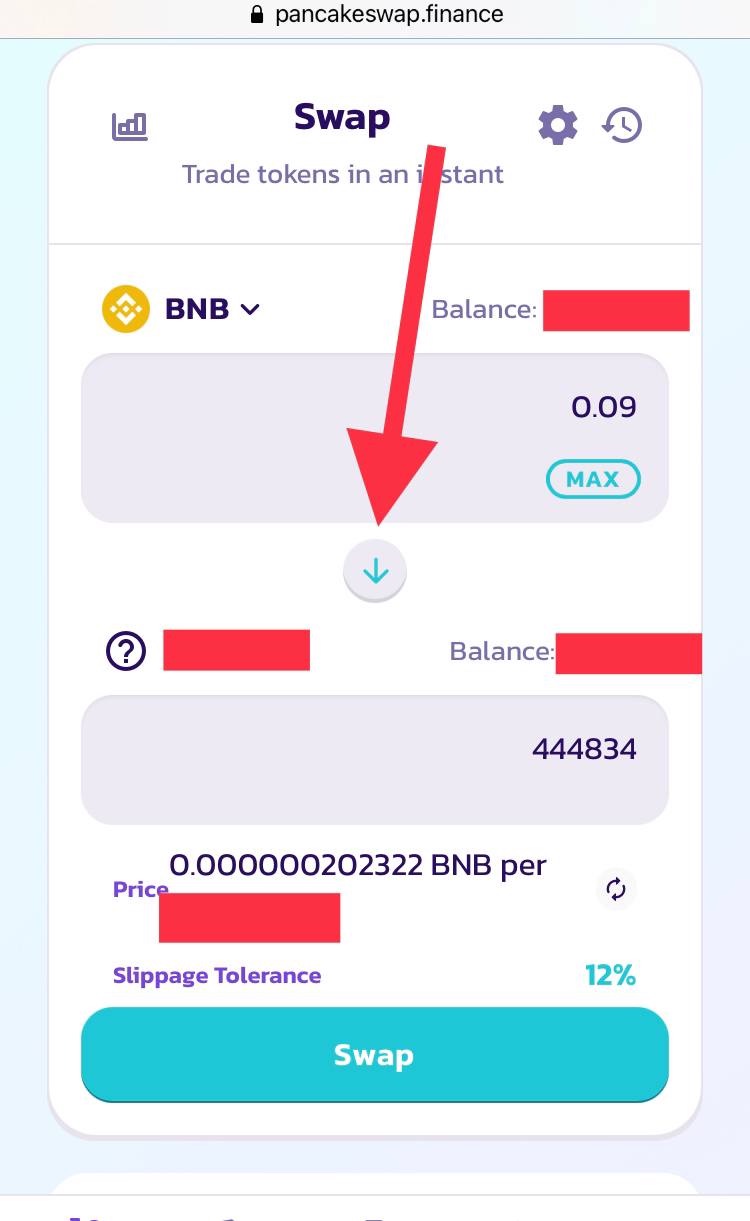

- Choose “slippage” 12%

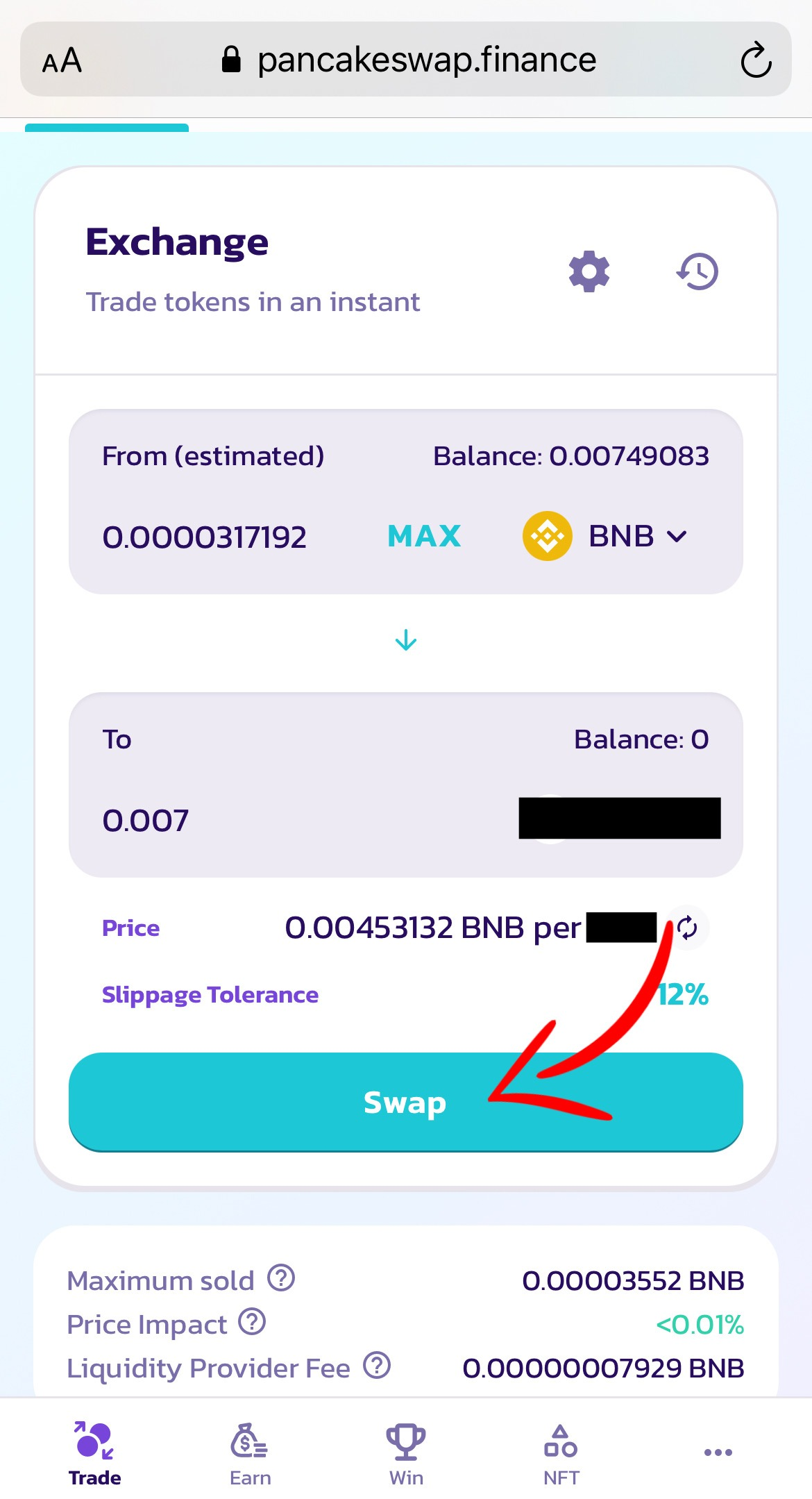

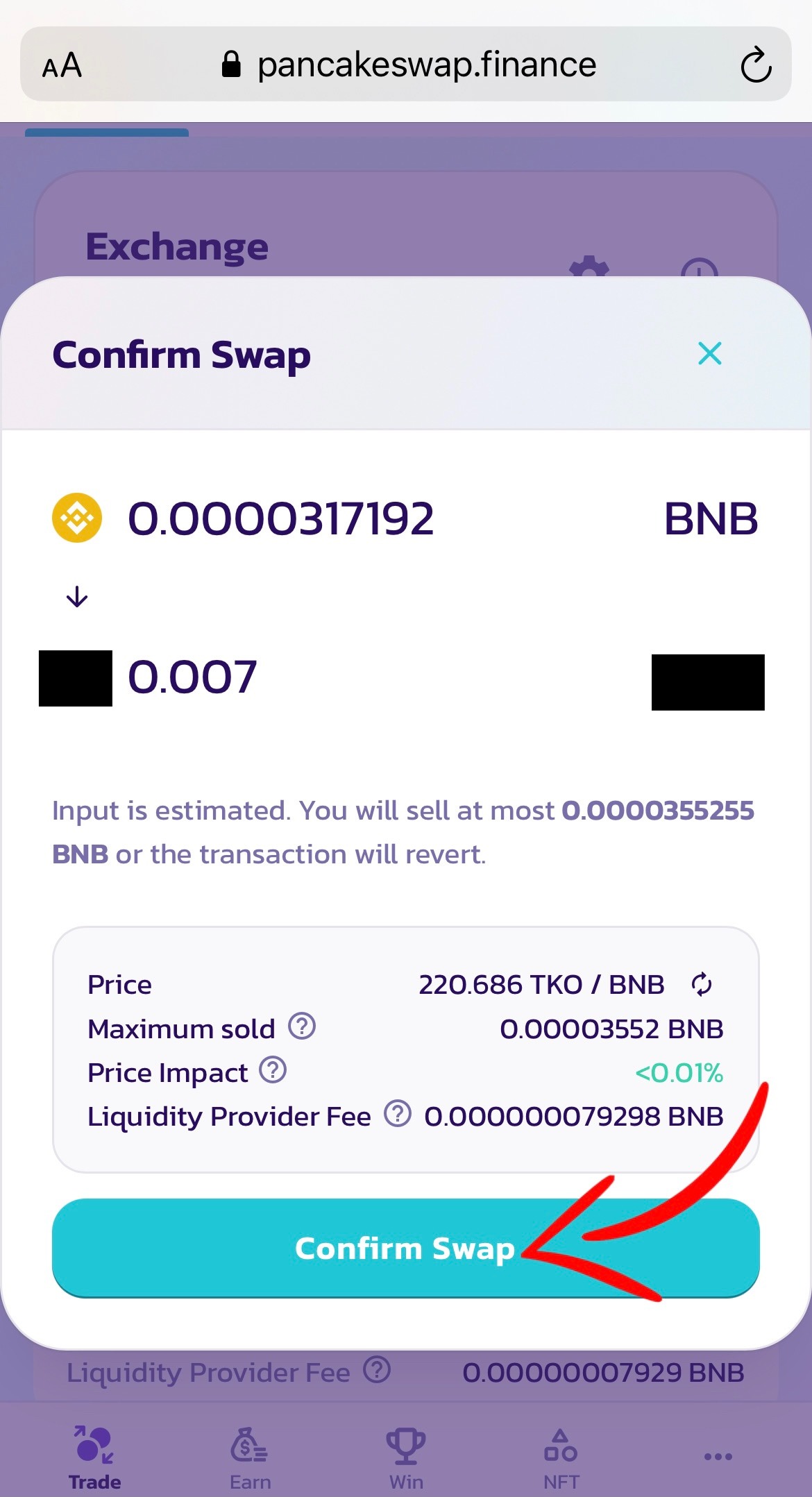

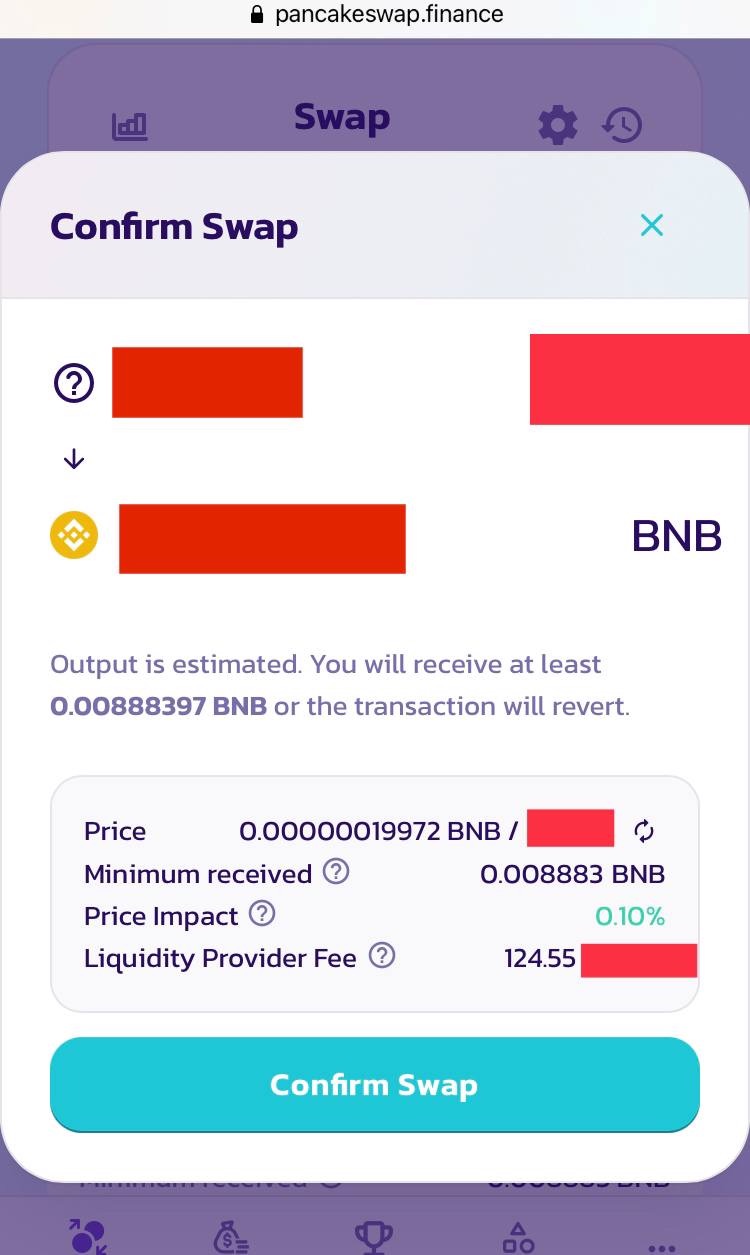

- Select the amount and press the “swap” button

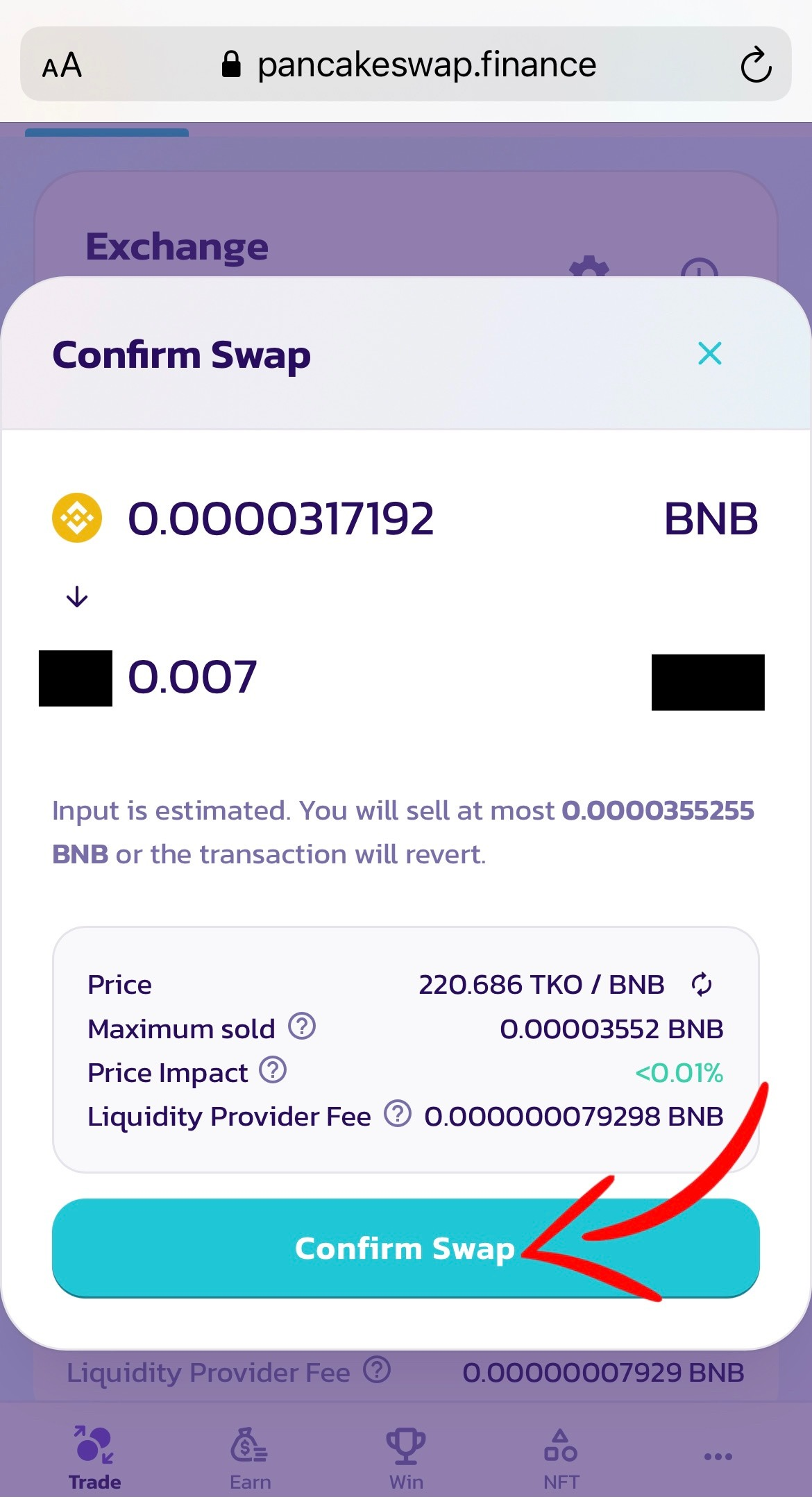

