Table of Contents

- Types of Crypto Funding for Traders

- PROP-trading (Proprietary crypto trading firms)

- Benefits of Crypto Funding for Traders

- Choosing the Right Crypto Funding Provider

- How to Get Crypto Funding for Trading

- Case Studies

- Conclusion

In recent years, the cryptocurrency market has experienced tremendous growth, leading to an increasing number of traders entering the space. As with any type of trading, having access to adequate funding is crucial for success. This is where Crypto Funding for Traders comes into play.

Crypto Funding for Traders refers to the various financing options available to traders who wish to fund their crypto trading activities. These options are designed to offer traders flexibility, affordability, and security when it comes to accessing the funds they need to trade cryptocurrencies.

The importance of Crypto Funding for Traders cannot be overstated. Without sufficient funding, traders may not be able to take advantage of market opportunities or manage risk effectively. Additionally, traditional financing options may not be available or suitable for traders looking to invest in the cryptocurrency market.

There are several Alternative Financing Options available for Crypto Traders, including Crypto Lending, Cryptocurrency Loans, Crypto-backed Loans, Peer-to-Peer Crypto Lending, and Crypto Margin Funding. Each of these options has its own unique advantages and disadvantages, making it important for traders to carefully consider their options and choose the one that best suits their needs.

Choosing the right Crypto Funding Provider is also critical. It is essential to work with a provider that has a good reputation and track record, offers transparent and easy-to-use services, and charges reasonable fees and interest rates. With the right provider, traders can access the funds they need to trade cryptocurrencies effectively.

Crypto Funding for Traders is a critical component of successful cryptocurrency trading. As the cryptocurrency market continues to grow and evolve, it is essential for traders to stay informed about their financing options and choose the right provider to meet their needs.

Looking for the Best cryptocurrency trading tools and services?

Types of Crypto Funding for Traders

When it comes to Crypto Funding for Traders, there are several financing options available to choose from. Each of these options has its own unique advantages and disadvantages, making it important for traders to carefully consider their options and choose the one that best suits their needs.

Crypto Lending

One of the most popular Crypto Funding options is Crypto Lending. This option involves borrowing funds from a Crypto Funding Provider, with the loan amount and interest rate determined by the provider. Crypto Lending offers traders a fast and secure way to access funds, with reduced fees and interest rates compared to traditional financing options.

Cryptocurrency Loans

Another option is Cryptocurrency Loans, which involves borrowing funds using cryptocurrency as collateral. This option is particularly attractive for traders who do not have traditional assets to use as collateral. The loan amount and interest rate are determined by the value of the collateral, with repayment required once the loan term has ended.

Crypto-backed Loans

Crypto-backed Loans are a variation of Cryptocurrency Loans. With this option, traders can borrow funds using cryptocurrency as collateral, but with a higher loan-to-value ratio. This means that traders can access a larger loan amount compared to Cryptocurrency Loans, with the same cryptocurrency collateral.

Peer-to-Peer Crypto Lending

Peer-to-Peer Crypto Lending is another financing option available to traders. This option involves borrowing funds from other traders who are willing to lend their cryptocurrency. Peer-to-Peer Crypto Lending offers traders increased flexibility and reduced fees compared to traditional lending options.

