Table of Contents

- Introduction: The Importance of Funding for Traders

- Finding Trading Capital: Tips and Strategies

- Tips for Maximizing Your Chances of Securing Funding

- Proprietary Trading Firms: How to Connect and Benefit

- The benefits of working with a proprietary trading firm, such as access to funding, resources, and mentorship

- Tips for Connecting with and Impressing Proprietary Trading Firms

- Funding Programs for Traders: What You Need to Know

- Trading Strategy Funding: Strategies for Success

- How to increase your chances of Funding for traders?

- Examples of successful trading strategies and the funding programs that support them

- Risk Management: How to Mitigate Risk and Increase Your Chances of Success

- Conclusion: Taking Your Trading Career to the Next Level

- FAQ

In this guide, we’ll provide you with an in-depth look at the different ways you can obtain trading capital. We’ll explore the pros and cons of personal savings, loans, and investor funding, and help you determine which method is right for you.

We’ll also take a closer look at proprietary trading firms and funding programs for traders. You’ll learn how to connect with these firms and programs, and how to choose the right one for your needs. Additionally, we’ll discuss risk management strategies and performance-based funding, and provide you with tips and advice for maximizing your chances of success.

Introduction: The Importance of Funding for Traders

As a trader, having adequate funding is essential to your success. Without enough capital, you may miss out on profitable opportunities and struggle to execute your trading strategy. In this chapter, we’ll explore why having adequate funding is so important for traders and provide an overview of the article’s content.

Why Having Adequate Funding is Essential for Traders

Having adequate funding is crucial for traders for several reasons. Firstly, it allows you to take advantage of profitable opportunities that require a significant amount of capital. Secondly, having enough funding can help you manage risk and minimize losses. Thirdly, having sufficient capital can help you withstand market fluctuations and ensure that you can continue trading during difficult times.

Finding Trading Capital: Tips and Strategies

One of the biggest challenges traders face is finding enough capital to execute their trading strategies. Without adequate funding, it can be challenging to take advantage of profitable opportunities and manage risk effectively. In this chapter, we’ll explore some tips and strategies for finding trading capital, so you can take your trading career to the next level.

1. Start with Personal Savings

One of the most straightforward ways to obtain trading capital is through personal savings. By saving a portion of your income regularly, you can accumulate enough capital to start trading. Additionally, using personal savings to fund your trading allows you to avoid taking on debt, which can be a significant advantage in the long run.

Pros of Personal Savings:

- Using personal savings allows you to avoid taking on debt, which can be a significant advantage in the long run.

- You have complete control over your capital, so you can manage your trades and risk according to your trading strategy.

- By saving regularly, you can accumulate capital over time and gradually build your trading account.

Cons of Personal Savings:

- Depending on your savings rate, it may take a while to accumulate enough capital to start trading.

- There is no guarantee that your trades will be profitable, which means you may risk losing your savings.

2. Explore Loan Options

If you don’t have enough personal savings, you can explore loan options to obtain trading capital. Many lenders offer personal loans or lines of credit that you can use to fund your trading account. However, it’s essential to be cautious when taking on debt, as high-interest rates can quickly eat into your profits.

Pros of Loans:

- Loans can provide you with immediate access to capital, which can be beneficial if you’re looking to start trading quickly.

- If you have a solid credit score, you may be able to secure a low-interest loan, which can save you money in the long run.

- You can choose the loan amount that meets your funding needs, which can help you manage your risk effectively.

Cons of Loans:

- High-interest rates can quickly eat into your profits, making it challenging to earn a substantial return on your investment.

- Taking on debt can be risky, especially if you’re not confident in your trading skills or strategy.

- Depending on the loan terms, you may be required to make regular payments, which can limit your trading flexibility.

3. Consider Crowdfunding

Another way to obtain trading capital is through crowdfunding platforms. These platforms allow you to pitch your trading strategy to potential investors and receive funding in exchange for a share of your profits. However, it’s essential to choose a reputable crowdfunding platform and be transparent about your trading strategy to attract investors.

Pros of Crowdfunding:

- Crowdfunding platforms can provide you with access to a large pool of potential investors, which can increase your chances of obtaining funding.

- You can pitch your trading strategy to potential investors, which can help you attract investors who share your investment goals and philosophy.

