Table of Contents

- Understanding PROP Crypto Trading

- Basic PROP Crypto Trading Strategies for Day Traders

- Advanced PROP Crypto Trading Strategies for Day Traders

- Technical Analysis-Based PROP Crypto Trading Strategies for Day Traders

- Fundamental Analysis-Based PROP Crypto Trading Strategies for Day Traders

- Price Action-Based PROP Crypto Trading Strategies for Day Traders

- Best PROP Crypto Trading Strategies for Minimizing Risks and Maximizing Profits

- Conclusion

- FAQ

In recent years, the world of cryptocurrency has gained significant popularity among traders and investors. With the rise of various cryptocurrencies, traders are constantly looking for effective trading strategies to maximize their profits while minimizing risks. PROP crypto trading is a popular strategy that has proven to be successful for day traders. In this article, we will explore different PROP crypto trading strategies that traders can use to make informed trading decisions.

Having an effective trading strategy is crucial for successful trading in the cryptocurrency market. It involves analyzing market trends, identifying profitable entry and exit points, and managing risks. Without a proper trading strategy, traders may find themselves making irrational decisions and losing money.

In this article, we will cover various PROP crypto trading strategies such as momentum trading, swing trading, and scalping. We will discuss each strategy in detail, outlining the benefits and risks associated with each. Our goal is to help day traders develop a solid understanding of PROP crypto trading strategies, enabling them to make informed decisions when trading cryptocurrencies.

By the end of this article, you will have a clear understanding of PROP crypto trading strategies and the various techniques that you can use to implement them in your trading. Whether you are a beginner or an experienced trader, this article will provide valuable insights that can help you improve your trading performance.

We also recommend reading the Ultimate Guide to Funding for Traders

Understanding PROP Crypto Trading

The world of cryptocurrency has gained significant attention from traders and investors around the globe. PROP crypto trading is one of the popular trading strategies that traders use to trade cryptocurrencies. In this chapter, we will dive into the world of PROP crypto trading and discuss what it is, its benefits and risks, and why trading strategies are important.

PROP crypto trading is a trading strategy that involves the use of borrowed funds to trade cryptocurrencies. Unlike other types of trading, such as spot trading, where traders purchase and hold cryptocurrencies, PROP crypto trading involves taking leveraged positions on cryptocurrencies, allowing traders to amplify their profits or losses. The use of leverage can magnify the returns on investment, but it can also result in significant losses if the trades do not go as planned.

The benefits of PROP crypto trading are its potential to generate significant returns on investment in a short period of time. Traders can take advantage of market volatility to make profits, even when the market is bearish. Another benefit of PROP crypto trading is the availability of margin funding, which allows traders to access additional capital to trade with.

On the other hand, PROP crypto trading is associated with significant risks. Since traders are using borrowed funds to trade, they are exposed to higher risks than those who trade with their own capital. This means that losses can be greater than the amount invested. Additionally, the volatile nature of the cryptocurrency market can lead to significant losses if trades do not go as planned.

Trading strategies play a crucial role in PROP crypto trading. Effective trading strategies can help minimize risks and maximize profits. They involve analyzing market trends, identifying profitable entry and exit points, and managing risks. With effective trading strategies, traders can make informed trading decisions, which can improve their overall trading performance.

In conclusion, PROP crypto trading is a popular trading strategy that involves taking leveraged positions on cryptocurrencies. It has the potential to generate significant returns on investment, but it also comes with significant risks. Trading strategies are important in PROP crypto trading as they help traders make informed decisions, minimizing risks, and maximizing profits.

Basic PROP Crypto Trading Strategies for Day Traders

When it comes to PROP crypto trading, day traders need to have a solid understanding of basic trading strategies that can help them make informed decisions and maximize their profits. In this chapter, we’ll explore some of the most common basic PROP crypto trading strategies that day traders can use to gain an edge in the market.

What is Basic PROP Crypto Trading Strategy?