Crypto Margin Funding

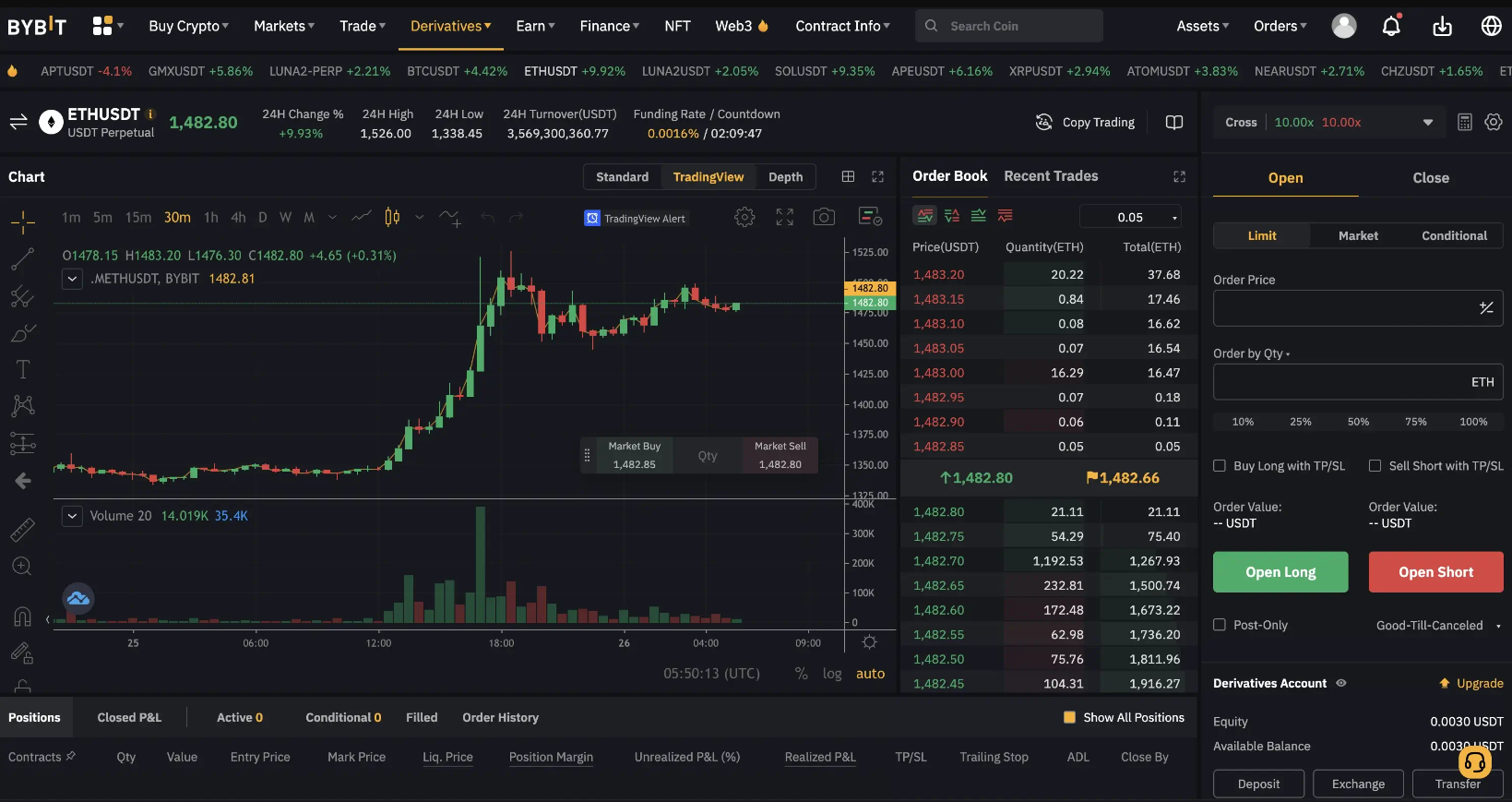

Lastly, Crypto Margin Funding is a financing option that allows traders to borrow funds to increase their trading margin. This option involves borrowing funds from a Crypto Funding Provider, with the loan amount and interest rate determined by the provider. Crypto Margin Funding can be a useful option for traders looking to increase their trading capital and take advantage of market opportunities.

PROP-trading (Proprietary crypto trading firms)

Proprietary trading firms, also known as “prop” firms, are a type of company that allows traders to access their capital in exchange for a share of the profits. In the world of cryptocurrency, there are many prop trading firms that offer funding to traders looking to enter the market.