- Crowdfunding can be a good option if you have limited access to other funding methods or if you’re looking for additional funding to supplement your trading account.

Cons of Crowdfunding:

- Crowdfunding platforms typically charge fees for their services, which can reduce your profits.

- To attract investors, you need to be transparent about your trading strategy, which may make it difficult to keep your trades private.

- If you don’t generate profits, you may not be able to pay back your investors, which can damage your reputation and limit your future funding options.

4. Join a Proprietary Trading Firm

Proprietary trading firms are another option for traders looking to obtain funding. These firms provide traders with capital in exchange for a share of their profits. However, it’s essential to do your research and choose a reputable firm that aligns with your trading goals and strategy.

Pros of Proprietary Trading Firms:

- Proprietary trading firms can provide you with access to significant capital, which can allow you to take advantage of profitable opportunities and manage your risk effectively.

- These firms often provide traders with coaching and risk management tools, which can help you improve your trading skills and performance.

- You may be able to earn a higher profit share than other funding methods, which can increase your earnings potential.

Cons of Proprietary Trading Firms:

- Proprietary trading firms typically have strict performance requirements, which means you may need to meet specific trading targets to retain your funding.

- The profit-sharing model may limit your earnings potential if the firm takes a large share of your profits.

- You may be required to follow specific trading rules or use specific trading platforms, which can limit your trading flexibility.

5. Look for Funding Programs for Traders

Finally, funding programs for traders can be an excellent option for traders looking to obtain capital. These programs often provide performance-based funding, meaning you only pay back the funds if you make a profit. Additionally, many of these programs offer risk management tools and coaching to help traders succeed.

Pros of Funding Programs:

- Funding programs often provide traders with performance-based funding, meaning you only pay back the funds if you generate a profit.

- These programs often provide traders with coaching, risk management tools, and other resources to help them succeed.

- Funding programs can be an excellent option if you have limited access to other funding methods or if you’re looking for additional funding to supplement your trading account.

Cons of Funding Programs:

- Funding programs typically have strict performance requirements, which means you may need to meet specific trading targets to retain your funding.

- These programs may charge fees or take a share of your profits

Tips for Maximizing Your Chances of Securing Funding

Finding trading capital can be a challenging process, but there are some tips that can help increase your chances of securing funding. Here are some strategies that you can use to maximize your chances of finding trading capital:

1. Develop a Strong Trading Plan: A strong trading plan will show potential investors that you have a well-thought-out strategy for achieving your trading goals. Make sure your plan includes a detailed analysis of your target market, your trading style, and your risk management strategy.

2. Build a Track Record: A solid track record of successful trading will increase your credibility with potential investors. If you’re just starting out, consider trading on a demo account or a small account to build your track record.

3. Network: Attend industry events, join trading communities online, and connect with other traders in your niche. Building relationships and networking can help you gain access to potential investors.

4. Be Persistent: Securing funding can take time and persistence. Don’t get discouraged if you receive rejections or no responses at first. Keep refining your pitch and reaching out to potential investors.

5. Be Transparent: Honesty and transparency are crucial when seeking funding. Be upfront about your trading history, risk tolerance, and expectations for the use of the funding. This will help potential investors make an informed decision about whether to invest in your trading strategy.

By following these tips, you can increase your chances of finding the funding you need to take your trading strategy to the next level. Remember, finding funding is a process, but with persistence and the right approach, it is possible to secure the funding you need to achieve your trading goals.

Proprietary Trading Firms: How to Connect and Benefit

Proprietary trading firms are becoming increasingly popular among traders, offering unique benefits and opportunities that traditional trading firms may not provide. In this chapter, we’ll explore what proprietary trading firms are, how they work, and how traders can connect with and benefit from them.

What are Proprietary Trading Firms?

Proprietary trading firms, also known as prop trading firms, are financial institutions that invest and trade using their own funds rather than their clients’ funds. These firms use their own capital to trade a variety of financial instruments, including stocks, futures, options, and forex.

How do Proprietary Trading Firms Work?

Proprietary trading firms typically hire traders to manage their trading operations. Traders are given access to the firm’s capital and are responsible for making trades that generate profits. In return, the traders receive a share of the profits they generate. Proprietary trading firms may also provide traders with access to advanced trading platforms, training, and other resources to help them succeed.