Basic PROP crypto trading strategies involve a range of techniques and approaches that traders use to make buy or sell decisions. These strategies are based on technical and fundamental analysis, market trends, and other key indicators that help traders determine the best entry and exit points for their trades.

Trend Following Strategy

The trend following strategy is a basic PROP crypto trading strategy that involves analyzing the market trends to determine the direction of the market. Traders who use this strategy look for an upward or downward trend and use it to identify when to buy or sell a specific cryptocurrency. This strategy assumes that a market trend will continue in the same direction, making it easier for traders to predict future price movements.

Contrarian Trading Strategy

Contrarian trading strategy is a basic PROP crypto trading strategy that involves going against the current market trends. Contrarian traders believe that the market often overreacts to news and events, leading to price fluctuations that are not sustainable in the long run. By going against the trend, contrarian traders aim to take advantage of these fluctuations and make profitable trades.

Momentum Trading Strategy

The momentum trading strategy is a basic PROP crypto trading strategy that involves buying and selling cryptocurrencies based on their recent performance. Traders who use this strategy look for cryptocurrencies that have shown consistent growth in price over a period and buy them in the hope that the momentum will continue. Similarly, traders who spot cryptocurrencies that have experienced consistent price drops may sell them, hoping to avoid further losses.

Advantages and Disadvantages of Basic PROP Crypto Trading Strategies

While basic PROP crypto trading strategies can be effective in minimizing risks and maximizing profits, they also come with their own set of advantages and disadvantages. Trend following strategy, for instance, can be useful in trending markets but may not be effective in choppy or range-bound markets. Contrarian trading strategy, on the other hand, can be profitable but requires traders to be patient and disciplined. Momentum trading strategy is ideal for traders who want to make quick profits but can be risky in unpredictable markets.

Basic PROP crypto trading strategies can be an effective way for day traders to make informed decisions and maximize their profits. Understanding these strategies and their advantages and disadvantages can help traders choose the right approach for their trading style and market conditions. In the next chapter, we’ll explore advanced PROP crypto trading strategies for day traders.

Advanced PROP Crypto Trading Strategies for Day Traders

When it comes to PROP crypto trading, day traders often seek to enhance their trading skills to make the most out of their investments. Basic trading strategies can be helpful, but they might not be enough to achieve the desired results. This is where advanced trading strategies come in.

In this chapter, we will explore some advanced PROP crypto trading strategies that day traders can use to gain an edge in the market. These strategies require more expertise and experience than basic trading strategies and can offer higher potential rewards, but they also come with higher risks.

Scalping

Scalping is a high-frequency trading strategy that involves making multiple trades in a short amount of time to take advantage of small price movements. This strategy requires quick decision-making skills, and traders need to be able to execute trades rapidly to benefit from small price changes. It is best suited for highly volatile markets, and traders often use it to capture profits from small price movements.

Swing Trading

Swing trading is a medium-term trading strategy that involves holding positions for a few days to a few weeks. The goal of this strategy is to capture price movements in the intermediate term. Swing traders look for trends and reversals and try to enter and exit trades at the optimal time to maximize profits. This strategy requires patience and discipline, and traders need to have a good understanding of technical analysis.

Arbitrage

Arbitrage is a trading strategy that involves buying and selling the same asset simultaneously in different markets to take advantage of price discrepancies. Traders can benefit from price inefficiencies in the market, and the profits from this strategy can be significant. However, arbitrage requires a lot of market knowledge, access to multiple exchanges, and the ability to execute trades quickly.

These advanced trading strategies require more knowledge, experience, and discipline than basic trading strategies. They offer higher potential rewards, but they also come with higher risks. Traders should carefully assess their risk tolerance and skill level before using these strategies in the market.

Advanced PROP crypto trading strategies can be a valuable tool for day traders looking to maximize their profits in the market. Scalping, swing trading, and arbitrage are some of the most popular advanced trading strategies used by traders. By understanding these strategies and applying them in the right market conditions, traders can gain an edge in the market and achieve their trading goals.