Prop trading firms typically have large amounts of capital at their disposal, which they use to make trades on behalf of their traders. Traders who join a prop trading firm typically receive a portion of the profits generated by their trades, as well as access to the firm’s trading tools and resources.

One of the benefits of prop trading is that traders do not need to provide their own capital to enter the market. Instead, they can leverage the capital provided by the firm to make larger trades and potentially generate greater profits.

Another advantage of prop trading is that traders can benefit from the expertise and resources of the firm. Prop trading firms typically have experienced traders who can provide guidance and support, as well as advanced trading tools and data analysis resources.

However, it’s important to note that prop trading firms typically have strict rules and requirements for their traders. Traders may need to meet certain performance targets or adhere to specific trading strategies in order to continue receiving funding from the firm.

Prop trading can be a viable option for traders looking to enter the cryptocurrency market without needing to provide their own capital. By joining a prop trading firm, traders can leverage the firm’s resources and expertise to potentially generate significant profits.

When comparing the various Crypto Funding options, it is important for traders to consider factors such as fees, interest rates, loan terms, and collateral requirements. By carefully considering their options and choosing the one that best suits their needs, traders can access the funds they need to trade cryptocurrencies effectively.

Benefits of Crypto Funding for Traders

Crypto Funding for Traders offers several benefits that can help traders effectively manage their cryptocurrency trading activities. Here are some of the key benefits of Crypto Funding for Traders:

Reduced Fees and Interest Rates

Compared to traditional financing options, Crypto Funding options typically offer reduced fees and interest rates. This can help traders save money and increase their trading capital, making it easier for them to take advantage of market opportunities.

Fast and Secure Funding Options

Crypto Funding options offer fast and secure funding options, allowing traders to access the funds they need quickly and easily. This can be particularly important in a fast-paced market where market opportunities can arise and disappear quickly.

No Need for Traditional Credit Checks

Crypto Funding options typically do not require traditional credit checks, making it easier for traders with limited credit histories or poor credit scores to access funding. This can be particularly important for traders who are just starting out in the cryptocurrency market.

Increased Flexibility for Traders

Crypto Funding options offer increased flexibility for traders, allowing them to choose the funding option that best suits their needs. With options such as Peer-to-Peer Crypto Lending and Crypto Margin Funding, traders have the ability to tailor their funding to their specific needs.

Helps Traders Take Advantage of Market Opportunities

By providing access to funding quickly and at reduced rates, Crypto Funding can help traders take advantage of market opportunities that arise in the fast-paced cryptocurrency market. This can help traders increase their profits and achieve success in their trading activities.

Crypto Funding for Traders offers several benefits that can help traders effectively manage their cryptocurrency trading activities. From reduced fees and interest rates to increased flexibility and the ability to take advantage of market opportunities, Crypto Funding is an essential component of successful cryptocurrency trading. By carefully considering their options and choosing the right funding provider, traders can access the funding they need to achieve success in the dynamic world of cryptocurrency trading.

Choosing the Right Crypto Funding Provider

When it comes to selecting a Crypto Funding Provider, there are several factors that traders should consider to ensure they are choosing the right provider. Here are some key factors to keep in mind when selecting a Crypto Funding Provider:

Reputation and Track Record of the Provider

The reputation and track record of the Crypto Funding Provider is a critical factor to consider. Traders should research the provider to ensure that they have a positive reputation and a history of successfully providing funding to traders. This can be done by checking reviews and testimonials from other traders, as well as looking into the provider’s track record of delivering funding on time and without issues.

Transparency and Ease of Use

Transparency and ease of use are also important considerations when selecting a Crypto Funding Provider. Traders should look for a provider that is transparent about their funding options, fees, and interest rates, and that makes it easy for traders to apply for and receive funding. A good provider will offer clear and concise information about their services, and will make it easy for traders to navigate the application and funding process.