Benefits of Proprietary Trading Firms

Proprietary trading firms offer several benefits to traders, including access to capital, advanced trading tools, and other resources. Traders may also benefit from the supportive trading community and mentorship opportunities provided by many proprietary trading firms.

In summary, proprietary trading firms are financial institutions that use their own funds to trade a variety of financial instruments. Traders can connect with and benefit from proprietary trading firms by doing their research, preparing a trading resume, attending trading events, and utilizing online resources. By connecting with the right proprietary trading firm, traders can gain access to the capital and resources they need to succeed.

The benefits of working with a proprietary trading firm, such as access to funding, resources, and mentorship

In the previous chapter, we explored what proprietary trading firms are and how they work. Now, let’s dive deeper into the benefits of working with a proprietary trading firm.

Access to Funding

One of the biggest advantages of working with a proprietary trading firm is access to funding. As a trader, having access to capital can be the difference between success and failure. Proprietary trading firms offer traders access to significant amounts of capital, which can be used to make larger trades and take advantage of market opportunities that might otherwise be unavailable.

Advanced Trading Resources

Proprietary trading firms also offer traders access to advanced trading resources, including trading platforms, data analysis tools, and other technologies that can help traders make more informed decisions. These resources can be expensive for individual traders to access on their own, making proprietary trading firms an attractive option for traders looking to improve their performance.

Mentorship Opportunities

Another benefit of working with a proprietary trading firm is the opportunity for mentorship. Many firms provide traders with mentorship and training programs designed to help them develop their skills and become better traders. This mentorship can be invaluable for traders who are just starting out or looking to take their trading to the next level.

Collaborative Trading Environment

Proprietary trading firms often offer a collaborative trading environment, where traders can work together and share ideas. This environment can be a valuable resource for traders looking to improve their skills and learn from others. Additionally, the supportive trading community can help traders stay motivated and focused on their goals.

Potential for Higher Returns

Working with a proprietary trading firm can also offer traders the potential for higher returns. As a trader, you are responsible for generating profits for the firm, and your compensation is often tied to your performance. This incentivizes traders to perform at their best and can lead to higher returns than trading on your own.

Tips for Connecting with and Impressing Proprietary Trading Firms

Connecting with a proprietary trading firm can be a great way to gain access to funding, resources, and mentorship that can help you succeed as a trader. However, competition can be fierce, and it can be challenging to stand out from the crowd. Here are some tips for connecting with and impressing proprietary trading firms:

- Do your research: Before reaching out to a proprietary trading firm, do your research. Learn as much as you can about the firm, including its trading strategies, risk management approach, and culture. This will help you tailor your approach and demonstrate that you are serious about working with the firm.

- Build your track record: Proprietary trading firms are interested in traders who have a proven track record of success. If you are just starting out, focus on building your track record by trading with your own funds or by participating in trading competitions. This will show potential firms that you are committed to trading and have the skills to succeed.

- Be professional: When reaching out to a proprietary trading firm, be professional and courteous. Use proper grammar and spelling in your communications, and make sure to follow up in a timely manner. Treat your interactions with the firm as you would a job interview, and be prepared to answer questions about your trading experience and goals.

- Demonstrate your value: Proprietary trading firms are looking for traders who can add value to their business. Be prepared to demonstrate how you can help the firm make money through your trading skills and knowledge. This could include sharing your trading strategies or identifying new market opportunities.

- Be persistent: Finally, don’t give up if you don’t hear back from a proprietary trading firm right away. It can take time to build relationships with these firms, so be persistent in your efforts to connect and impress. Keep refining your trading skills and track record, and stay active in the trading community to increase your visibility and network.

By following these tips, you can increase your chances of connecting with and impressing proprietary trading firms, and ultimately securing the funding and resources you need to succeed as a trader.

In summary, working with a proprietary trading firm can offer traders access to funding, advanced trading resources, mentorship opportunities, a collaborative trading environment, and the potential for higher returns. If you are a trader looking to take your trading to the next level, connecting with a proprietary trading firm may be a smart move. Just be sure to do your research, prepare a trading resume, and attend trading events to find the right firm for you.