- Confirm Swap

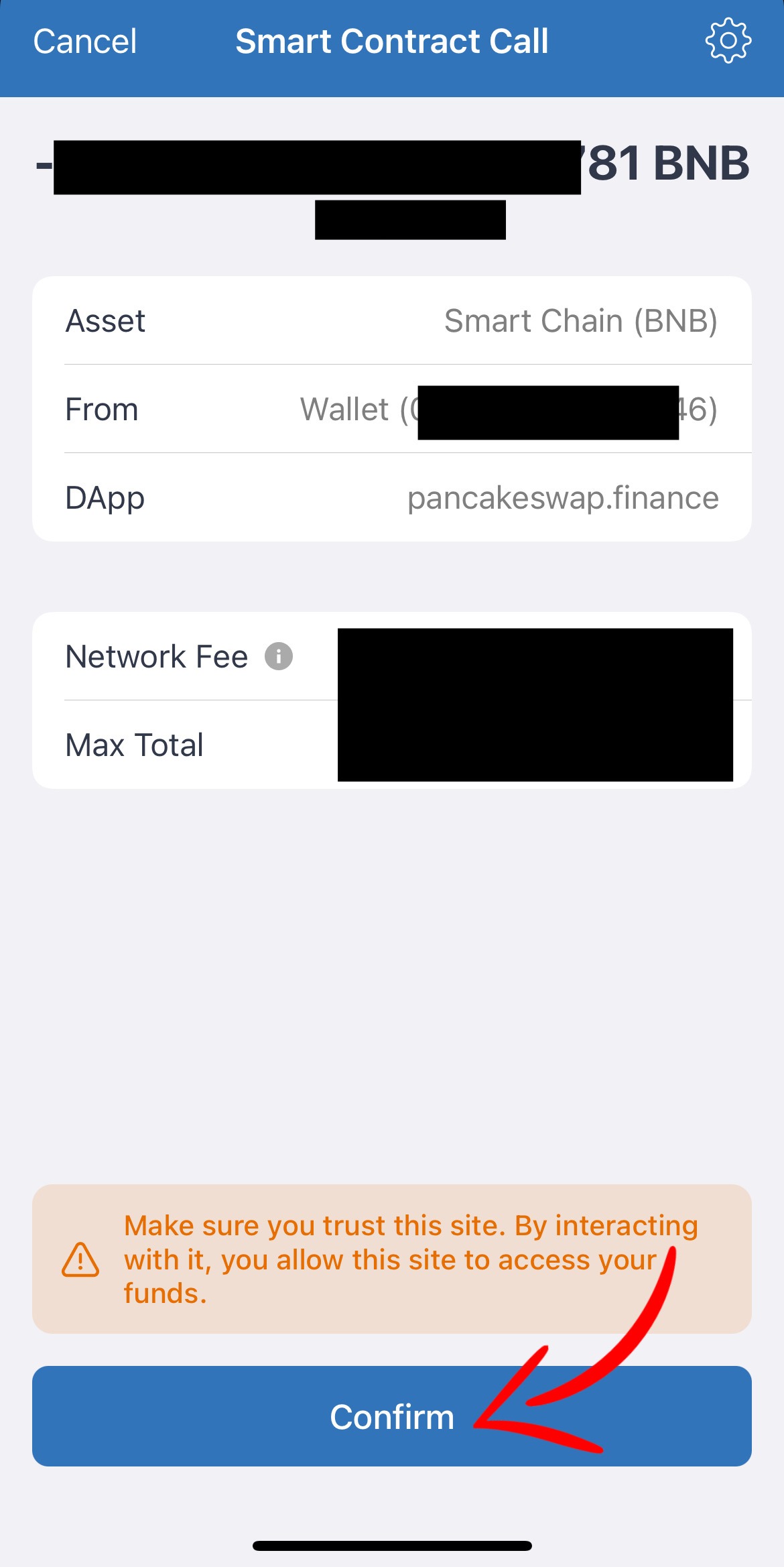

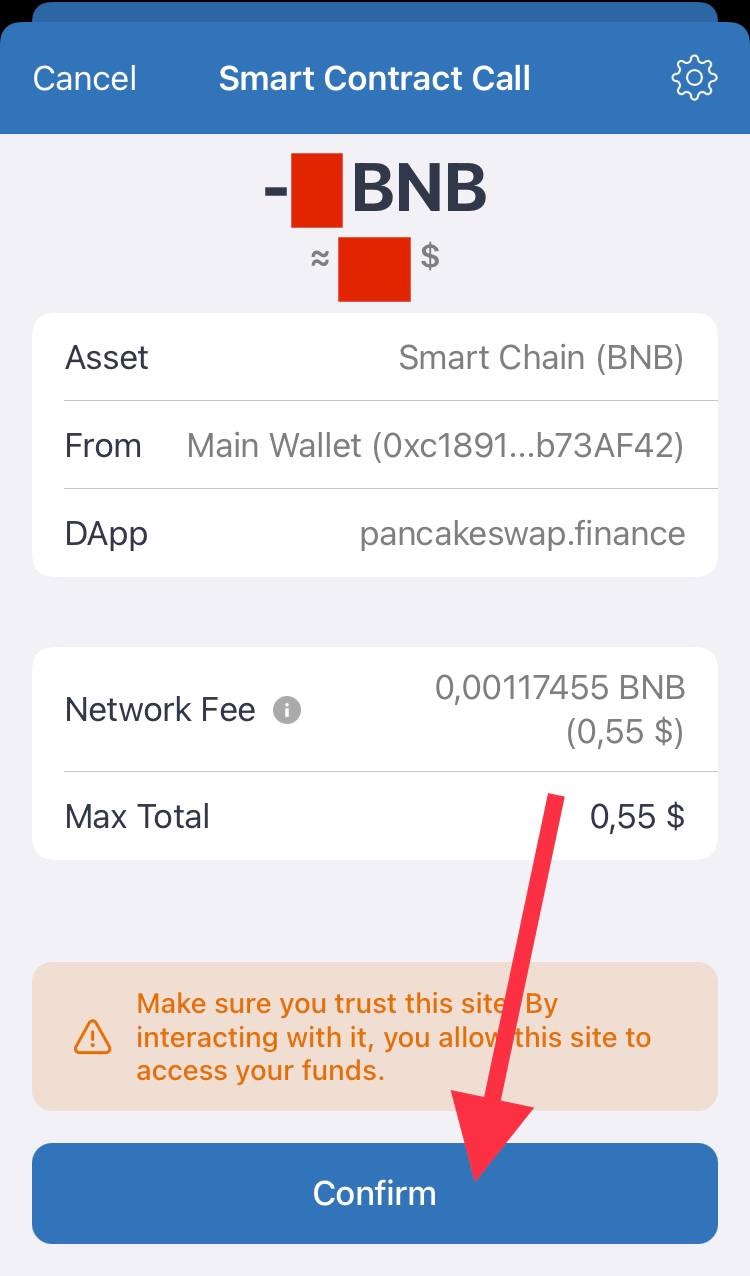

- We return to the trust vallet and click Confirm

Congratulations, you have purchased a coin, then you will are closely following the further signals