Fees and Interest Rates

The fees and interest rates associated with Crypto Funding options can vary significantly between providers, so it is important for traders to compare these factors when selecting a provider. Traders should look for a provider that offers competitive fees and interest rates that align with their financial goals and trading activities.

Loan Terms and Conditions

The terms and conditions of the Crypto Funding option are also important to consider. Traders should carefully review the loan terms and conditions to ensure that they are comfortable with the repayment schedule and any other requirements associated with the funding option. This can include factors such as loan duration, collateral requirements, and other important details that can impact the overall cost and viability of the funding option.

Selecting the right Crypto Funding Provider is critical for traders looking to effectively manage their cryptocurrency trading activities. By considering factors such as reputation, transparency, fees and interest rates, and loan terms and conditions, traders can identify a provider that meets their needs and provides the funding necessary to achieve success in the dynamic and fast-paced cryptocurrency market. With careful consideration and research, traders can choose the right Crypto Funding Provider and take advantage of the benefits that come with this valuable resource.

How to Get Crypto Funding for Trading

If you’re a trader looking to obtain Crypto Funding, there are several steps you can take to make the process as smooth and efficient as possible. Here’s a step-by-step guide to obtaining Crypto Funding for your trading activities:

Time needed: 1 day

Step-by-step guide: How to Get Crypto Funding for Trading?

- Prepare Your Trading Account

Before you can apply for Crypto Funding, it’s important to make sure that your trading account is ready to receive the funds. This may include ensuring that your account is properly registered and verified with the Crypto Funding Provider, as well as making sure that you have a clear understanding of the funding options available and how they can be used to support your trading activities.

- Apply for Crypto Funding

Once your trading account is prepared, you can begin the application process for Crypto Funding. This typically involves filling out an application form and providing any necessary documentation or information to the provider. Some providers may also require additional verification steps, such as KYC (know your customer) procedures or credit checks.

- Verification and Approval Process

After submitting your application, the provider will typically review your application and determine whether you are eligible for funding. This may involve additional verification steps or review of your trading history and financial situation. Once your application is approved, you will be notified and provided with the funding options available to you.

- Receive and Use the Funds

Once you have been approved for Crypto Funding, the funds will typically be disbursed to your trading account. You can then use the funds to support your trading activities, taking advantage of the reduced fees, increased flexibility, and other benefits that Crypto Funding provides. It’s important to use the funds responsibly and to adhere to the loan terms and conditions provided by the provider.

Also visit: The Ultimate Guide to Funding for Traders: Tips, Strategies, and Programs

Obtaining Crypto Funding for trading activities can be a valuable resource for traders looking to take advantage of the opportunities offered by the cryptocurrency market. By following these steps and working with a reputable Crypto Funding Provider, traders can secure the funding they need to support their trading activities and achieve success in this dynamic and fast-paced market. With careful preparation, diligent research, and a commitment to responsible use of funds, traders can take full advantage of the benefits that Crypto Funding provides.

Case Studies

Crypto Funding has become an increasingly popular financing option for traders in the cryptocurrency market. By leveraging the benefits of Crypto Funding, traders are able to access the funds they need to support their trading activities, while taking advantage of reduced fees, fast and secure funding options, and increased flexibility. In this chapter, we’ll explore some real-life case studies of traders who have successfully used Crypto Funding to achieve their trading goals.

Case Study 1: John

John is a seasoned trader who has been active in the cryptocurrency market for several years. Despite his experience, he found that traditional financing options were limiting his ability to take advantage of market opportunities. By working with a Crypto Funding Provider, John was able to secure the funding he needed to expand his trading activities and take advantage of new market trends. With reduced fees and interest rates, John was able to maximize his profits and achieve his trading goals.