Funding Programs for Traders: What You Need to Know

For many traders, securing funding is a critical aspect of their success. However, finding the right funding program can be a daunting task, especially for those who are new to the industry. In this article, we will provide an overview of different funding programs available to traders, including risk management funding and performance-based funding. We’ll also discuss what you need to know to make an informed decision when choosing a funding program that’s right for you.

Short overview of Funding Programs:

Risk Management Funding:

Risk management funding is a type of funding program that provides traders with the capital they need to manage their risk effectively. This funding program typically involves a risk-sharing agreement between the trader and the funding provider, where the trader is responsible for managing the risk of their trades, and the funding provider provides the capital necessary to execute those trades.

Performance-Based Funding:

Performance-based funding is a type of funding program where traders receive capital based on their performance. This funding program typically involves a profit-sharing agreement between the trader and the funding provider, where the trader receives a portion of the profits generated from their trades, and the funding provider receives a percentage of those profits as compensation.

Risk Management Funding

Risk management funding is an essential component of many trading strategies, particularly those involving high-risk instruments such as futures, options, and forex. This funding program enables traders to manage their risk effectively and execute their trades with confidence. In this article, we’ll provide a more in-depth look at risk management funding and the benefits it provides to traders.

Risk Management Funding Pros:

- Provides traders with a safety net to limit potential losses

- Allows traders to take on more risks than they would be able to with their own capital

- Can help traders build their track record and reputation

Risk Management Funding Cons:

- Limits the amount of profit that traders can make as they have to share a portion of their profits with the funding provider

- Can be difficult to qualify for as traders need to meet certain performance metrics and risk management criteria

- May come with additional rules and restrictions that traders need to adhere to

What is Risk Management Funding?

Risk management funding is a type of funding program that provides traders with the capital they need to execute trades while managing their risk effectively. The funding provider and the trader typically enter into a risk-sharing agreement, where the trader is responsible for managing the risk of their trades, and the funding provider provides the capital necessary to execute those trades.

The amount of capital provided by the funding provider can vary, depending on the trader’s experience, track record, and the level of risk involved in their trading strategy. Additionally, the funding provider may set certain conditions or requirements that the trader must meet, such as maintaining a specific risk-to-reward ratio or adhering to strict risk management guidelines.

Benefits of Risk Management Funding:

One of the primary benefits of risk management funding is that it enables traders to manage their risk effectively, which is essential when trading volatile instruments such as futures, options, and forex. With risk management funding, traders can execute their trades with confidence, knowing that they have the capital they need to manage any potential losses effectively.

Another significant benefit of risk management funding is that it can provide traders with the resources they need to develop and refine their trading strategies. The funding provider may offer additional resources, such as access to proprietary trading software or educational resources, that can help traders become more successful.

Conclusion:

Risk management funding is an essential component of many successful trading strategies. It enables traders to manage their risk effectively, execute trades with confidence, and access additional resources that can help them become more successful. If you’re considering risk management funding, be sure to do your research and choose a funding provider that aligns with your trading goals and risk tolerance.

Performance-Based Funding

Performance-based funding is another option available to traders who are seeking funding for their trading strategies. Unlike risk management funding, which is based on a trader’s ability to manage risk, performance-based funding is based on the trader’s ability to generate profits.

Performance-Based Funding Pros:

- Allows traders to keep all of their profits

- Provides a strong incentive for traders to perform well and generate profits

- Can offer traders more flexibility as they are not bound by as many rules and restrictions as with risk management funding

Performance-Based Funding Cons:

- Can be more difficult to find as not all funding providers offer this type of funding

- Requires traders to have a strong track record and proven trading strategy to qualify

- May require traders to pay higher fees or offer a larger share of profits to the funding provider

In general, performance-based funding involves a trader receiving a certain amount of capital to trade with, and then keeping a percentage of the profits they generate. The exact terms of the funding agreement may vary depending on the specific firm or program offering the funding.

One benefit of performance-based funding is that it incentivizes traders to generate profits, which can lead to a greater focus on trading strategies that are likely to be profitable. Additionally, because the funding is based on performance, traders may feel more motivated to take calculated risks and pursue high-reward trading opportunities.

However, it’s important to note that performance-based funding can also come with risks. Traders who are not able to generate profits may find themselves without funding or in debt to the firm or program providing the funding. Additionally, traders may feel pressure to take on risky trades in order to generate profits and meet the terms of their funding agreement.