in our telegram channel I will give a sell signal, in order to sell you need to swap in the opposite direction.

If you don’t have BNB Smartchain in a Trust Wallet or if you’ve never used PancakeSwap here is an explanatory video that explains the whole process.

To participate in the PUMP you need BNB BEP20 on your wallet.

If you don’t have BNB Smartchain in a TrustWallet & Metamask or if you’ve never used PancakeSwap here is an explanatory video that explains the whole process.

Watch 1 to 9 minutes only

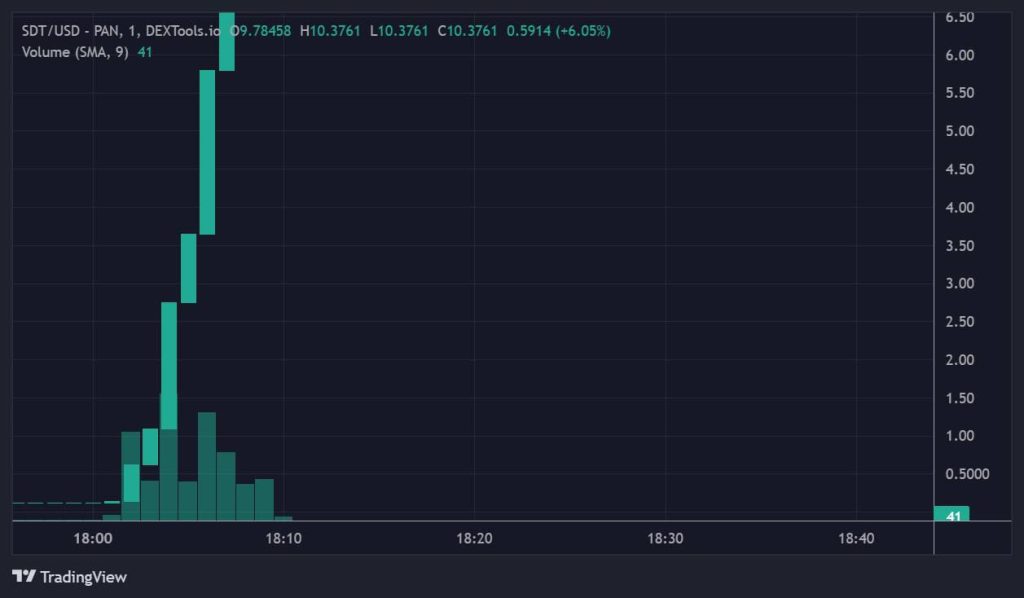

During the Pump telegram groups send the following information so that you can buy the token:

- Name, Ticker and all useful information about the token

- Link to buy (you need to copy and paste it in the browser, not in the telegram.)