Technical Analysis-Based PROP Crypto Trading Strategies for Day Traders

Technical analysis is an important tool for traders in the PROP crypto market. It involves studying market data, such as price and volume, to identify patterns and trends that can be used to make informed trading decisions. In this chapter, we will discuss technical analysis-based trading strategies that day traders can use for PROP crypto trading.

Key Technical Indicators

There are a number of key technical indicators that traders use to analyze the market. These include moving averages, relative strength index (RSI), and Bollinger Bands. Moving averages are used to smooth out price movements and identify trends. RSI is used to measure the strength of a market trend, while Bollinger Bands are used to identify price volatility.

Reading Charts

Charts are an essential part of technical analysis-based trading. They display price data over time, allowing traders to identify trends and make informed trading decisions. There are a number of different chart types, including line charts, bar charts, and candlestick charts. Candlestick charts are the most commonly used chart type in PROP crypto trading. They provide a visual representation of price movements and can help traders identify patterns, such as support and resistance levels.

Identifying Trends

Identifying trends is a key part of technical analysis-based trading. Traders use technical indicators, such as moving averages, to identify trends and make informed trading decisions. There are three types of trends: uptrend, downtrend, and sideways trend. An uptrend occurs when the price of an asset is increasing, while a downtrend occurs when the price is decreasing. A sideways trend occurs when the price is relatively stable.

Technical analysis is a powerful tool that can help day traders make informed trading decisions in the PROP crypto market. By studying market data and identifying patterns and trends, traders can develop effective trading strategies that minimize risks and maximize profits. Key technical indicators, such as moving averages and RSI, and chart analysis, such as candlestick charts, are essential tools in technical analysis-based trading.

Fundamental Analysis-Based PROP Crypto Trading Strategies for Day Traders

When it comes to PROP crypto trading, there are two main approaches: technical analysis and fundamental analysis. While technical analysis involves using charts and technical indicators to make trading decisions, fundamental analysis focuses on the underlying factors that affect the value of cryptocurrencies. In this chapter, we’ll explore fundamental analysis and how it can be used for PROP crypto trading.

What is Fundamental Analysis?

Fundamental analysis involves analyzing the underlying factors that influence the value of a cryptocurrency. These factors can include the project behind the cryptocurrency, the team behind the project, the market demand for the cryptocurrency, and the overall state of the cryptocurrency market.

Fundamental analysis can help traders understand the intrinsic value of a cryptocurrency and whether it is overvalued or undervalued. This knowledge can then be used to make informed trading decisions.

Factors to Consider in Fundamental Analysis

When conducting fundamental analysis, there are several factors to consider. These include:

- The Project behind the Cryptocurrency: The project behind the cryptocurrency is one of the most important factors to consider. A strong project with a clear vision and strong team can indicate a higher potential for success and increased demand for the cryptocurrency.

- Market Demand: The level of demand for the cryptocurrency in the market can have a significant impact on its value. If there is a high level of demand, the price of the cryptocurrency is likely to increase.

- Competition: The level of competition in the market can also impact the value of a cryptocurrency. If there are many competitors offering similar products, the value of the cryptocurrency may be lower.

- Regulatory Environment: Regulatory developments can also have a significant impact on the value of a cryptocurrency. Changes in regulations can affect the demand and supply of the cryptocurrency, and can cause its value to fluctuate.

Using Fundamental Analysis for PROP Crypto Trading

To use fundamental analysis for PROP crypto trading, traders need to keep a close eye on news and developments related to the cryptocurrency market. This can include keeping up with the latest news and updates related to the cryptocurrency projects, as well as monitoring regulatory developments and market trends.

Traders can also use tools like social media sentiment analysis to understand the market sentiment around a particular cryptocurrency. This can provide valuable insights into market demand and sentiment, and help traders make informed trading decisions.