If you are considering performance-based funding, it’s important to thoroughly research and understand the terms and risks associated with the funding program or firm. It may also be helpful to consult with other traders who have worked with the program or firm in question to get a better sense of their experiences.

Overall, performance-based funding can be a useful option for traders who are confident in their ability to generate profits and are willing to take on the associated risks.

Tips for finding the right funding program for your needs and goals

When it comes to finding the right funding program for your trading needs and goals, there are a few key factors to consider. Here are some tips to help you find the best fit:

1. Research and compare: Take the time to research and compare different funding programs that are available. Look at the terms, requirements, and benefits of each program, and compare them to your needs and goals.

2. Know your strengths and weaknesses: Be aware of your strengths and weaknesses as a trader. Some funding programs may be better suited for traders with certain strengths or strategies, so it’s important to choose a program that aligns with your strengths.

3. Consider the funding amount and structure: Think about the amount of funding you need and the structure of the program. Some programs may offer more funding than others, while some may have more flexible or restrictive funding structures.

4. Look for reputable providers: Make sure to choose a funding program from a reputable provider. Check reviews and ratings from other traders, and look for programs that have a track record of success.

5. Be prepared to meet the requirements: Before applying for a funding program, make sure you understand and are prepared to meet the program’s requirements. This may include demonstrating a certain level of trading experience or meeting specific performance metrics.

Both risk management funding and performance-based funding have their advantages and disadvantages. Traders should carefully evaluate their options and consider their goals and risk tolerance before choosing a funding program. It is also important to read and understand the terms and conditions of the funding agreement to avoid any surprises or misunderstandings down the road.

Trading Strategy Funding: Strategies for Success

What trading strategy funding is and how it works

Trading strategy funding is a process where traders seek external capital to fund their trading strategies. The idea is simple: traders can borrow money from investors, use it to trade, and then pay back the capital along with a percentage of the profits earned from the trades. This type of funding is different from traditional methods in that it is more focused on the trading strategy itself rather than the trader’s creditworthiness.

Trading strategy funding is typically used by experienced traders who have developed a profitable strategy but lack the capital to fully exploit it. By leveraging external capital, traders can increase the size of their positions and potentially generate greater returns. Additionally, trading strategy funding allows traders to focus on what they do best – developing and executing profitable trading strategies – while leaving the fundraising and capital management to others.

To secure trading strategy funding, traders typically need to present their strategy to potential investors or firms. This involves providing a detailed explanation of the strategy, including its track record, risk profile, and potential for future profitability. Traders should also be prepared to answer questions about their trading experience, risk management techniques, and trading style.

Trading strategy funding can be a useful tool for experienced traders looking to take their trading to the next level. However, it is important to carefully evaluate potential funding sources and ensure that the terms and conditions of the funding agreement are favorable to the trader’s goals and objectives. In the following sections, we will explore some of the strategies that traders can use to successfully secure trading strategy funding.

How to increase your chances of Funding for traders?

Time needed: 30 days

How to increase your chances of getting funded?

- Research the markets

Before you start trading, it’s important to research the markets thoroughly. This includes understanding the fundamentals of the markets you’re interested in, such as economic indicators, geopolitical events, and supply and demand factors.

- Identify your trading style

Once you’ve researched the markets, you’ll need to decide on a trading style. There are several different styles to choose from, including day trading, swing trading, and position trading. Choose the style that fits your personality, risk tolerance, and trading goals.