- Chart link (we will monitor the price)

- Sell at my signal. I’ll write to you!

Make Money Using Cryptocurrency

Anyone can participate in the cryptocurrency market by buying and selling virtual currencies. Profits vary based on market conditions but, as a general rule, higher sell prices usually correlate to higher buy prices. This creates a potential for earning fast and furious profits from minimal investment.

The most popular way to profit from cryptocurrency is through ‘pump and dump’ schemes, also known as ‘short-selling’ or ‘accusing’ cryptocurrencies. In a pump and dump scheme, a promoter buys a small amount of a cryptocurrency (usually Bitcoin or Ethereum) with the intent of increasing its value and profiting from the rise in price. Once the price increases in value, the promoter ‘dumps’ (sends back) their investment, making a large profit.

In a nutshell, pump and dump schemes allow investors to profit from the inevitable rise in prices associated with any new or popular cryptocurrency. Short-sellers (often referred to as bears) profit when the price of a cryptocurrency falls, resulting in a short-selling opportunity. In most cases, pump and dump schemes are carried out through special financial vehicles, or ‘dark pools’, that shield buyers from exposure to sudden price movements. Examples of cryptocurrencies that are frequently used in pump and dump schemes include Bitcoin, Ethereum, and Litecoin.

Short-selling Cryptocurrency

Traditional stockbrokers and financial institutions don’t deal in cryptocurrencies directly but rather through ‘exchange-traded funds’ (ETFs) that track the performance of major cryptocurrencies. Cryptocurrency is also available for direct purchase from some stockbrokers and investment advisors. For practical purposes, it is usually best to purchase cryptocurrency through an organized channel, such as a crypto broker club . Once you have the cryptocurrency, you can use commercially-available software to short it, seeking to profit from its fall in price.

Some brokers will only allow short-sellers to enter certain markets. For instance, the Efficient Frontier Capital Management (EF Capital) group of companies has a blanket prohibition on short-selling certain cryptocurrencies due to their status as ‘legacy’ currencies, according to a March 13, 2019 article in the New York Times. Short-sellers are restricted from investing in cryptocurrencies that are more than 10 years old. This policy effectively limits short-selling opportunities to investors who want to take a gamble on early-stage cryptocurrencies. The article also points out that many newer cryptocurrencies are designed to be resistant to short-selling, which makes it more difficult for speculators to profit from price movements. The policy is purportedly aimed at preserving the value of these currencies.

Avoid Getting Scammed

Due to the nature of the cryptocurrency market and the anonymity that it affords users, scammers have taken advantage of naive investors looking to make a quick buck. To combat this, cryptocurrency exchanges and market places vet new users and ensure they operate from a reputable source. Sometimes this means an investment from a larger financial institution is required. Nevertheless, the growing use of blockchain protocols to confirm transactions and foster trust among participants (as discussed under ‘How To Make Money Using Cryptocurrency’) means that getting scammed is becoming less common.

Because of the highly unregulated nature of the cryptocurrency market, investors are advised to exercise extreme caution when dealing with any unknown traders. As part of their due diligence process, reputable cryptocurrency exchanges keep a close eye on customer activity and engage in frequent internal audits to ensure systems are not being compromised. Because of the large sums of money at stake in some cases, cryptocurrency exchanges also engage in anti-money laundering (AML) and know your customer (KYC) measures to ensure customers are who they claim to be and aren’t using the platform to launder money or finance illegal activities. In some instances, cryptocurrency exchanges have also been known to work with law enforcement agencies to prosecute internet scammers who attempt to trick users into handing over their private keys and credentials. Finally, in instances where digital wallets and web hosting are hosted in low-security countries with lax enforcement, users are advised to avoid storing large sums of money on their account.

FAQ

Pump is a deliberate and drastic increase in the value of a coin with the help of a massive purchase by our entire team.

Team buy tokens on PancakeSwap exchange, as soon as we buy each one – the coin begins to grow and arouse interest in the entire crypto community, after its growth at the peak of the price, we sell it and get our profit

We all buy the coin at the same time, due to the large number of buyers, we attract the attention of other traders and investors, after the huge growth of the coin, we immediately fix our profit, while other traders and investors buy it.

I myself will not be able to move the coin in value. For this, I have gathered a community to make money together. The more us, the more we earn!

This is the method that we earn $ with our large community.

No, there is no way to trade on Pancakeswap on binance, you need to install a Trust Wallet or Meta mask to participate.

Hey guys! Glad to see you here, I will explain on how to buy on PancakeSwap market with your Trustwallet or Metamask wallet.

Step One

In telegram channels admins will be posting PUMP info. They have a countdown before pump, as well as we have a date set couple days before we PUMP. So everyone have time to prepare.

Click on the pancake swap site link, after clicking on the link, we expect 5 – 10 seconds after which we will see a window where we must click the “I understand” checkbox.

Step Two (you can do this step even before PUMP, but ALWAYS check it before buying, because sometimes PancakeSwap refresh all settings)

Press “Settings”

Now, you have to make sure you have three things set up correctly here.