Case Study 2: Sarah

Sarah is a new trader who was initially hesitant to enter the cryptocurrency market due to the perceived risks and uncertainties. However, after doing some research, she realized that Crypto Funding could provide her with the support she needed to get started. By working with a reputable Crypto Funding Provider, Sarah was able to secure the funds she needed to start trading with confidence. With fast and secure funding options, Sarah was able to quickly respond to market changes and take advantage of new opportunities.

Case Study 3: David

David is an experienced trader who had been struggling to find financing options that aligned with his trading strategy. After exploring various Crypto Funding options, David found a provider that offered the flexibility and support he needed to achieve his goals. By leveraging Crypto Funding, David was able to take advantage of new trading opportunities, while also minimizing his risks and maximizing his profits.

These case studies illustrate the diverse ways in which Crypto Funding can help traders achieve their trading goals. By working with a reputable provider and taking advantage of the benefits of Crypto Funding, traders can access the funds they need to support their activities, while also enjoying reduced fees, increased flexibility, and other valuable benefits. Whether you’re a seasoned trader or just starting out, Crypto Funding can be a valuable resource for achieving success in the dynamic and rapidly evolving cryptocurrency market.

Conclusion

In conclusion, Crypto Funding is an alternative financing option for traders that has the potential to revolutionize the trading industry. The growth of the cryptocurrency market has provided traders with new opportunities to access funding for their trading activities, without the need for traditional financial institutions.

Through Crypto Funding, traders can benefit from reduced fees and interest rates, fast and secure funding options, and increased flexibility to take advantage of market opportunities. However, choosing the right Crypto Funding provider is crucial for a successful trading experience.

Factors to consider when selecting a Crypto Funding provider include the provider’s reputation and track record, transparency and ease of use, fees and interest rates, and loan terms and conditions. By following a step-by-step guide to obtaining Crypto Funding, traders can prepare their trading account, apply for funding, go through the verification and approval process, and receive and use the funds.

Real-life case studies have shown how Crypto Funding has helped traders achieve their trading goals. From expanding their trading activities to boosting their profits, Crypto Funding has proved to be a valuable financing option for traders.

We highly recommend traders to explore Crypto Funding options and choose the right provider that suits their needs. The potential of Crypto Funding to transform the trading industry is immense, and we believe that it is only a matter of time before it becomes a mainstream financing option for traders.

Crypto Funding for Traders is an alternative financing option that allows traders to access funding for their trading activities without the need for traditional financial institutions. It involves using cryptocurrencies as collateral to obtain loans, lending, or margin funding.

The benefits of Crypto Funding for Traders include reduced fees and interest rates, fast and secure funding options, no need for traditional credit checks, increased flexibility for traders, and the ability to take advantage of market opportunities.

The different types of Crypto Funding options available include Crypto Lending, Cryptocurrency Loans, Crypto-backed Loans, Peer-to-Peer Crypto Lending, and Crypto Margin Funding.

Factors to consider when selecting a Crypto Funding Provider include the provider’s reputation and track record, transparency and ease of use, fees and interest rates, and loan terms and conditions.

To obtain Crypto Funding for Trading, traders need to prepare their trading account, apply for funding, go through the verification and approval process, and receive and use the funds.

Crypto Funding is a relatively safe option for traders, as long as they choose a reputable and trustworthy Crypto Funding Provider. Traders should also be aware of the risks associated with cryptocurrencies and ensure that they have a solid understanding of the market.

Yes, Crypto Funding can help traders achieve their trading goals by providing them with the necessary funding to expand their trading activities and take advantage of market opportunities.

Restrictions may vary depending on the Crypto Funding Provider, but generally, traders need to meet certain requirements, such as having a minimum credit score and providing proof of income or trading experience.

The regulation of Crypto Funding varies depending on the country and region. Traders should always research the regulations and laws governing Crypto Funding in their area before making any decisions.

Traders should evaluate their financial situation and trading goals to determine if Crypto Funding is the right option for them. It’s also important to do research, compare different providers, and understand the risks associated with Crypto Funding.