While technical analysis is often the go-to approach for PROP crypto trading, fundamental analysis can also be a valuable tool for traders. By analyzing the underlying factors that affect the value of a cryptocurrency, traders can make informed decisions and potentially increase their profits. However, it is important to remember that no trading strategy is foolproof, and traders should always exercise caution and use risk management techniques when trading.

Price Action-Based PROP Crypto Trading Strategies for Day Traders

Price action analysis is a popular trading strategy that is based on studying the movements of price charts. It is a powerful tool that can help day traders make informed trading decisions and maximize their profits. In this chapter, we will explore how price action can be used for PROP crypto trading.

Understanding Price Action in PROP Crypto Trading

Price action refers to the movement of prices over a period of time. It is the foundation of technical analysis and is used to identify trends, support and resistance levels, and key chart patterns. In PROP crypto trading, price action is used to analyze the movement of cryptocurrency prices and to make trading decisions based on the patterns that emerge.

Price Action-Based PROP Crypto Trading Strategies

There are several price action-based trading strategies that day traders can use for PROP crypto trading. Here are some of the most popular ones:

- Trend Following: This strategy involves identifying the direction of the trend and trading in the same direction. Traders use various technical indicators to identify trends and enter trades when the trend is strong.

- Breakout Trading: This strategy involves identifying key support and resistance levels and entering trades when the price breaks through these levels. Traders use various technical indicators to identify these levels and enter trades when the breakout occurs.

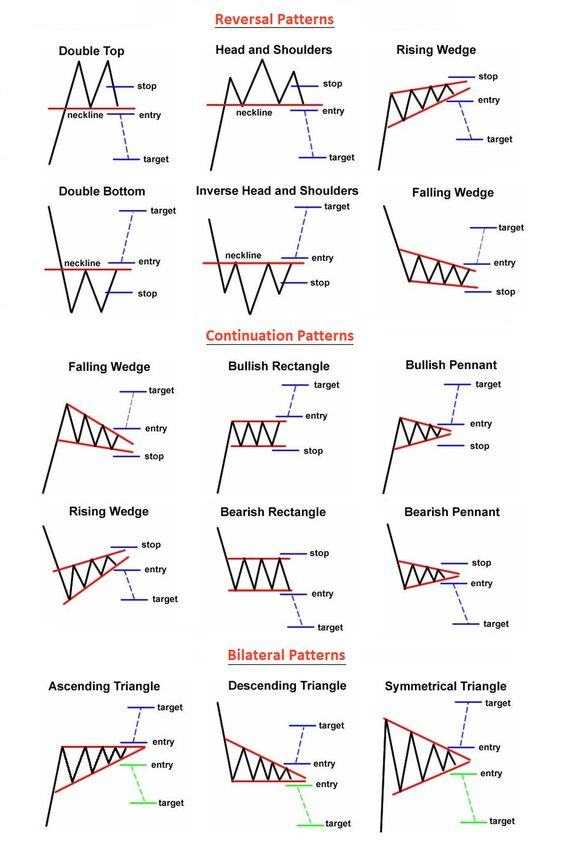

- Pattern Trading: This strategy involves identifying key chart patterns, such as head and shoulders, double tops, and triangles. Traders use these patterns to enter trades when the pattern is confirmed.

Using Price Action Analysis in PROP Crypto Trading

To use price action analysis in PROP crypto trading, traders need to have a good understanding of technical analysis and chart patterns. They also need to use various technical indicators, such as moving averages, RSI, and MACD, to confirm their trades. Traders should also pay attention to key support and resistance levels and use stop-loss orders to manage their risk.

Price action analysis is a powerful tool that can help day traders make informed trading decisions and maximize their profits in PROP crypto trading. By using various price action-based trading strategies, traders can identify key trends, support and resistance levels, and chart patterns to enter and exit trades at the right time. To use this strategy effectively, traders should have a good understanding of technical analysis and chart patterns, and use various technical indicators to confirm their trades.