Default transaction speed should be INSTANT – that will cost you less then a dollar more for a transaction but you will save another 1-2 minutes which is very important during pump.

Slippage Tolerance – Set it at 20. If it will be less – it will take less. This way you just don’t need to worry and be distracted of it. Slippage is the expected % difference between intended and executed prices.

Expert mode – ON.

Step One

Select the amount and press the “SWAP” button

Confirm Swap

Return to your wallet and Press Confirm Transaction.

That’s it guys. Now you are a PUMP coin owner.

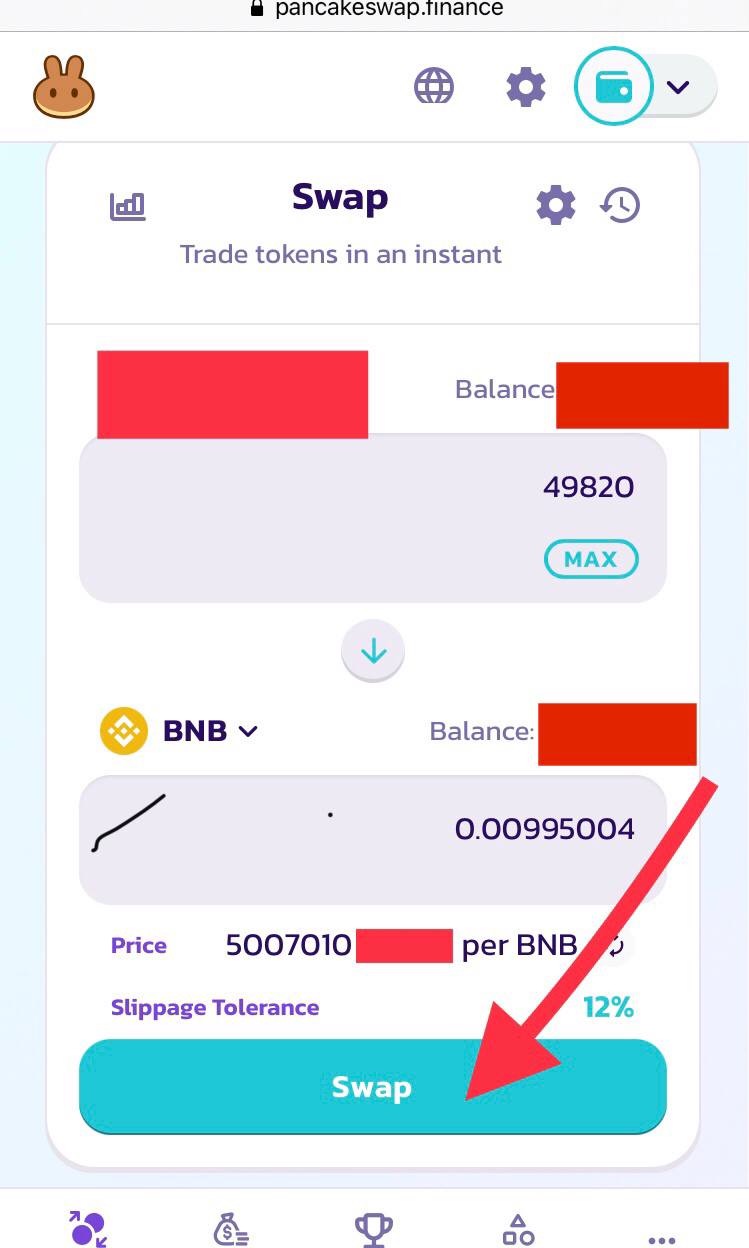

Now you have to wait until I give SELL signal on a channel and then make a SWAP back. From pump coins to BNB.

We got 30 minutes to BUY! After I will give a SELL signal and we will have 5 minutes to sell!!! Good luck to everyone and again remember – the faster you buy, the bigger % you get.

So, the most important thing is to wait for my sell signal and not to sell before everyone else.

Step One

Back to the PancakeSwap and choose a pair with whom we have worked before. Click reverse

Fine! Your pair should change places

Enter amount and Click Swap

Check and click confirm

You will be redirected to TrustWallet or Metamask – click confirm!