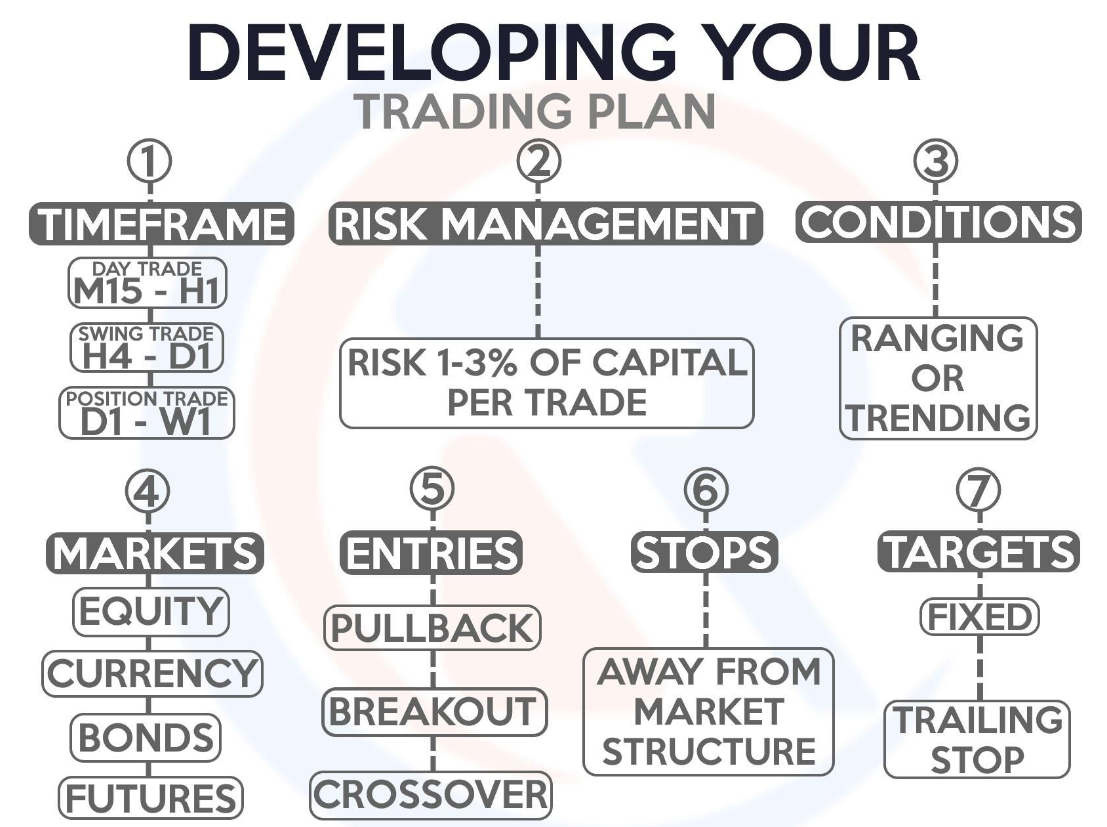

- Develop a trading plan

A trading plan is a document that outlines your trading strategy, including your entry and exit points, risk management rules, and trade management rules. It’s essential to have a well-defined trading plan to help you stay disciplined and focused on your goals.

- Backtest your strategy

Once you have a trading plan in place, you should backtest it using historical market data. This will help you identify any weaknesses in your strategy and make necessary adjustments before you start trading with real money.

- Monitor and evaluate your results

After you start trading, it’s essential to monitor your results and evaluate your performance regularly. This will help you identify areas for improvement and make necessary adjustments to your trading strategy.

By following these steps, you can increase your chances of creating a winning trading strategy and getting funded. Remember, trading strategy funding is highly competitive, so it’s important to put in the time and effort to develop a solid plan that sets you apart from other traders.

Examples of successful trading strategies and the funding programs that support them

When it comes to trading, having a winning strategy is essential to success. But what exactly is a winning strategy? And how can you create one that will attract the attention of funding programs?

A winning trading strategy is one that is based on a clear understanding of the markets, a strong set of rules for entering and exiting trades, and a track record of success over time. It’s a strategy that can be backtested and proven to work under a variety of market conditions.

Once you have a winning trading strategy, the next step is to find funding programs that will support it. Fortunately, there are a variety of funding programs out there that cater to different types of trading strategies. Here are some examples:

- Risk management funding: This type of funding program focuses on managing risk by limiting losses and maximizing gains. It’s ideal for traders who use a conservative, low-risk approach to trading.

- Performance-based funding: This type of funding program rewards traders who are able to generate consistent profits over time. It’s ideal for traders who have a proven track record of success and are able to generate returns regardless of market conditions.

- Seed capital: Seed capital programs provide funding to traders who are just starting out and need capital to get their trading business off the ground. These programs often provide mentorship and support in addition to funding.

- Incubator programs: Incubator programs provide funding, mentorship, and other resources to traders who have a unique trading strategy or approach. These programs are often highly selective and require a significant amount of dedication and effort from traders.