Best PROP Crypto Trading Strategies for Minimizing Risks and Maximizing Profits

In this article, we have covered various PROP crypto trading strategies that day traders can use to maximize their profits while minimizing risks. In this final chapter, we will summarize these strategies and provide tips on how to develop an effective trading strategy that suits your trading style.

Effective Trading Strategies for Minimizing Risks and Maximizing Profits:

- Understand Your Risk Tolerance: Before you start trading, it is crucial to understand your risk tolerance. Your risk tolerance will determine your trading style and the type of strategies you will use. Knowing your risk tolerance will help you avoid making impulsive decisions that could lead to significant losses.

- Develop a Trading Plan: A trading plan is essential in minimizing risks and maximizing profits. Your trading plan should include your trading goals, trading strategies, risk management techniques, and trading rules. Having a trading plan will help you avoid emotional decision-making, which can be costly in the long run.

- Diversify Your Portfolio: Diversification is one of the most effective ways to minimize risks in trading. By diversifying your portfolio, you spread your investments across different cryptocurrencies, which reduces your exposure to any particular asset.

- Use Stop-Loss Orders: Stop-loss orders are an essential tool in risk management. By setting a stop-loss order, you can limit your losses in case the market goes against you.

- Use Technical and Fundamental Analysis: Technical and fundamental analysis are both valuable tools for trading. Technical analysis helps you identify trends and patterns in the market, while fundamental analysis helps you understand the underlying factors that influence the value of cryptocurrencies.

PROP crypto trading can be a profitable venture if you use the right trading strategies and risk management techniques. By understanding your risk tolerance, developing a trading plan, diversifying your portfolio, using stop-loss orders, and using technical and fundamental analysis, you can minimize risks and maximize profits. Remember, successful trading requires discipline, patience, and a willingness to learn and adapt to changing market conditions.

Conclusion

As the popularity of PROP crypto trading continues to rise, it becomes increasingly important for day traders to develop effective trading strategies that minimize risks and maximize profits. In this article, we covered various types of PROP crypto trading strategies, including basic and advanced strategies, technical analysis-based strategies, fundamental analysis-based strategies, and price action-based strategies.

By implementing these different strategies, day traders can improve their chances of success in the highly volatile world of crypto trading. We also discussed the importance of risk management and how to implement it in PROP crypto trading.

As you continue to explore and learn more about PROP crypto trading, it’s crucial to stay updated and adapt to new market trends and conditions. Don’t be afraid to try new strategies and always remember to manage your risks.

To stay informed on the latest developments in PROP crypto trading strategies, subscribe or follow our platform for more related content. Thank you for reading!

FAQ

PROP crypto trading refers to the act of buying and selling cryptocurrencies with the aim of making a profit. It involves analyzing market trends, making informed trading decisions, and implementing effective trading strategies.

Trading strategies are essential for minimizing risks and maximizing profits in PROP crypto trading. Without a strategy, traders are more likely to make impulsive decisions that may result in losses. Effective trading strategies help traders to stay focused, make informed decisions, and achieve their trading goals.

Some basic PROP crypto trading strategies for day traders include trend following, contrarian, and momentum trading. These strategies involve analyzing market trends and making trades based on the direction of the trend or momentum.

Some advanced PROP crypto trading strategies for day traders include scalping, swing trading, and arbitrage. These strategies involve making short-term trades based on market fluctuations or taking advantage of price discrepancies between different exchanges.

Technical analysis involves using charts and technical indicators to analyze market trends and make trading decisions. It can be used in PROP crypto trading to identify key support and resistance levels, predict price movements, and spot trading opportunities.

Fundamental analysis involves analyzing the underlying factors that affect the value of cryptocurrencies, such as economic and political events. It can be used in PROP crypto trading to assess the long-term prospects of different cryptocurrencies and make trading decisions based on their fundamental value.

To minimize risks and maximize profits in PROP crypto trading, it is important to develop effective trading strategies, manage your risks by setting stop-loss orders, and keep up-to-date with market trends and news. Additionally, it is important to only invest what you can afford to lose and to never invest solely based on emotions.