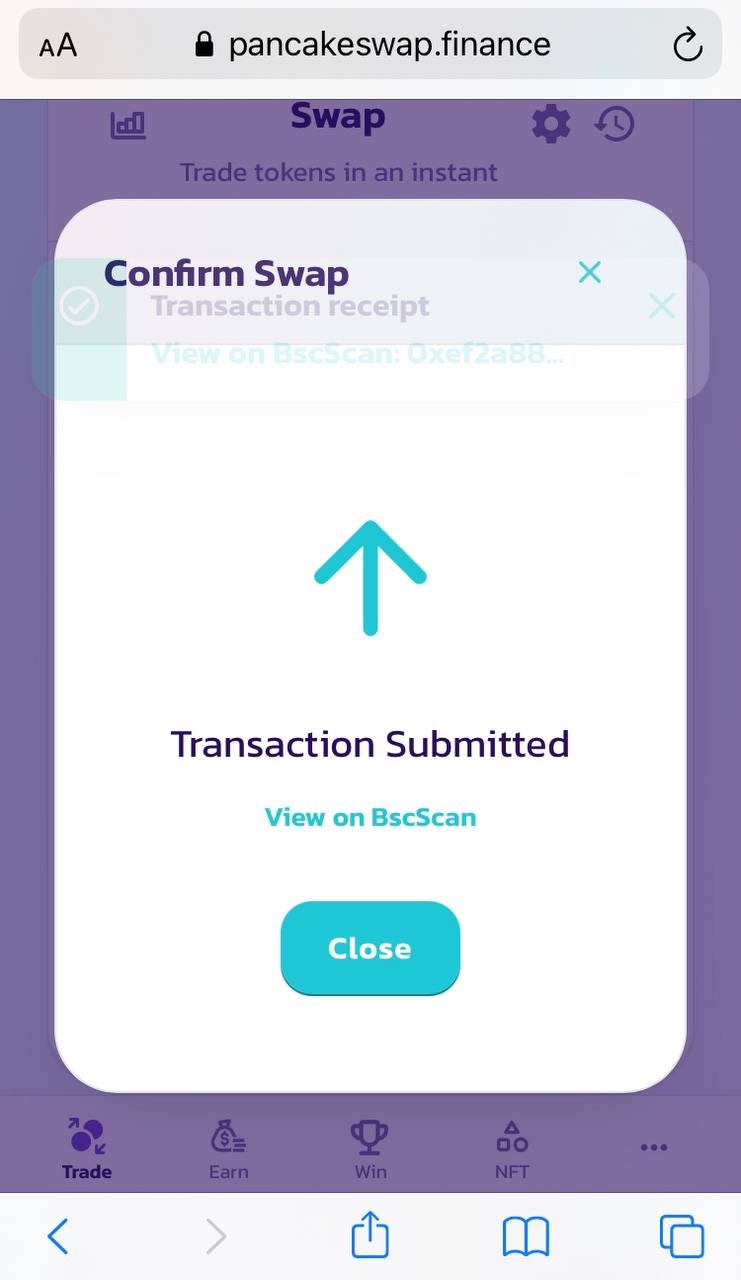

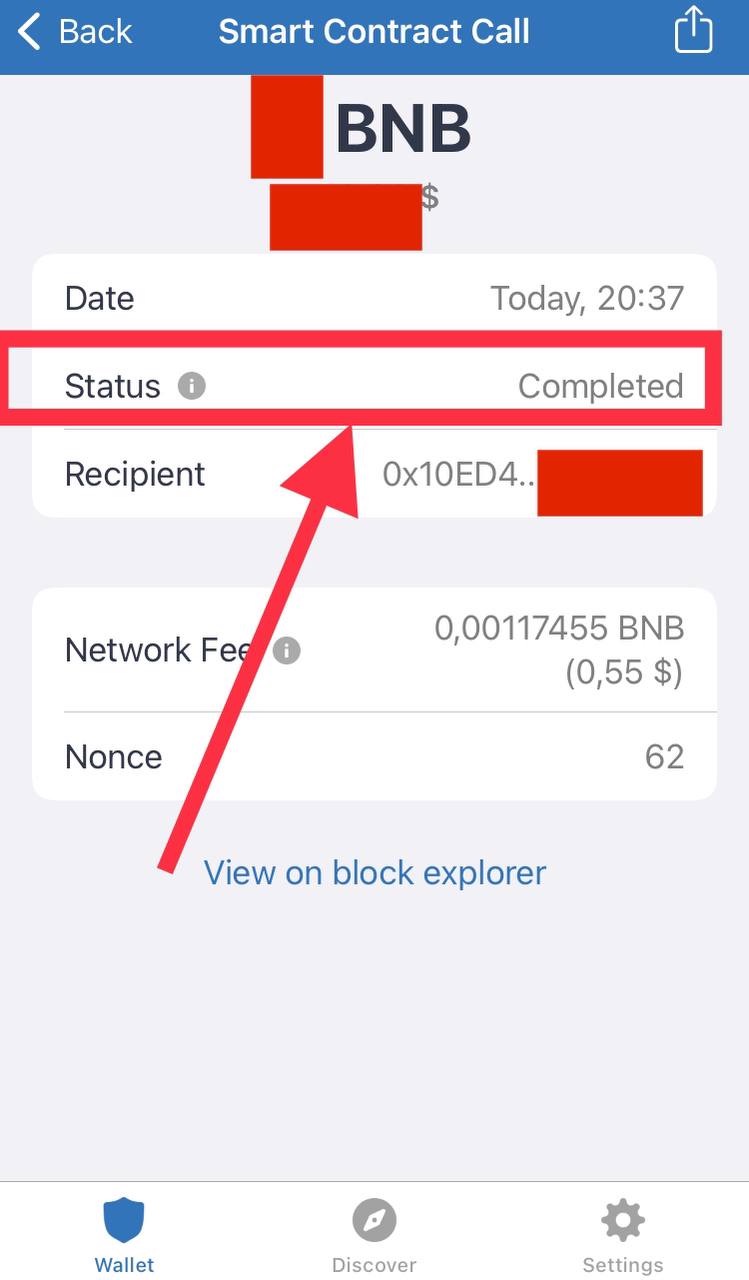

If you did everything right, the exchange will show you that the transaction is in progress.

In a few seconds, your wallet will be replenished. Average earnings from one investment 500-900% (I recommend investing at least 1-2 BNB while the pumps are working, because nothing lasts forever)

Remember our pump instructions and remember the main objective of this pump: Buying, holding and waiting for outside traders to enter our coin before selling.

VISIT TOP Pump and Dump Telegram Groups – https://win-win-trade.com/best-crypto-tools/categories/pump-and-dump-telegram-groups/

One Response

It is not my first time to pay a visit this site,

i am browsing this site dailly and get pleasant data from here everyday.