When it comes to finding the right funding program for your trading strategy, it’s important to do your research and find a program that aligns with your goals and objectives. Look for programs that have a track record of success and are willing to provide support and guidance to traders.

Having a winning trading strategy is essential to success in the markets. Once you have a strategy in place, it’s important to find funding programs that will support it and help you achieve your goals. By doing your research and finding the right program for your needs, you can increase your chances of success and achieve your trading goals.

Risk Management: How to Mitigate Risk and Increase Your Chances of Success

Why risk management is essential for traders

Risk management is an essential aspect of trading that can help traders mitigate losses and increase their chances of success. Whether you are a beginner or an experienced trader, it’s crucial to have a solid understanding of risk management strategies to ensure that you can make informed decisions and minimize potential risks.

Risk management involves identifying potential risks, assessing their potential impact on your trades, and implementing strategies to manage them effectively. Without proper risk management, traders can fall victim to emotional decision-making, which can result in costly mistakes and significant losses.

There are many different risk management strategies that traders can use to mitigate risks. These strategies include setting stop-loss orders, diversifying your portfolio, and analyzing market trends and patterns. By implementing these strategies, traders can reduce their exposure to potential losses and increase their chances of success.

In addition to risk management strategies, traders can also use various tools and technologies to help them manage risks effectively. These tools include trading software that can help automate trades and monitor market trends, as well as risk management software that can help traders identify and analyze potential risks in real-time.

Risk management is a crucial component of successful trading. By implementing effective risk management strategies and utilizing the right tools and technologies, traders can increase their chances of success and minimize potential losses.

Different risk management strategies and techniques

As a trader, it’s important to understand that trading always involves risk. However, that doesn’t mean you should avoid it altogether. Instead, the key is to manage your risks effectively so that you can increase your chances of success.

One of the most important aspects of risk management is to have a solid understanding of your own risk tolerance. This means knowing how much risk you can afford to take on without jeopardizing your trading capital. Once you have a clear understanding of your risk tolerance, you can start implementing strategies to manage your risks.

One effective risk management strategy is to diversify your trading portfolio. By investing in a range of different assets, you can spread your risk and reduce the impact of any individual losses. Another approach is to use stop-loss orders to automatically close out a trade if it reaches a certain level of loss.

In addition to diversification and stop-loss orders, there are many other risk management techniques that traders can use, such as hedging and using options. Hedging involves taking an opposite position to an existing trade, which can help to minimize losses if the original trade goes against you. Options provide traders with the ability to limit their losses while still maintaining upside potential.

Ultimately, the most effective risk management strategy will depend on your own individual trading style and risk tolerance. However, by taking the time to understand the various techniques available, you can develop a risk management plan that is tailored to your needs.

In the next section of this chapter, we will explore some of the most common risk management strategies and techniques in more detail, so that you can start incorporating them into your own trading approach.

Importance of Risk Assessment and Analysis

Risk assessment and analysis are key components of effective risk management. Before you can mitigate risk, you need to understand it. This involves identifying potential risks and assessing the likelihood and impact of each one. A risk assessment can help you prioritize which risks to focus on first and how to allocate your resources.

There are several different methods for conducting a risk assessment, including:

1. Qualitative Risk Assessment

Qualitative risk assessment is a subjective approach that relies on expert judgment to evaluate the likelihood and impact of each risk. This approach is useful for identifying and prioritizing risks based on their potential severity.

2. Quantitative Risk Assessment

Quantitative risk assessment is a more objective approach that uses statistical analysis to estimate the likelihood and impact of each risk. This approach is useful for making data-driven decisions about risk management.

3. Scenario Analysis

Scenario analysis involves creating hypothetical scenarios to evaluate the potential impact of different risks. This approach can help you understand how different risks may interact with each other and identify potential cascading effects.

4. Risk Mapping

Risk mapping involves visualizing risks on a map or diagram to help you understand their spatial relationships and potential impact on different areas or assets.

By conducting a thorough risk assessment and analysis, you can identify potential risks and develop strategies to mitigate them. This can help you avoid unexpected losses and increase your chances of success as a trader.

Conclusion: Taking Your Trading Career to the Next Level

As a trader, having adequate funding is crucial for success. There are various funding options available, including proprietary trading firms, risk management funding, and performance-based funding. Each funding program has its pros and cons, and traders should carefully evaluate which one is the best fit for their needs and goals.

Additionally, developing a winning trading strategy is essential for securing funding and achieving success. Traders should focus on risk management techniques to mitigate potential losses and increase their chances of success. Some popular risk management strategies include diversification, position sizing, and stop-loss orders.

It’s also essential to stay up-to-date with the latest market trends and news to make informed trading decisions. By continually learning and adapting their strategies, traders can increase their chances of success and take their trading careers to the next level.

To succeed as a trader, it’s crucial to have adequate funding, develop a winning trading strategy, and employ effective risk management techniques. By following these key principles and staying informed, traders can increase their chances of success and achieve their trading goals.

Encouragement to take action and start funding your trading strategy today

If you’re serious about taking your trading career to the next level, it’s time to take action and start funding your trading strategy today. The financial markets are constantly evolving, and to succeed as a trader, you need to be proactive and adapt to the changing landscape.

As we’ve discussed in this article, there are a variety of funding programs and options available to traders, including risk management funding, performance-based funding, and proprietary trading firms. By taking the time to research and explore these options, you can increase your chances of securing the capital and resources you need to execute your trading strategy effectively.

However, it’s not just about finding funding. As we’ve also emphasized, effective risk management is a crucial component of any successful trading strategy. By implementing risk management strategies and techniques, you can mitigate your exposure to market volatility and minimize your potential losses.

So, what are you waiting for? Whether you’re a seasoned trader or just starting out, there’s never been a better time to take your trading career to the next level. By taking advantage of the funding programs and risk management strategies available to you, you can increase your chances of success in the financial markets and achieve your goals as a trader.

Remember, success in trading is not a guarantee, but with hard work, discipline, and a willingness to learn and adapt, you can improve your chances of achieving your goals and taking your trading career to the next level. So, don’t wait any longer – start funding your trading strategy today and take the first step towards achieving your dreams.

Call to action to connect with funding programs, proprietary trading firms, and other resources that can help you achieve your goals.

As a trader, you know the importance of having adequate funding to support your trading strategy and reach your financial goals. However, finding the right funding program or trading firm can be a daunting task.

In this article, we’ve covered a range of funding options, from risk management and performance-based funding to proprietary trading firms. We’ve also discussed the importance of developing a winning trading strategy and managing risk effectively.

So, what’s the next step? It’s time to take action and start exploring your options. Connect with funding programs, proprietary trading firms, and other resources that can help you achieve your goals. Don’t be afraid to reach out and ask for help or guidance.

Remember, trading is a competitive industry, but with the right funding and support, you can take your career to the next level. Take advantage of the resources available to you and keep learning and improving your skills.

In conclusion, we hope this article has provided you with valuable insights and information on funding options and risk management strategies for traders. Now it’s up to you to take action and make the most of the opportunities available to you. Good luck on your trading journey!

FAQ

Trading strategy funding refers to the process of securing funding for a trading strategy from external sources, such as proprietary trading firms, angel investors, or venture capitalists.

There are a variety of funding programs available for traders, including risk management and performance-based funding, as well as programs offered by proprietary trading firms and other financial institutions.

There are several strategies you can use to increase your chances of getting funded, including creating a well-researched and tested trading strategy, networking with potential funders, and implementing effective risk management techniques.

Some key risk management techniques for traders include diversifying your portfolio, setting stop-loss orders, and monitoring market trends and news to stay informed about potential risks.

When searching for a funding program for your trading strategy, it’s important to consider factors such as the program’s requirements and eligibility criteria, the level of funding available, and any potential benefits or drawbacks of the program.

Yes, it is possible to fund your trading strategy without external funding, by investing your own capital or using leverage from a broker. However, external funding can provide additional resources and support to help you achieve your goals more quickly and effectively.

When considering a proprietary trading firm, it’s important to research their track record and reputation, their trading strategy and approach, and their level of support and resources for traders. It’s also important to consider any fees or requirements associated with the firm’s program.

2 Responses

Cool, maybe it’s the most completed guide that help me choose right ways to get funding for my trading.

Thank you, we are very pleased!